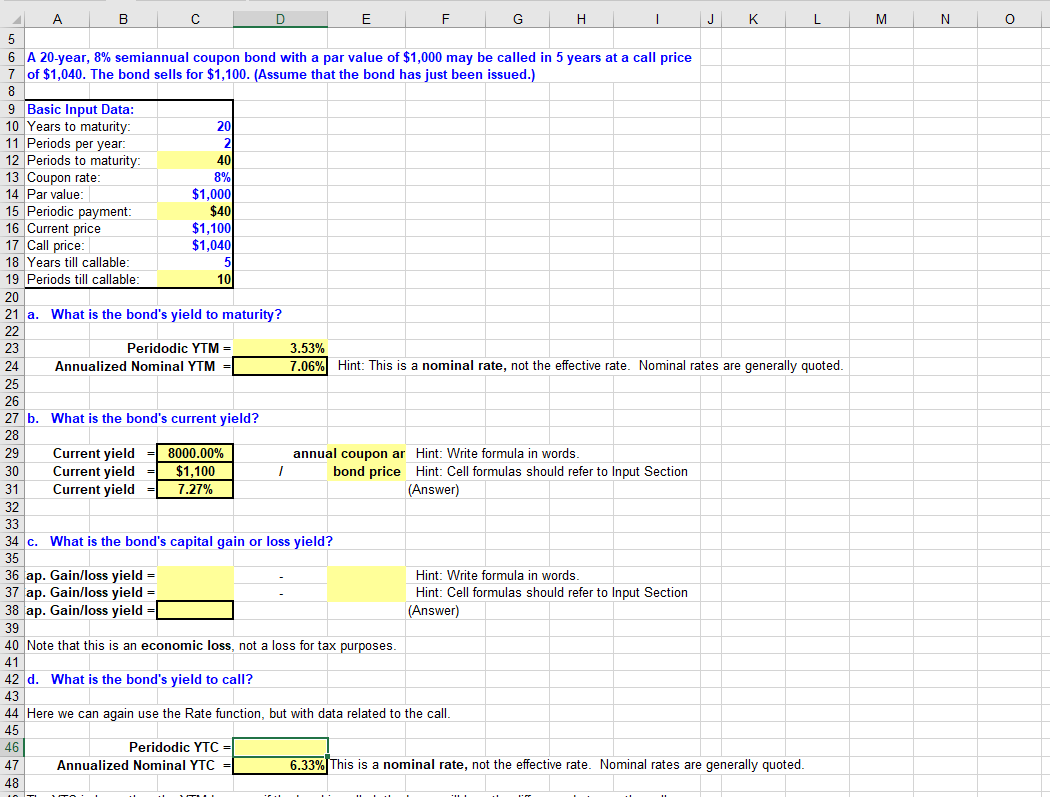

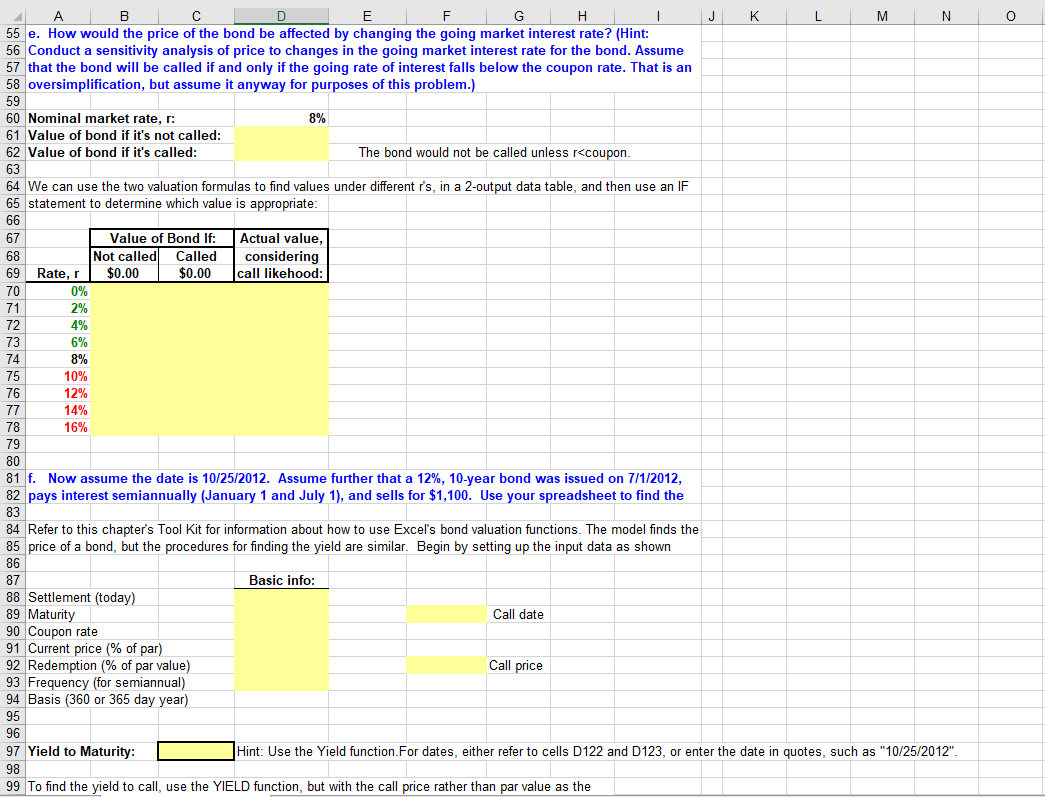

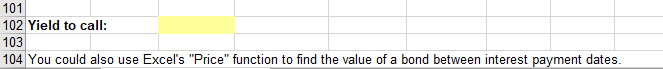

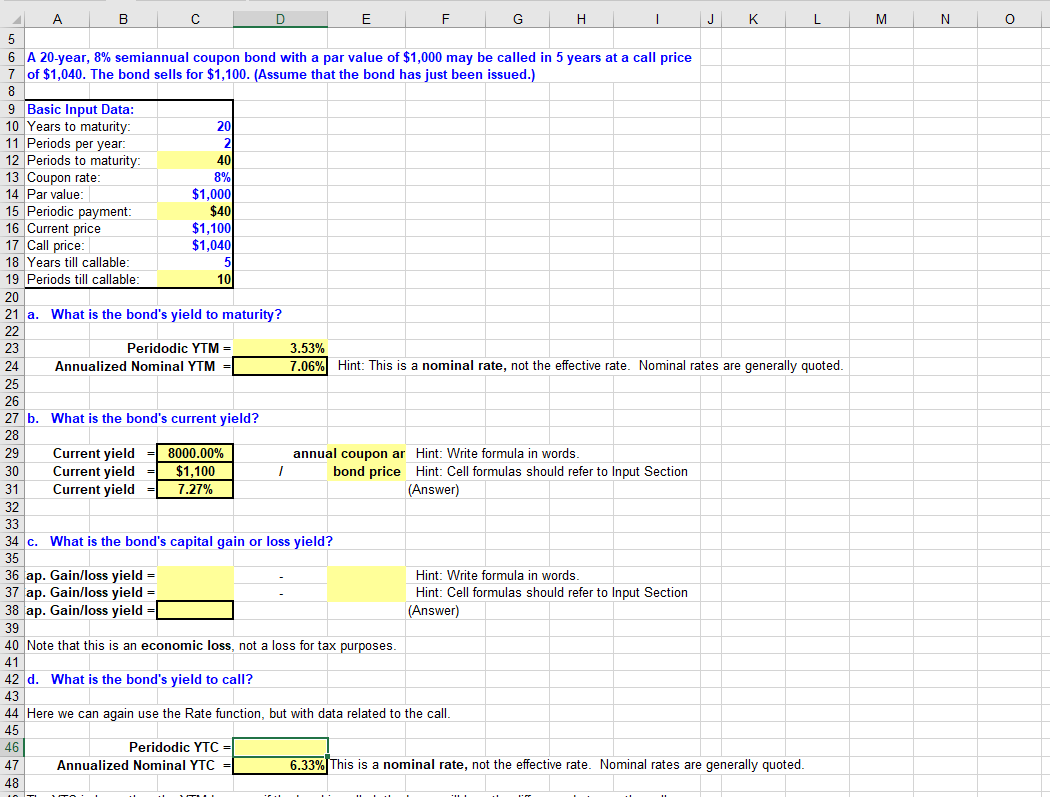

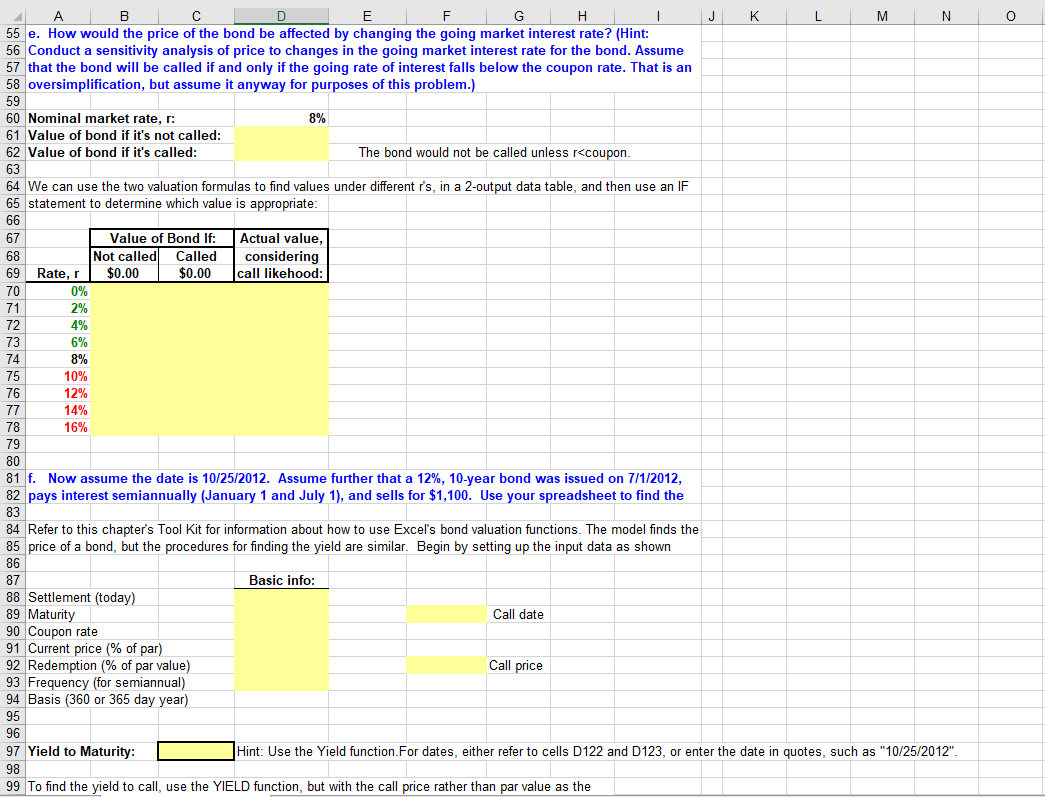

A A I B D E F G H I J K L M N O 5 40 6 A 20-year, 8% semiannual coupon bond with a par value of $1,000 may be called in 5 years at a call price 7 of $1,040. The bond sells for $1,100. (Assume that the bond has just been issued.) 8 9 Basic Input Data: 10 Years to maturity: 11 Periods per year: 12 Periods to maturity: 13 Coupon rate: 8% 14 Par value: $1,000 15 Periodic payment: $40 16 Current price $1,100 17 Call price: $1,040 18 Years till callable: 19 Periods till callable: 10 20 21 a. What is the bond's yield to maturity? Peridodic YTM = Annualized Nominal YTM = 3.53% 7.06% Hint: This is a nominal rate, not the effective rate. Nominal rates are generally quoted. 27 b. What is the bond's current yield? Current yield = 8000.00% Current yield = $1,100 Current yield = 7.27% annual coupon ar Hint: Write formula in words. bond price Hint: Cell formulas should refer to Input Section (Answer) 34 c. What is the bond's capital gain or loss yield? 35 36 ap. Gain/loss yield = 37 ap. Gain/loss yield = 38 ap. Gain/loss yield = 39 40 Note that this is an economic loss, not a loss for tax purposes. 41 42 d. What is the bond's yield to call? Hint: Write formula in words. Hint: Cell formulas should refer to Input Section (Answer) 43 44 Here we can again use the Rate function, but with data related to the call. 45 46 Peridodic YTC = 47 Annualized Nominal YTC = 6.33% This is a nominal rate, not the effective rate. Nominal rates are generally quoted. 48 J K L M N O A B C D E F G H I 55 e. How would the price of the bond be affected by changing the going market interest rate? (Hint: 56 Conduct a sensitivity analysis of price to changes in the going market interest rate for the bond. Assume 57 that the bond will be called if and only if the going rate of interest falls below the coupon rate. That is an 58 oversimplification, but assume it anyway for purposes of this problem.) 8% 60 Nominal market rate, r: 61 Value of bond if it's not called: 62 Value of bond if it's called: The bond would not be called unless r