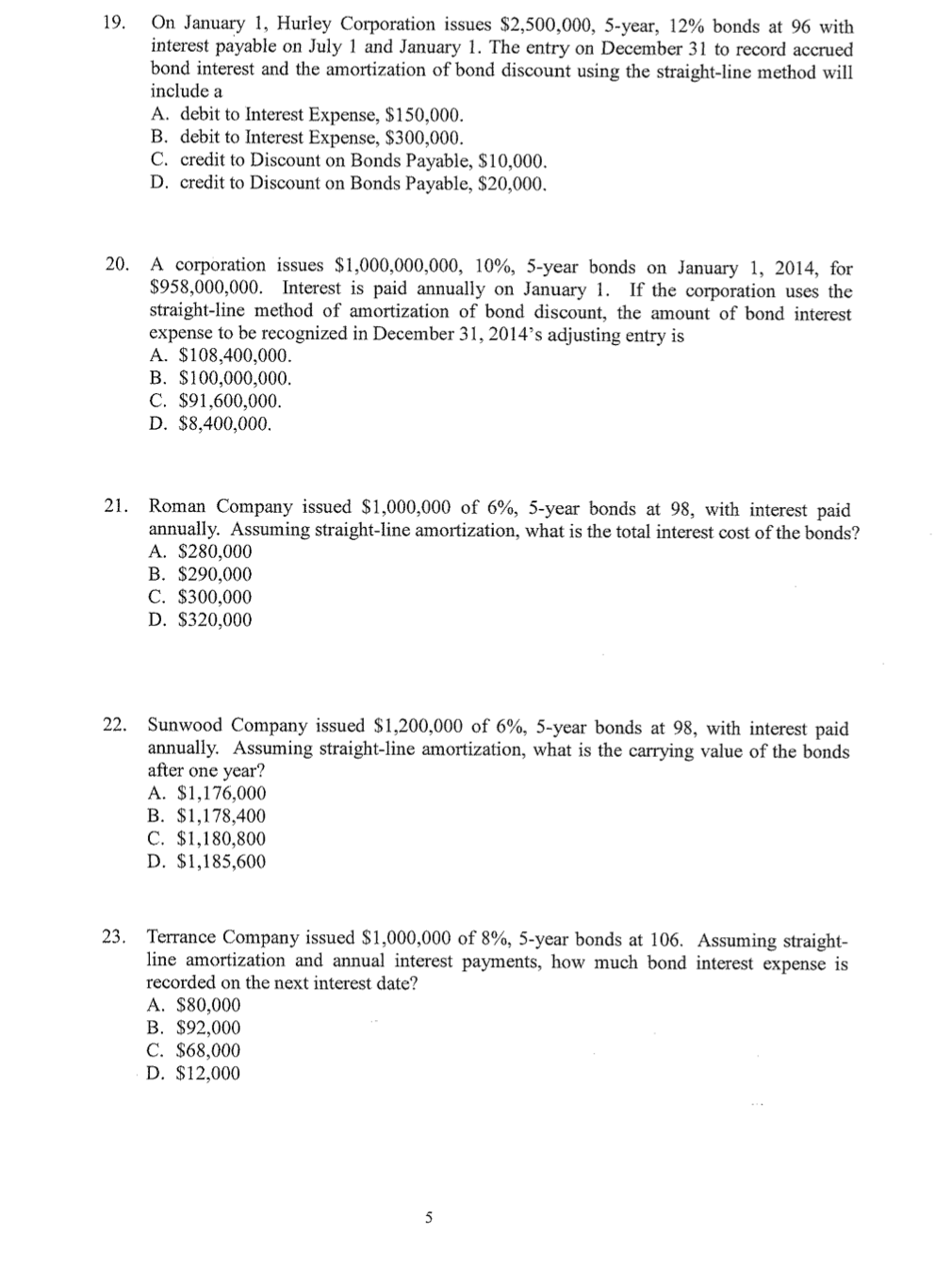

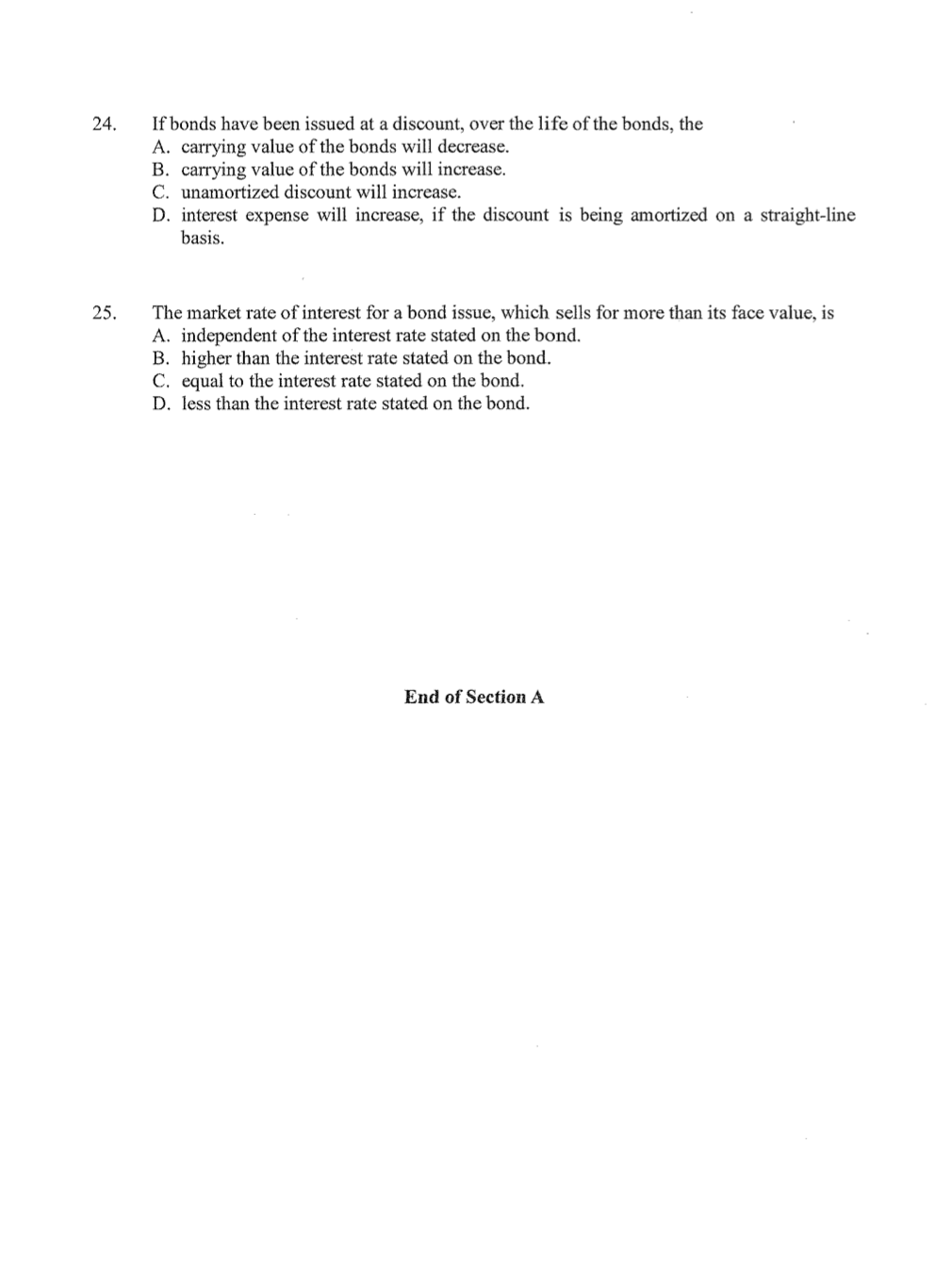

A. a journal entry is posted twice. B. a wrong amount is used in journalizing. C. incorrect account titles are used in journalizing. D. a journal entry is only partially posted. 14. Which of the following statements regarding the periodic and perpetual inventory systems is correct? A. Inventory is updated after each sale under the periodic method. B. Under the periodic method, the amount of inventory is not known until the end of the period when an inventory count is taken. C. Inventory on hand is determined by a physical count only under the perpetual method. D. The primary advantage of the periodic method is that it maintains detailed transaction-by- transaction records. 15. Which of the following statements is correct if the balance on the bank statement does not equal the balance in the company's cash account? A. The bookkeeper made a mistake. B. The bank made a mistake. C. Both the bank and the bookkeeper made a mistake. D. It is perfectly normal for the two balances to be different. 16. Which of the following transactions would cause a change in the amount of a company's working capital? A. Collection of an account receivable B. Payment of an account payable C. Borrowing cash over a 60-day period D. Selling merchandise for cash at a price above its cost During the month, you purchased $12,000 of supplies on credit and $19,000 of equipment for cash. When you prepare a statement of financial position, assets are $24,000 more than liabilities plus shareholders' equity. A. You may have posted the increase in supplies as a credit rather than a debit. B. You may have neglected to post the change in accounts payable. C. You may have posted the increase in accounts payable as a debit rather than a credit. D All of the above would have resulted in the $24,000 error. 18. Joe's Copy Shop bought equipment for $60,000 on January 1, 2016. Joe estimated the useful life to be 3 years with no salvage value, and the straight-line method of depreciation will be used. On January 1, 2017, Joe decides that the business will use the equipment for 5 years. What is the revised depreciation expense for 2017? A. $20,000. B. $8,000. C. $10,000. D. $15,000. 19. On January 1, Hurley Corporation issues $2,500,000, 5-year, 12% bonds at 96 with interest payable on July 1 and January 1. The entry on December 31 to record accrued bond interest and the amortization of bond discount using the straight-line method will include a A. debit to Interest Expense, $150,000. B. debit to Interest Expense, $300,000. C. credit to Discount on Bonds Payable, $10,000. D. credit to Discount on Bonds Payable, $20,000. 20. A corporation issues $1,000,000,000, 10%, 5-year bonds on January 1, 2014, for $958,000,000. Interest is paid annually on January 1. If the corporation uses the straight-line method of amortization of bond discount, the amount of bond interest expense to be recognized in December 31, 2014's adjusting entry is A. $108,400,000. B. $100,000,000. C. $91,600,000. D. $8,400,000. 21. Roman Company issued $1,000,000 of 6%, 5-year bonds at 98, with interest paid annually. Assuming straight-line amortization, what is the total interest cost of the bonds? A. $280,000 B. $290,000 C. $300,000 D. $320,000 22. Sunwood Company issued $1,200,000 of 6%, 5-year bonds at 98, with interest paid annually. Assuming straight-line amortization, what is the carrying value of the bonds after one year? A. $1,176,000 B. $1,178,400 C. $1,180,800 D. $1,185,600 23. Terrance Company issued $1,000,000 of 8%, 5-year bonds at 106. Assuming straight- line amortization and annual interest payments, how much bond interest expense is recorded on the next interest date? A. $80,000 B. $92,000 C. $68,000 D. $12,000 24. If bonds have been issued at a discount, over the life of the bonds, the A. carrying value of the bonds will decrease. B. carrying value of the bonds will increase. C. unamortized discount will increase. D. interest expense will increase, if the discount is being amortized on a straight-line basis. The market rate of interest for a bond issue, which sells for more than its face value, is A. independent of the interest rate stated on the bond. B. higher than the interest rate stated on the bond. C. equal to the interest rate stated on the bond. D. less than the interest rate stated on the bond. End of Section A