Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) A life aged 30 years old took out a life insurance policy with the following benefits: Sum insured of $1,000 payable at the

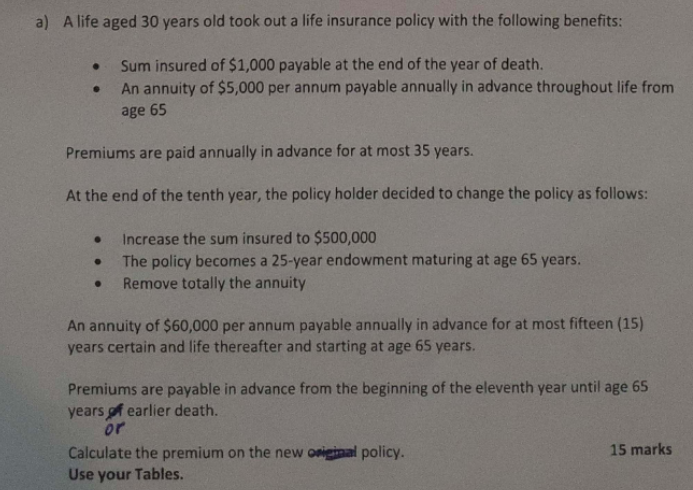

a) A life aged 30 years old took out a life insurance policy with the following benefits: Sum insured of $1,000 payable at the end of the year of death. An annuity of $5,000 per annum payable annually in advance throughout life from age 65 Premiums are paid annually in advance for at most 35 years. At the end of the tenth year, the policy holder decided to change the policy as follows: Increase the sum insured to $500,000 The policy becomes a 25-year endowment maturing at age 65 years. Remove totally the annuity An annuity of $60,000 per annum payable annually in advance for at most fifteen (15) years certain and life thereafter and starting at age 65 years. Premiums are payable in advance from the beginning of the eleventh year until age 65 years of earlier death. or Calculate the premium on the new original policy. Use your Tables. 15 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started