Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) A mutual fund raised Rs. 150 lakhs on April 1, 2018 by issue of 15 lakh units at Rs. 10 per unit. The

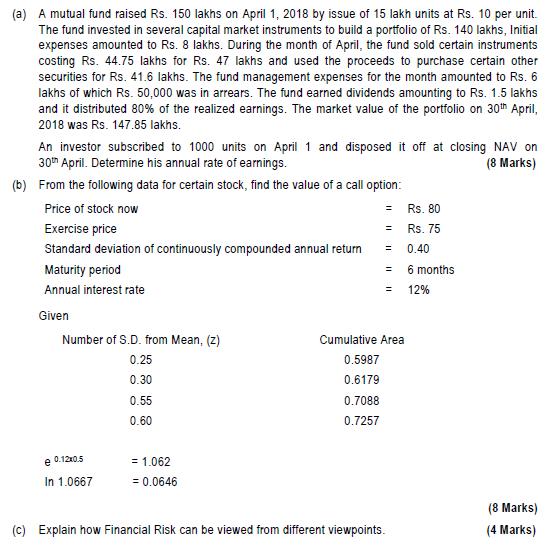

(a) A mutual fund raised Rs. 150 lakhs on April 1, 2018 by issue of 15 lakh units at Rs. 10 per unit. The fund invested in several capital market instruments to build a portfolio of Rs. 140 lakhs, Initial expenses amounted to Rs. 8 lakhs. During the month of April, the fund sold certain instruments costing Rs. 44.75 lakhs for Rs. 47 lakhs and used the proceeds to purchase certain other securities for Rs. 41.6 lakhs. The fund management expenses for the month amounted to Rs. 6 lakhs of which Rs. 50,000 was in arrears. The fund earned dividends amounting to Rs. 1.5 lakhs and it distributed 80% of the realized earnings. The market value of the portfolio on 30th April, 2018 was Rs. 147.85 lakhs. An investor subscribed to 1000 units on April 1 and disposed it off at closing NAV on 30th April. Determine his annual rate of earnings. (b) From the following data for certain stock, find the value of a call option: (8 Marks) Price of stock now = Rs. 80 Exercise price = Rs. 75 Standard deviation of continuously compounded annual return = 0.40 Maturity period = 6 months Annual interest rate = 12% Given Number of S.D. from Mean, (z) Cumulative Area 0.25 0.5987 0.30 0.6179 0.55 0.7088 0.60 0.7257 e 0.12x0.5 = 1.062 In 1.0667 = 0.0646 (c) Explain how Financial Risk can be viewed from different viewpoints. (8 Marks) (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the investors annual rate of earnings we need to calculate the net asset value NAV at the beginning and end of the investment period and then calculate the rate of return Given data Ini...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started