Answered step by step

Verified Expert Solution

Question

1 Approved Answer

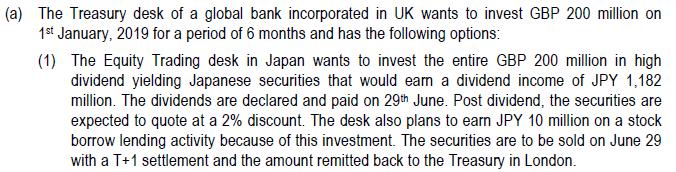

(a) The Treasury desk of a global bank incorporated in UK wants to invest GBP 200 million on 1st January, 2019 for a period

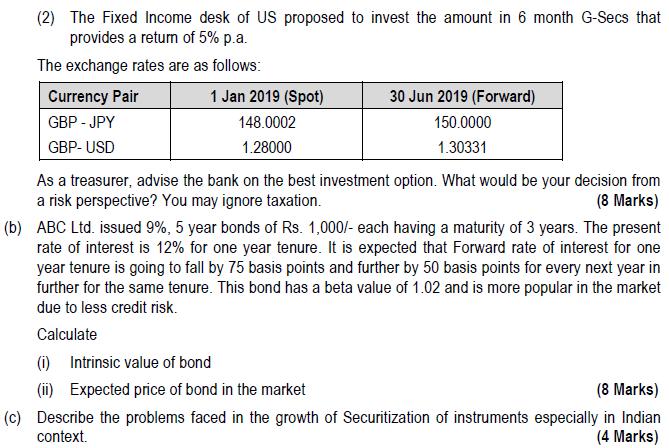

(a) The Treasury desk of a global bank incorporated in UK wants to invest GBP 200 million on 1st January, 2019 for a period of 6 months and has the following options: (1) The Equity Trading desk in Japan wants to invest the entire GBP 200 million in high dividend yielding Japanese securities that would earn a dividend income of JPY 1,182 million. The dividends are declared and paid on 29th June. Post dividend, the securities are expected to quote at a 2% discount. The desk also plans to earn JPY 10 million on a stock borrow lending activity because of this investment. The securities are to be sold on June 29 with a T+1 settlement and the amount remitted back to the Treasury in London. (2) The Fixed Income desk of US proposed to invest the amount in 6 month G-Secs that provides a return of 5% p.a. The exchange rates are as follows: Currency Pair GBP - JPY GBP- USD 1 Jan 2019 (Spot) 30 Jun 2019 (Forward) 148.0002 1.28000 150.0000 1.30331 As a treasurer, advise the bank on the best investment option. What would be your decision from a risk perspective? You may ignore taxation. (8 Marks) (b) ABC Ltd. issued 9%, 5 year bonds of Rs. 1,000/- each having a maturity of 3 years. The present rate of interest is 12% for one year tenure. It is expected that Forward rate of interest for one year tenure is going to fall by 75 basis points and further by 50 basis points for every next year in further for the same tenure. This bond has a beta value of 1.02 and is more popular in the market due to less credit risk. Calculate (i) Intrinsic value of bond (ii) Expected price of bond in the market (8 Marks) (c) Describe the problems faced in the growth of Securitization of instruments especially in Indian context. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To exhort the bank on the best venture choice we should assess the two decisions 1 Option 1 Putting resources into high profit yielding Japanese protections Introductory speculation GBP 200 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started