Answered step by step

Verified Expert Solution

Question

1 Approved Answer

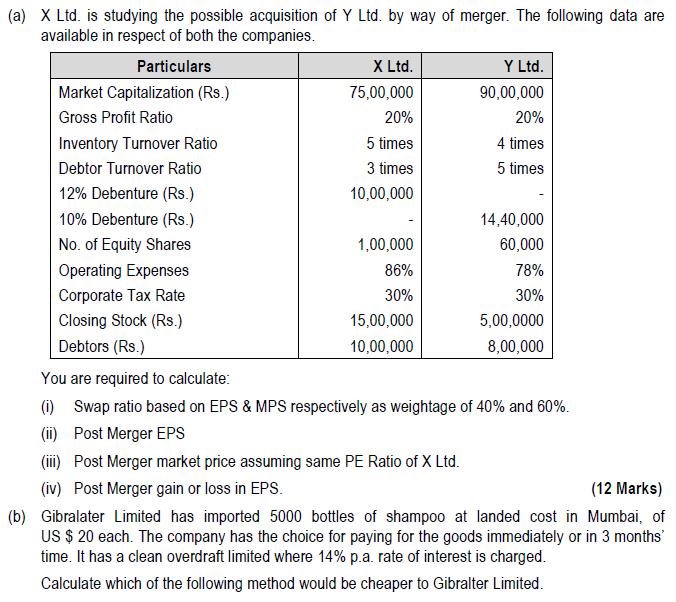

(a) X Ltd. is studying the possible acquisition of Y Ltd. by way of merger. The following data are available in respect of both

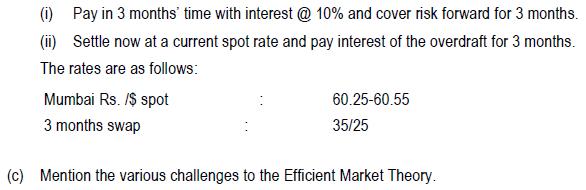

(a) X Ltd. is studying the possible acquisition of Y Ltd. by way of merger. The following data are available in respect of both the companies. Particulars Market Capitalization (Rs.) Gross Profit Ratio Inventory Turnover Ratio X Ltd. 75,00,000 Y Ltd. 90,00,000 20% 20% 4 times 5 times 5 times 3 times Debtor Turnover Ratio 12% Debenture (Rs.) 10% Debenture (Rs.) No. of Equity Shares Operating Expenses Corporate Tax Rate Closing Stock (Rs.) Debtors (Rs.) You are required to calculate: 10,00,000 14,40,000 1,00,000 60,000 86% 78% 30% 30% 15,00,000 5,00,0000 10,00,000 8,00,000 (i) Swap ratio based on EPS & MPS respectively as weightage of 40% and 60%. (ii) Post Merger EPS (iii) Post Merger market price assuming same PE Ratio of X Ltd. (iv) Post Merger gain or loss in EPS. (12 Marks) (b) Gibralater Limited has imported 5000 bottles of shampoo at landed cost in Mumbai, of US $ 20 each. The company has the choice for paying for the goods immediately or in 3 months' time. It has a clean overdraft limited where 14% p.a. rate of interest is charged. Calculate which of the following method would be cheaper to Gibralter Limited. (i) Pay in 3 months' time with interest @ 10% and cover risk forward for 3 months. (ii) Settle now at a current spot rate and pay interest of the overdraft for 3 months. The rates are as follows: Mumbai Rs. /$ spot 3 months swap 60.25-60.55 35/25 (c) Mention the various challenges to the Efficient Market Theory.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a i Computation of Swap Ratios First let us compute EPS Earning Per Share PE Ratio and Market Price Per Share MPS X Ltd EPS Gross Profit No of Equity Shares Net Sales Operating expensesGross Profit Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started