Answered step by step

Verified Expert Solution

Question

1 Approved Answer

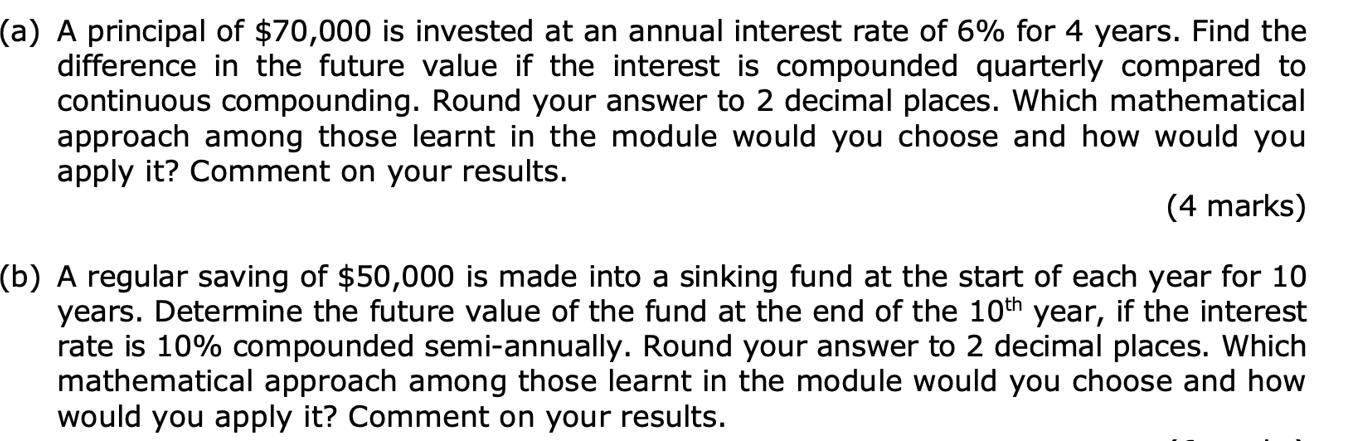

(a) A principal of $70,000 is invested at an annual interest rate of 6% for 4 years. Find the difference in the future value

(a) A principal of $70,000 is invested at an annual interest rate of 6% for 4 years. Find the difference in the future value if the interest is compounded quarterly compared to continuous compounding. Round your answer to 2 decimal places. Which mathematical approach among those learnt in the module would you choose and how would you apply it? Comment on your results. (4 marks) (b) A regular saving of $50,000 is made into a sinking fund at the start of each year for 10 years. Determine the future value of the fund at the end of the 10th year, if the interest rate is 10% compounded semi-annually. Round your answer to 2 decimal places. Which mathematical approach among those learnt in the module would you choose and how would you apply it? Comment on your results.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To find the future value of the principal with quarterly compounding we use the formula FV P1 rnnt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started