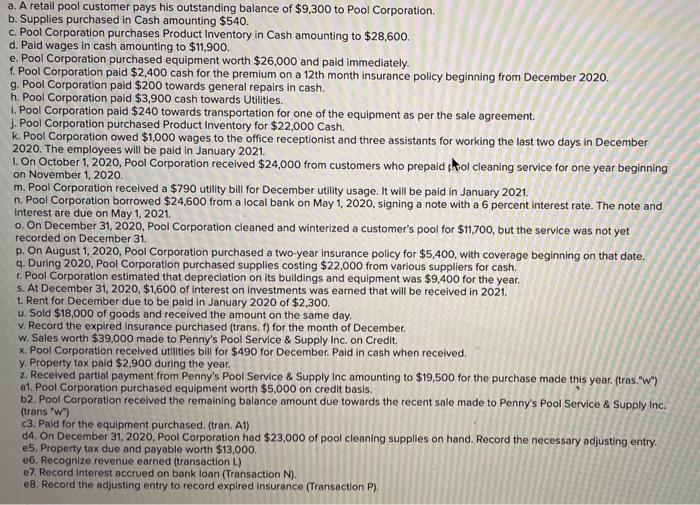

a. A retail pool customer pays his outstanding balance of $9,300 to Pool Corporation. b. Supplies purchased in Cash amounting $540. c. Pool Corporation purchases Product Inventory in Cash amounting to $28,600. d. Paid wages in cash amounting to $11,900. e. Pool Corporation purchased equipment worth $26,000 and paid immediately. f. Pool Corporation paid \$2,400 cash for the premium on a 12th month insurance policy beginning from December 2020 . g. Pool Corporation paid $200 towards general repairs in cash. h. Pool Corporation paid $3,900 cash towards Utilities. 1. Pool Corporation paid $240 towards transportation for one of the equipment as per the sale agreement. j. Pool Corporation purchased Product Inventory for $22,000 Cash. k. Pool Corporation owed $1,000 wages to the office receptionist and three assistants for working the last two days in December 2020. The employees will be paid in January 2021. I. On October 1,2020 , Pool Corporation received $24,000 from customers who prepaid thol cleaning service for one year beginning on November 1, 2020. m. Pool Corporation recelved a $790 utillty bill for December utility usage. It will be paid in January 2021 . n. Pool Corporation borrowed $24,600 from a local bank on May 1, 2020, signing a note with a 6 percent interest rate. The note and interest are due on May 1, 2021 . o. On December 31, 2020, Pool Corporation cleaned and winterized a customer's pool for $11,700, but the service was not yet recorded on December 31 . p. On August 1, 2020, Pool Corporation purchased a two-year insurance policy for $5,400, with coverage beginning on that date. q. During 2020. Pool Corporation purchased supplies costing $22,000 from various suppliers for cash. r. Pool Corporation estimated that depreclation on its buildings and equipment was $9,400 for the year. s. At December 31, 2020, \$1,600 of interest on investments was earned that will be received in 2021 . t. Rent for December due to be paid in January 2020 of $2,300. u. Sold $18,000 of goods and received the amount on the same day, v. Record the expired insurance purchased (trans, f ) for the month of December. w. Sales worth $39,000 made to Penny's Pool Service \& Supply Inc. on Credit. x. Pool Corporation recelved utilities bill for $490 for December. Paid in cash when received. y. Property tax paid $2,900 during the year. z. Received partial payment from Penny's Pool Service \& Supply inc amounting to $19,500 for the purchase made this year. (tras. "w") a1. Pool Corporation purchased equipment worth $5,000 on credit basis. b2. Pool Corporation recelved the remaining balance amount due towards the recent sale made to Penny's Pool Service \& Supply Inc. (trans " w ") c3. Pald for the equipment purchased. (tran. At) d4. On December 31, 2020, Pool Corporation had $23,000 of pool cleaning supplies on hand. Record the necessary adjusting entry. e5. Property tax due and payable worth $13,000. e6. Recognize revenue earned (transaction L) e7. Record interest accrued on bank loan (Transaction N ). e8. Record the adjusting entry to record expired insurance (Transaction P). a. A retail pool customer pays his outstanding balance of $9,300 to Pool Corporation. b. Supplies purchased in Cash amounting $540. c. Pool Corporation purchases Product Inventory in Cash amounting to $28,600. d. Paid wages in cash amounting to $11,900. e. Pool Corporation purchased equipment worth $26,000 and paid immediately. f. Pool Corporation paid \$2,400 cash for the premium on a 12th month insurance policy beginning from December 2020 . g. Pool Corporation paid $200 towards general repairs in cash. h. Pool Corporation paid $3,900 cash towards Utilities. 1. Pool Corporation paid $240 towards transportation for one of the equipment as per the sale agreement. j. Pool Corporation purchased Product Inventory for $22,000 Cash. k. Pool Corporation owed $1,000 wages to the office receptionist and three assistants for working the last two days in December 2020. The employees will be paid in January 2021. I. On October 1,2020 , Pool Corporation received $24,000 from customers who prepaid thol cleaning service for one year beginning on November 1, 2020. m. Pool Corporation recelved a $790 utillty bill for December utility usage. It will be paid in January 2021 . n. Pool Corporation borrowed $24,600 from a local bank on May 1, 2020, signing a note with a 6 percent interest rate. The note and interest are due on May 1, 2021 . o. On December 31, 2020, Pool Corporation cleaned and winterized a customer's pool for $11,700, but the service was not yet recorded on December 31 . p. On August 1, 2020, Pool Corporation purchased a two-year insurance policy for $5,400, with coverage beginning on that date. q. During 2020. Pool Corporation purchased supplies costing $22,000 from various suppliers for cash. r. Pool Corporation estimated that depreclation on its buildings and equipment was $9,400 for the year. s. At December 31, 2020, \$1,600 of interest on investments was earned that will be received in 2021 . t. Rent for December due to be paid in January 2020 of $2,300. u. Sold $18,000 of goods and received the amount on the same day, v. Record the expired insurance purchased (trans, f ) for the month of December. w. Sales worth $39,000 made to Penny's Pool Service \& Supply Inc. on Credit. x. Pool Corporation recelved utilities bill for $490 for December. Paid in cash when received. y. Property tax paid $2,900 during the year. z. Received partial payment from Penny's Pool Service \& Supply inc amounting to $19,500 for the purchase made this year. (tras. "w") a1. Pool Corporation purchased equipment worth $5,000 on credit basis. b2. Pool Corporation recelved the remaining balance amount due towards the recent sale made to Penny's Pool Service \& Supply Inc. (trans " w ") c3. Pald for the equipment purchased. (tran. At) d4. On December 31, 2020, Pool Corporation had $23,000 of pool cleaning supplies on hand. Record the necessary adjusting entry. e5. Property tax due and payable worth $13,000. e6. Recognize revenue earned (transaction L) e7. Record interest accrued on bank loan (Transaction N ). e8. Record the adjusting entry to record expired insurance (Transaction P)