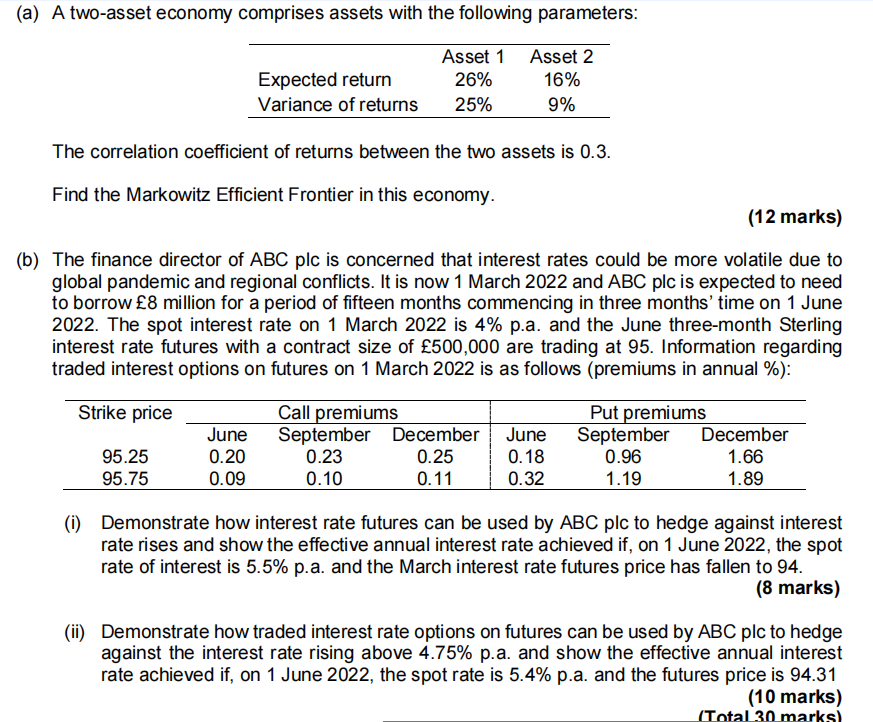

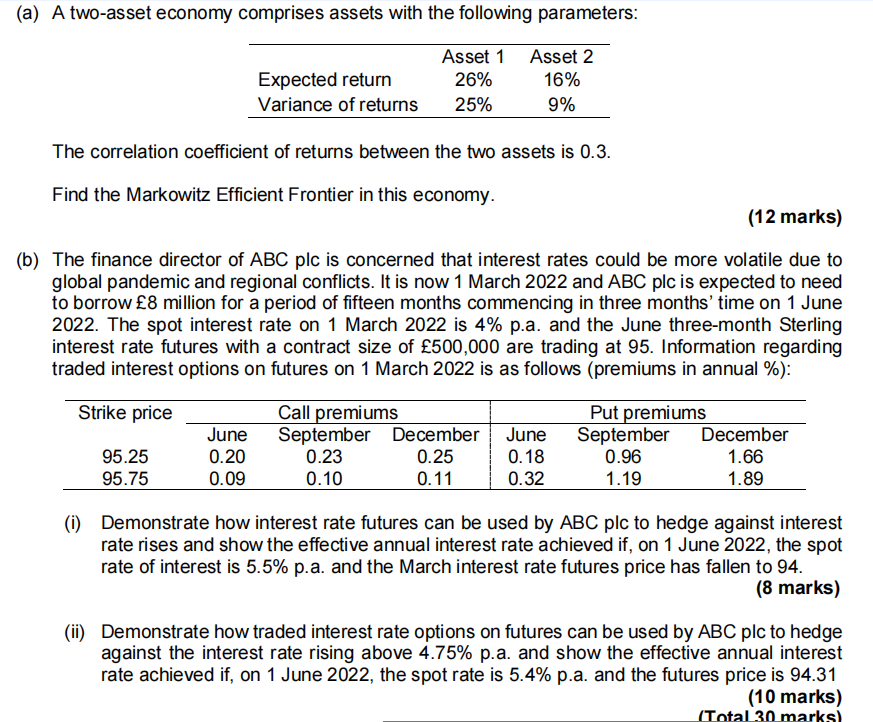

(a) A two-asset economy comprises assets with the following parameters: Expected return Variance of returns Asset 1 Asset 2 26% 16% 25% 9% The correlation coefficient of returns between the two assets is 0.3. Find the Markowitz Efficient Frontier in this economy. (12 marks) (b) The finance director of ABC plc is concerned that interest rates could be more volatile due to global pandemic and regional conflicts. It is now 1 March 2022 and ABC plc is expected to need to borrow 8 million for a period of fifteen months commencing in three months' time on 1 June 2022. The spot interest rate on 1 March 2022 is 4% p.a. and the June three-month Sterling interest rate futures with a contract size of 500,000 are trading at 95. Information regarding traded interest options on futures on 1 March 2022 is as follows (premiums in annual %): Strike price Call premiums September December June 0.23 0.25 0.18 0.10 0.11 0.32 June 0.20 0.09 95.25 95.75 Put premiums September December 0.96 1.66 1.19 1.89 (1) Demonstrate how interest rate futures can be used by ABC plc to hedge against interest rate rises and show the effective annual interest rate achieved if, on 1 June 2022, the spot rate of interest is 5.5% p.a. and the March interest rate futures price has fallen to 94. (8 marks) (ii) Demonstrate how traded interest rate options on futures can be used by ABC plc to hedge against the interest rate rising above 4.75% p.a. and show the effective annual interest rate achieved if, on 1 June 2022, the spot rate is 5.4% p.a. and the futures price is 94.31 (10 marks) (Total 30 marks) (a) A two-asset economy comprises assets with the following parameters: Expected return Variance of returns Asset 1 Asset 2 26% 16% 25% 9% The correlation coefficient of returns between the two assets is 0.3. Find the Markowitz Efficient Frontier in this economy. (12 marks) (b) The finance director of ABC plc is concerned that interest rates could be more volatile due to global pandemic and regional conflicts. It is now 1 March 2022 and ABC plc is expected to need to borrow 8 million for a period of fifteen months commencing in three months' time on 1 June 2022. The spot interest rate on 1 March 2022 is 4% p.a. and the June three-month Sterling interest rate futures with a contract size of 500,000 are trading at 95. Information regarding traded interest options on futures on 1 March 2022 is as follows (premiums in annual %): Strike price Call premiums September December June 0.23 0.25 0.18 0.10 0.11 0.32 June 0.20 0.09 95.25 95.75 Put premiums September December 0.96 1.66 1.19 1.89 (1) Demonstrate how interest rate futures can be used by ABC plc to hedge against interest rate rises and show the effective annual interest rate achieved if, on 1 June 2022, the spot rate of interest is 5.5% p.a. and the March interest rate futures price has fallen to 94. (8 marks) (ii) Demonstrate how traded interest rate options on futures can be used by ABC plc to hedge against the interest rate rising above 4.75% p.a. and show the effective annual interest rate achieved if, on 1 June 2022, the spot rate is 5.4% p.a. and the futures price is 94.31 (10 marks) (Total 30 marks)