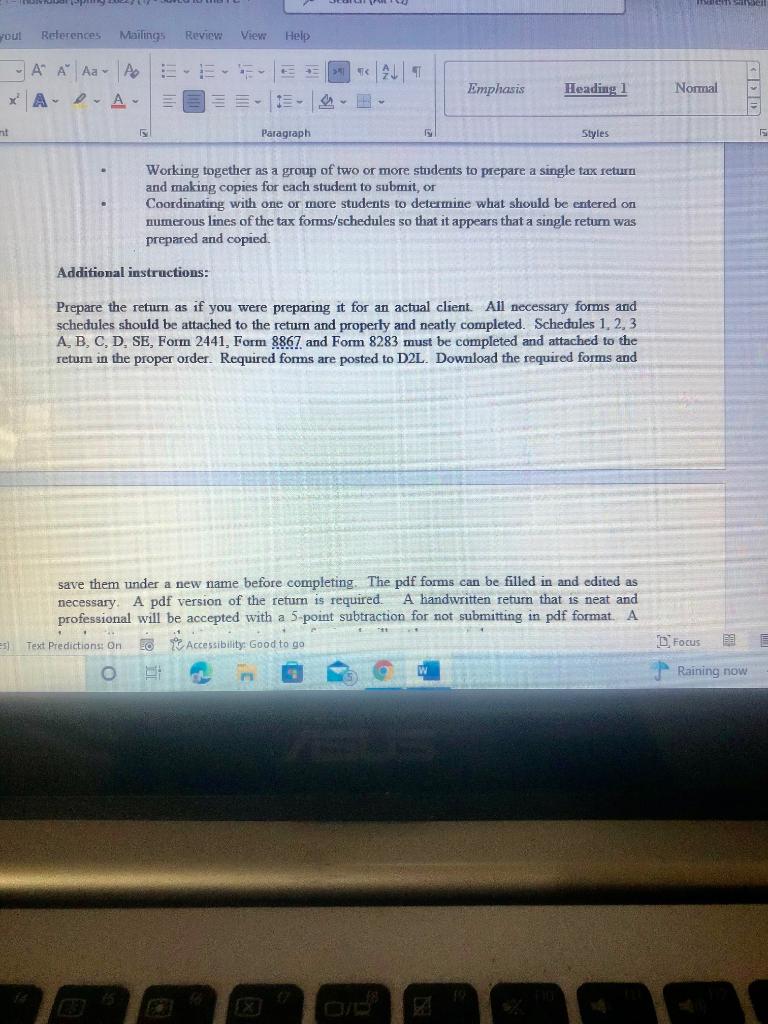

A Aa A 46 24 Emphasis Heading 1 Norr XA -A- 6 Paragraph Styles Instructions Prepare a 2021 Form 1040 - U.S. Individual Income Tax Return - for Helen Hanson that is both professional in appearance and technically correct. The use of tax software or a professional tax preparer to complete this project is prohibited. This project is due on or before 8:00 pm on Friday, February 25, 2022. Late returns will not be accepted. The following three documents must be uploaded to the appropriate D2L Dropbox on or before the due date: 1. A signed copy of the required cover sheet certifying that the tax retur project is entirely your own work and you have neither given nor received unpermitted oral, written or other assistance to or from anyone, including past or present students, in completing this project. 2. The completed tax return project. Submit one pdf document consisting of all required forms and schedules. You may not submit multiple copies of individual forms. Late tax retums will not be accepted 3. An excel spreadsheet showing a detailed calculation of taxable income. The spreadsheet should follow the format set forth in Exhibit 4-1 of the textbook. Show the details of all calculations and clearly label gross (total) income, adjusted gross income taxable income, income tax liability, other tax liability, and taxes due or (refund). The objective of this project is to enhance your understanding of the Internal Revenue Code rules as they relate to the individual taxpayer through practical application. After you have tried to the best of your ability to resolve any questions you have on your own, you are welcome to contact me with specific questions. The learning experience can be enhanced if students are allowed to resolve a few relatively minor issues among themselves. However, the objective can only be achieved if each student substantially completes his her own project. Examples of student collaboration that are not acceptable include, but are not limited to: TTT 51 Text Predictions: On Et Accessibility: Good to go Focus Rainin Foul References Mailings Review View Help A A A A XA-A- Emphasis Heading 1 Normal TE Paragraph Styles Working together as a group of two or more students to prepare a single tax return and making copies for each student to submit, or Coordinating with one or more students to determine what should be entered on numerous lmes of the tax forms/schedules so that it appears that a single return was prepared and copied Additional instructions: Prepare the return as if you were preparing it for an actual client. All necessary forms and schedules should be attached to the return and property and neatly completed. Schedules 1, 2, 3 A,B,C,D. SE, Form 2441, Form 8867 and Form 8283 must be completed and attached to the retum in the proper order. Required forms are posted to D2L. Download the required forms and save them under a new name before completing. The pdf forms can be filled in and edited as necessary A pdf version of the return is required A handwritten return that is neat and professional will be accepted with a 5 point subtraction for not submitting in pdf format. A 5) Text Predictions: On Accessibility: Good to go Focus BE Raining now Emphasis Heading 2 Normal A A Aa 4 A- A- Styles Paragraph save them under a new name before completing. The pdf forms can be filled in and edited as necessary A pdf version of the return is required A handwritten return that is neat and professional will be accepted with a 5-point subtraction for not submitting in pdf format. A handwritten return that is not neat and professional will not be accepted. Interview Information Helen Hanson is an unmarried, calendar year, cash basis taxpayer. Helen provides the majority of support for her two children (Hillary and Hank), who live with her. Hillary is a full-time student at Middle Tennessee State University and eamed $5,000 in wages in 2021. Hank had no income in 2021. Helen did not receive any advance child tax credit payments in 2021. IHelen's mother, Heather Johnson, also lives with Helen Helen provides 80% of Heather's support. Heather provides the other 20% Heather received $14,000 in social security benefits and $1,400 in interest from a savings account in 2021. The social security numbers and dates of birth for members of the family are as follows: Helen Hillary Hank Heather Social Security Number 471-11-1111 471-22-2222 471-33-3333 471-44-4444 Date of Birth 9/30/1974 2/12/1999 8/19/2015 9/27/1930 The Hanson family resides at 280 Happy Street, Murfreesboro, Tennessee 37132. An in-depth interview with Helen, coupled with a review of all her documentation reveals the following information for the current vear: Text Predictions On Lo Accessibility: Good to go Focus 5) W Raining no 2 Die dividual (Spring 2022) (Saved to this PC Search (Alt+O) References Mailings Review View Help A Aa- A > ST 120 Emphasis Heading 1 ADA Paragraph Styles The Hanson family resides at 280 Happy Street, Murfreesboro, Termessee 37132 An in-depth interview with Helen, coupled with a review of all her documentation, reveals the following information for the current year: 1. Helen owns and operates a computer consulting business specializing in computer systems design (doing business as Helen's Computer Solutions) as a sole proprietorship. Helen's Computer Solutions specializes in computer system design and related services. Helen's office is located at 125 Blackberry Boulevard, Murfreesboro, Tennessee 37132. The employer identification number of the company is 41-5474678 The company uses the cash method of accounting for keeping its books. This is a service business, so Helen has no cost of goods sold. xt Predictions on E Accessibility. Good to go DR rences Mailings Review View Help | Aa- Po --- E TC Emphasis Heading Normal - A Paragraph Styles 5 Helen collected revenue of $301,120 (all reported to the Company on Form 1099-NEC). and paid the following expenses all of these expenses pass the 12-month rule test for tax recognition in 2021): . . Repairs and maintenance, $500. Rent on office, $30,000. Employee salaries (wages), $100,000 Office expense, $2,720. Payroll Taxes, $7,650. Advertising, $2,500. Fine paid to the state of Tennessee for unfair trade practices. $2,000. Legal and professional fees, $2,000. Business meals, $4,000. The entire $4,000 of the business meals were paid to restaurants Business entertainment, $800 Utilities, $3,740 Supplies, $1,500 Property, casualty, and liability insurance, $3,500 Health insurance premiums on a policy Helen purchased to cover her and her two children, $20,000. The coverage was in place for the entire year and Helen does not qualify for the premium tax credit. Helen used a 2015 Cadillac (purchased on January 1, 2015) for both business and personal purposes. Helen drove the car 5,594 miles for business in 2021. She also drove it 16,176 miles for personal reasons (3,206 of those miles were for commuting) Helen uses the standard mileage rate to account for her business transportation expenses rather Accessibility: Good to go C Focus dictions: On Raining now A Aa - A SIC Emphasis Heading 1 Normal - A- Paragraph Styles 4. Helen paid Kinder Care, Inc. a total of $6,200 to take care of Hank while she was at work Kinder Care, Inc. is located at 1200 Child Care Street, Murfreesboro, TN 37132. Kinder Care's tax identification number is 46-3456789 5. Helen received a Form 1099-INT from State Street Bank and Trust indicating she earned a total of $2,000 of interest income from her bank account. Helen has no interest in any foreign accounts or trusts. 6. Helen received a Form 1099-DIV from ABC Corporation indicating she received a total of $1,000 of dividend income from the corporation. The Form 1099-DIV indicated that the entire $1,000 was qualified dividend income (eligible for the preferential maximum tax rate). 7. On April 14, 2021 Helen won a jackpot of $9,000 at the Lucky Lady Casino. The casino withheld federal income taxes of $1,800 from Helen's jackpot and gave Helen a check for $7,200. Helen received a W-2 from the casino showing the gambling winnings of $9,000 and the Federal income tax withholding of $1,800. In addition to her gambling winnings. Helen had properly documented gambling losses totaling $10,000 in 2021. 8. Helen sold 500 shares of XYZ Corporation stock for $33.00 per share on October 1, 2021. She paid an additional $20 commission to her broker to transact the sale. She originally paid $22.00 per share when she purchased the stock on January 15, 2009. She paid an additional $20 commission to her broker to make the purchase. This information (including basis information) was reported to Helen on Form 1099-B. 9. Helen sold 100 shares of ABC Corporation stock for $10 per share on December 1, 2021 She paid an additional $10 commission to her broker to transact the sale. She originally neid sa nar share then ther shared the tot Tanvar 2001 che unistan Predictions: On Accessibility: Good to go Focus Rainin TAa-Ao 1 Emphasis Heading 1 Normal Paragraph Styles 9. Helen sold 100 shares of ABC Corporation stock for $10 per share on December 1, 2021 She paid an additional $10 commission to her broker to transact the sale. She originally paid $9 per share when they purchased the stock on January 2, 2021. She paid an additional $5 commission to her broker to make the purchase. This information (including basis information) was reported to Helen on Form 1099-B. 10. Helen recerved $800 in interest on a state of Tennessee bond in 2021. This information was reported to them on Form 1099-INT. 11. Helen received a Form 1098 from Regions Bank indicating she paid a total of $11,800 in home mortgage interest. The mortgage origination date was January 1, 2016 and the current balance on the mortgage is $290,000. She also paid $3,240 in property taxes on her home and $900 interest on personal debt (i.e., a car loan and credit cards). 12. Helen contributed $4,800 to her local church, an organization officially recognized by the IRS as a nonprofit, tax exempt entity. Helen has proper documentation for this contribution 13. On October 1, 2021. Helen contributed 50 shares of ZZZ Corporation stock to the Red Cross, an organization officially recognized by the IRS as a nonprofit, tax-exempt entity D) Focus redictions: On Accessibility: Good to go Raining u Ag- o IC Emphasis Heading 1 Normal -PA 15 Paragraph Styles Helen purchased the 50 shares on February 5, 2008 for a total of $2,000. The fair market value of the stock on the date of contribution was $5,000. 14. 324012030302Helen paid $12,000 in tuition to Middle Tennessee State University in 2021. The tuition was paid on behalf of Hillary, who was a full-time student at State University in 2021. Hillary is a Sophomore at MTSU and Helen claimed the American Opportunity Tax Credit for expenses paid on behalf of Hillary for the first time in 2019. Hillary received a Form 1099-T from MTSU indicating the $12,000 of tuition paid in 2021. 15. Helen has no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. Search for the "sales tax deduction calculator" on the IRS website, and use it to simplify the calculation of their deductible sales tax Assume that Helen had no additional large purchases that were subject to sales tax in 2021. 16. Helen paid $13,832 in out-of-pocket medical expenses (documented hospital doctor and dental bills) in 2021. She also drove a total of 600 miles going to and from medical appointments. She has proper documentation for this mileage 17. Helen paid $5,400 for prescription drugs and $2,640 for over-the-counter (non prescription) drugs in 2021. 18. Helen contributed $6,000 to a traditional IRA in 2021. She is not covered by another qualified retirement plan {She should talk to her CPA about setting up a retirement plan for her business) 19. Helen received $12,000 in alimony from her ex-husband, Bobby Baker (SSN: 471-55- 5555) in 2001 Helen'e dita e fealizar on March 2014 and the dance Predictions: On Accessibility: Good to go Focus Raining LIS A A Aa- / PoE A . A- Emphasis Heading 1 Nom Paragraph ry Styles Plan tor her usmessy 19. Helen received $12,000 in alimony from her ex-husband, Bobby Baker (SSN: 471-55- 5555) in 2021. Helen's divorce was finalized on March 2, 2014 and the divorce settlement agreement has not been modified 20. Helen received $18,000 in child support from her ex-husband, Bobby Baker (SSN: 471- 55-5555) in 2021 21. Helen made a $10,000 gift to her sister to congratulate her on graduating from MTSU. 22. Helen received a $25,000 gift from her great uncle Charlie in 2021 Additional notes: Helen has adequate documentation to support each of the aforementioned expenses, and they have no carryforwards from previous years that will impact their return for the current year. Round all amounts presented on the tax return to the nearest dollar and leave the "cents" column blank. Any lines on the tax return that you don't need to use should be left blank do not enter zeros. Helen has no AMT liability so you may omit Form 6251. D. Focus ext Predictions on Eot Accessibility: Good to go Rain A Aa A 46 24 Emphasis Heading 1 Norr XA -A- 6 Paragraph Styles Instructions Prepare a 2021 Form 1040 - U.S. Individual Income Tax Return - for Helen Hanson that is both professional in appearance and technically correct. The use of tax software or a professional tax preparer to complete this project is prohibited. This project is due on or before 8:00 pm on Friday, February 25, 2022. Late returns will not be accepted. The following three documents must be uploaded to the appropriate D2L Dropbox on or before the due date: 1. A signed copy of the required cover sheet certifying that the tax retur project is entirely your own work and you have neither given nor received unpermitted oral, written or other assistance to or from anyone, including past or present students, in completing this project. 2. The completed tax return project. Submit one pdf document consisting of all required forms and schedules. You may not submit multiple copies of individual forms. Late tax retums will not be accepted 3. An excel spreadsheet showing a detailed calculation of taxable income. The spreadsheet should follow the format set forth in Exhibit 4-1 of the textbook. Show the details of all calculations and clearly label gross (total) income, adjusted gross income taxable income, income tax liability, other tax liability, and taxes due or (refund). The objective of this project is to enhance your understanding of the Internal Revenue Code rules as they relate to the individual taxpayer through practical application. After you have tried to the best of your ability to resolve any questions you have on your own, you are welcome to contact me with specific questions. The learning experience can be enhanced if students are allowed to resolve a few relatively minor issues among themselves. However, the objective can only be achieved if each student substantially completes his her own project. Examples of student collaboration that are not acceptable include, but are not limited to: TTT 51 Text Predictions: On Et Accessibility: Good to go Focus Rainin Foul References Mailings Review View Help A A A A XA-A- Emphasis Heading 1 Normal TE Paragraph Styles Working together as a group of two or more students to prepare a single tax return and making copies for each student to submit, or Coordinating with one or more students to determine what should be entered on numerous lmes of the tax forms/schedules so that it appears that a single return was prepared and copied Additional instructions: Prepare the return as if you were preparing it for an actual client. All necessary forms and schedules should be attached to the return and property and neatly completed. Schedules 1, 2, 3 A,B,C,D. SE, Form 2441, Form 8867 and Form 8283 must be completed and attached to the retum in the proper order. Required forms are posted to D2L. Download the required forms and save them under a new name before completing. The pdf forms can be filled in and edited as necessary A pdf version of the return is required A handwritten return that is neat and professional will be accepted with a 5 point subtraction for not submitting in pdf format. A 5) Text Predictions: On Accessibility: Good to go Focus BE Raining now Emphasis Heading 2 Normal A A Aa 4 A- A- Styles Paragraph save them under a new name before completing. The pdf forms can be filled in and edited as necessary A pdf version of the return is required A handwritten return that is neat and professional will be accepted with a 5-point subtraction for not submitting in pdf format. A handwritten return that is not neat and professional will not be accepted. Interview Information Helen Hanson is an unmarried, calendar year, cash basis taxpayer. Helen provides the majority of support for her two children (Hillary and Hank), who live with her. Hillary is a full-time student at Middle Tennessee State University and eamed $5,000 in wages in 2021. Hank had no income in 2021. Helen did not receive any advance child tax credit payments in 2021. IHelen's mother, Heather Johnson, also lives with Helen Helen provides 80% of Heather's support. Heather provides the other 20% Heather received $14,000 in social security benefits and $1,400 in interest from a savings account in 2021. The social security numbers and dates of birth for members of the family are as follows: Helen Hillary Hank Heather Social Security Number 471-11-1111 471-22-2222 471-33-3333 471-44-4444 Date of Birth 9/30/1974 2/12/1999 8/19/2015 9/27/1930 The Hanson family resides at 280 Happy Street, Murfreesboro, Tennessee 37132. An in-depth interview with Helen, coupled with a review of all her documentation reveals the following information for the current vear: Text Predictions On Lo Accessibility: Good to go Focus 5) W Raining no 2 Die dividual (Spring 2022) (Saved to this PC Search (Alt+O) References Mailings Review View Help A Aa- A > ST 120 Emphasis Heading 1 ADA Paragraph Styles The Hanson family resides at 280 Happy Street, Murfreesboro, Termessee 37132 An in-depth interview with Helen, coupled with a review of all her documentation, reveals the following information for the current year: 1. Helen owns and operates a computer consulting business specializing in computer systems design (doing business as Helen's Computer Solutions) as a sole proprietorship. Helen's Computer Solutions specializes in computer system design and related services. Helen's office is located at 125 Blackberry Boulevard, Murfreesboro, Tennessee 37132. The employer identification number of the company is 41-5474678 The company uses the cash method of accounting for keeping its books. This is a service business, so Helen has no cost of goods sold. xt Predictions on E Accessibility. Good to go DR rences Mailings Review View Help | Aa- Po --- E TC Emphasis Heading Normal - A Paragraph Styles 5 Helen collected revenue of $301,120 (all reported to the Company on Form 1099-NEC). and paid the following expenses all of these expenses pass the 12-month rule test for tax recognition in 2021): . . Repairs and maintenance, $500. Rent on office, $30,000. Employee salaries (wages), $100,000 Office expense, $2,720. Payroll Taxes, $7,650. Advertising, $2,500. Fine paid to the state of Tennessee for unfair trade practices. $2,000. Legal and professional fees, $2,000. Business meals, $4,000. The entire $4,000 of the business meals were paid to restaurants Business entertainment, $800 Utilities, $3,740 Supplies, $1,500 Property, casualty, and liability insurance, $3,500 Health insurance premiums on a policy Helen purchased to cover her and her two children, $20,000. The coverage was in place for the entire year and Helen does not qualify for the premium tax credit. Helen used a 2015 Cadillac (purchased on January 1, 2015) for both business and personal purposes. Helen drove the car 5,594 miles for business in 2021. She also drove it 16,176 miles for personal reasons (3,206 of those miles were for commuting) Helen uses the standard mileage rate to account for her business transportation expenses rather Accessibility: Good to go C Focus dictions: On Raining now A Aa - A SIC Emphasis Heading 1 Normal - A- Paragraph Styles 4. Helen paid Kinder Care, Inc. a total of $6,200 to take care of Hank while she was at work Kinder Care, Inc. is located at 1200 Child Care Street, Murfreesboro, TN 37132. Kinder Care's tax identification number is 46-3456789 5. Helen received a Form 1099-INT from State Street Bank and Trust indicating she earned a total of $2,000 of interest income from her bank account. Helen has no interest in any foreign accounts or trusts. 6. Helen received a Form 1099-DIV from ABC Corporation indicating she received a total of $1,000 of dividend income from the corporation. The Form 1099-DIV indicated that the entire $1,000 was qualified dividend income (eligible for the preferential maximum tax rate). 7. On April 14, 2021 Helen won a jackpot of $9,000 at the Lucky Lady Casino. The casino withheld federal income taxes of $1,800 from Helen's jackpot and gave Helen a check for $7,200. Helen received a W-2 from the casino showing the gambling winnings of $9,000 and the Federal income tax withholding of $1,800. In addition to her gambling winnings. Helen had properly documented gambling losses totaling $10,000 in 2021. 8. Helen sold 500 shares of XYZ Corporation stock for $33.00 per share on October 1, 2021. She paid an additional $20 commission to her broker to transact the sale. She originally paid $22.00 per share when she purchased the stock on January 15, 2009. She paid an additional $20 commission to her broker to make the purchase. This information (including basis information) was reported to Helen on Form 1099-B. 9. Helen sold 100 shares of ABC Corporation stock for $10 per share on December 1, 2021 She paid an additional $10 commission to her broker to transact the sale. She originally neid sa nar share then ther shared the tot Tanvar 2001 che unistan Predictions: On Accessibility: Good to go Focus Rainin TAa-Ao 1 Emphasis Heading 1 Normal Paragraph Styles 9. Helen sold 100 shares of ABC Corporation stock for $10 per share on December 1, 2021 She paid an additional $10 commission to her broker to transact the sale. She originally paid $9 per share when they purchased the stock on January 2, 2021. She paid an additional $5 commission to her broker to make the purchase. This information (including basis information) was reported to Helen on Form 1099-B. 10. Helen recerved $800 in interest on a state of Tennessee bond in 2021. This information was reported to them on Form 1099-INT. 11. Helen received a Form 1098 from Regions Bank indicating she paid a total of $11,800 in home mortgage interest. The mortgage origination date was January 1, 2016 and the current balance on the mortgage is $290,000. She also paid $3,240 in property taxes on her home and $900 interest on personal debt (i.e., a car loan and credit cards). 12. Helen contributed $4,800 to her local church, an organization officially recognized by the IRS as a nonprofit, tax exempt entity. Helen has proper documentation for this contribution 13. On October 1, 2021. Helen contributed 50 shares of ZZZ Corporation stock to the Red Cross, an organization officially recognized by the IRS as a nonprofit, tax-exempt entity D) Focus redictions: On Accessibility: Good to go Raining u Ag- o IC Emphasis Heading 1 Normal -PA 15 Paragraph Styles Helen purchased the 50 shares on February 5, 2008 for a total of $2,000. The fair market value of the stock on the date of contribution was $5,000. 14. 324012030302Helen paid $12,000 in tuition to Middle Tennessee State University in 2021. The tuition was paid on behalf of Hillary, who was a full-time student at State University in 2021. Hillary is a Sophomore at MTSU and Helen claimed the American Opportunity Tax Credit for expenses paid on behalf of Hillary for the first time in 2019. Hillary received a Form 1099-T from MTSU indicating the $12,000 of tuition paid in 2021. 15. Helen has no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. Search for the "sales tax deduction calculator" on the IRS website, and use it to simplify the calculation of their deductible sales tax Assume that Helen had no additional large purchases that were subject to sales tax in 2021. 16. Helen paid $13,832 in out-of-pocket medical expenses (documented hospital doctor and dental bills) in 2021. She also drove a total of 600 miles going to and from medical appointments. She has proper documentation for this mileage 17. Helen paid $5,400 for prescription drugs and $2,640 for over-the-counter (non prescription) drugs in 2021. 18. Helen contributed $6,000 to a traditional IRA in 2021. She is not covered by another qualified retirement plan {She should talk to her CPA about setting up a retirement plan for her business) 19. Helen received $12,000 in alimony from her ex-husband, Bobby Baker (SSN: 471-55- 5555) in 2001 Helen'e dita e fealizar on March 2014 and the dance Predictions: On Accessibility: Good to go Focus Raining LIS A A Aa- / PoE A . A- Emphasis Heading 1 Nom Paragraph ry Styles Plan tor her usmessy 19. Helen received $12,000 in alimony from her ex-husband, Bobby Baker (SSN: 471-55- 5555) in 2021. Helen's divorce was finalized on March 2, 2014 and the divorce settlement agreement has not been modified 20. Helen received $18,000 in child support from her ex-husband, Bobby Baker (SSN: 471- 55-5555) in 2021 21. Helen made a $10,000 gift to her sister to congratulate her on graduating from MTSU. 22. Helen received a $25,000 gift from her great uncle Charlie in 2021 Additional notes: Helen has adequate documentation to support each of the aforementioned expenses, and they have no carryforwards from previous years that will impact their return for the current year. Round all amounts presented on the tax return to the nearest dollar and leave the "cents" column blank. Any lines on the tax return that you don't need to use should be left blank do not enter zeros. Helen has no AMT liability so you may omit Form 6251. D. Focus ext Predictions on Eot Accessibility: Good to go Rain