Answered step by step

Verified Expert Solution

Question

1 Approved Answer

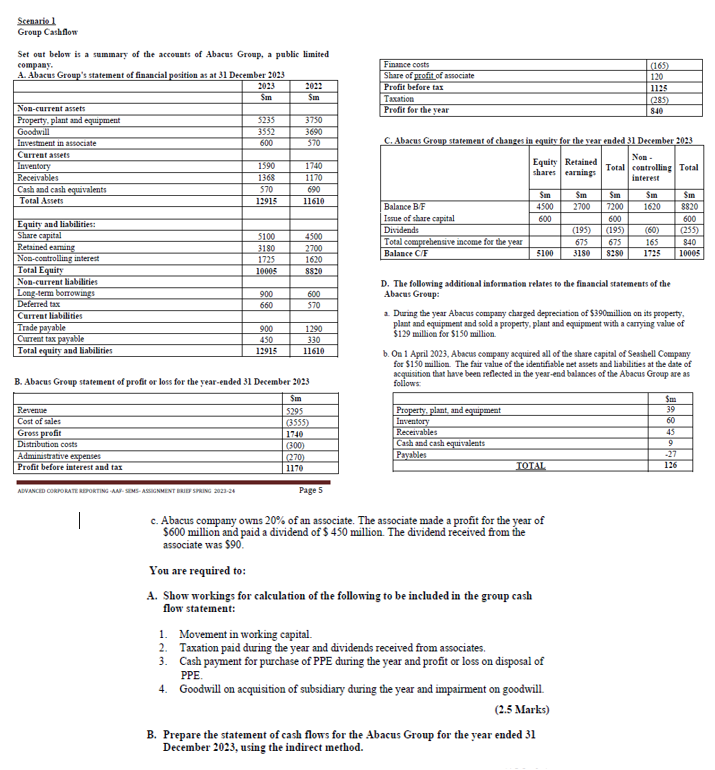

A. Abacus Group's statement of financial position as at 31 December 2023 2023 2022 Sm $m Non-current assets Property, plant and equipment 5235 3750

A. Abacus Group's statement of financial position as at 31 December 2023 2023 2022 Sm $m Non-current assets Property, plant and equipment 5235 3750 Goodwill 3552 3690 Investment in associate 600 570 Scenario 1 Group Cashflow Set out below is a summary of the accounts of Abacus Group, a public limited company. Finance costs Share of profit of associate Profit before tax Taxation Profit for the year (165) 120 1125 (285) 840 C. Abacus Group statement of changes in equity for the year ended 31 December 2023 Current assets Inventory 1590 1740 Equity Retained shares earnings Non- Total controlling Total Receivables 1368 1170 interest Cash and cash equivalents 570 690 Sm Sm Sm Sm Sm Total Assets 12915 11610 Balance B/F 4500 2700 7200 1620 8820 Equity and liabilities: Issue of share capital 600 600 600 Dividends (195) (195) (60) (255) Share capital 5100 4500 Retained earning 3180 2700 Total comprehensive income for the year Balance C/F 5100 675 675 3180 8280 165 840 1725 10005 Non-controlling interest 1725 1620 Total Equity 10005 8820 Non-current liabilities Long-term borrowings Deferred tax Current liabilities Trade payable Current tax payable Total equity and liabilities 900 600 660 570 900 1290 450 330 12915 11610 B. Abacus Group statement of profit or loss for the year-ended 31 December 2023 D. The following additional information relates to the financial statements of the Abacus Group: a. During the year Abacus company charged depreciation of $390 million on its property, plant and equipment and sold a property, plant and equipment with a carrying value of $129 million for $150 million. b. On 1 April 2023, Abacus company acquired all of the share capital of Seashell Company for $150 million. The fair value of the identifiable net assets and liabilities at the date of acquisition that have been reflected in the year-end balances of the Abacus Group are as follows: $m Revenue Cost of sales Gross profit 5295 (3555) 1740 Distribution costs Administrative expenses Profit before interest and tax (300) (270) 1170 ADVANCED CORPORATE REPORTING-AAF-SEMS-ASSIGNMENT BRIEF SPRING 2023-24 Page 5 | Property, plant, and equipment Inventory Receivables Cash and cash equivalents Payables $m 39 60 45 9 -27 TOTAL 126 c. Abacus company owns 20% of an associate. The associate made a profit for the year of $600 million and paid a dividend of $ 450 million. The dividend received from the associate was $90. You are required to: A. Show workings for calculation of the following to be included in the group cash flow statement: 1. Movement in working capital. 2. Taxation paid during the year and dividends received from associates. 3. Cash payment for purchase of PPE during the year and profit or loss on disposal of PPE. 4. Goodwill on acquisition of subsidiary during the year and impairment on goodwill. (2.5 Marks) B. Prepare the statement of cash flows for the Abacus Group for the year ended 31 December 2023, using the indirect method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started