Answered step by step

Verified Expert Solution

Question

1 Approved Answer

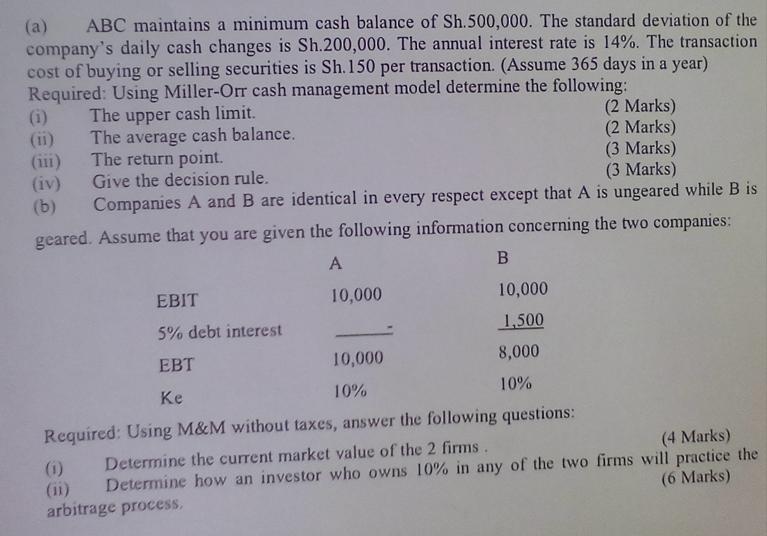

(a) ABC maintains a minimum cash balance of Sh.500,000. The standard deviation of the company's daily cash changes is Sh.200,000. The annual interest rate

(a) ABC maintains a minimum cash balance of Sh.500,000. The standard deviation of the company's daily cash changes is Sh.200,000. The annual interest rate is 14%. The transaction cost of buying or selling securities is Sh. 150 per transaction. (Assume 365 days in a year) Required: Using Miller-Orr cash management model determine the following: (i) (11) The upper cash limit. The average cash balance. The return point. Give the decision rule. (3 Marks) Companies A and B are identical in every respect except that A is ungeared while B is geared. Assume that you are given the following information concerning the two companies: A 10,000 (iii) (iv) (b) EBIT 5% debt interest EBT Ke 10,000 10% B 10,000 1,500 (2 Marks) (2 Marks) (3 Marks) 8,000 10% Required: Using M&M without taxes, answer the following questions: (4 Marks) (1) Determine the current market value of the 2 firms. (ii) (6 Marks) Determine how an investor who owns 10% in any of the two firms will practice the arbitrage process.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION The MillerOrr cash management model is used to determine the optimal cash balance for a company to minimize transaction costs while maintaining a desired level of liquidity Given Minimum cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started