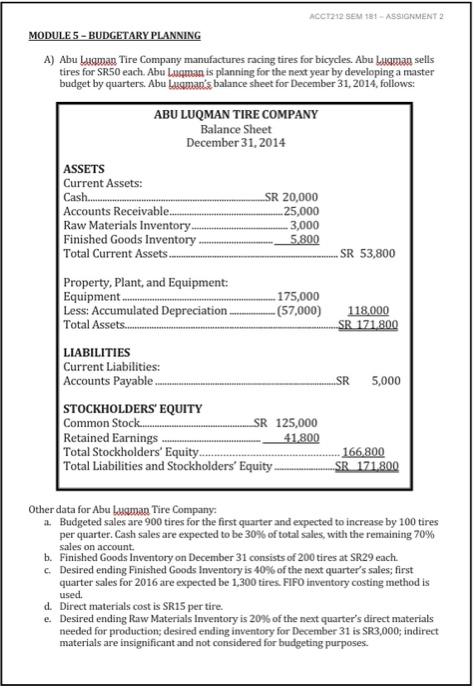

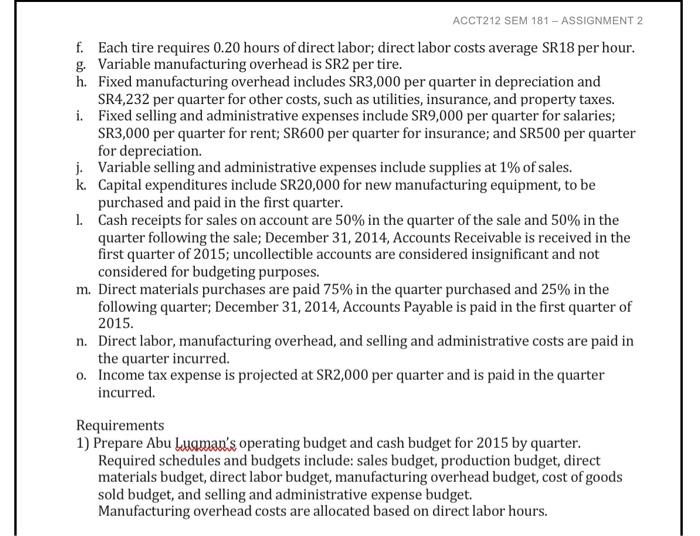

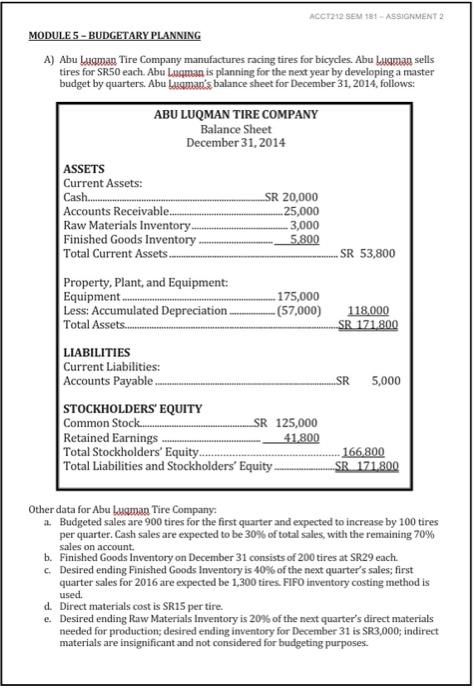

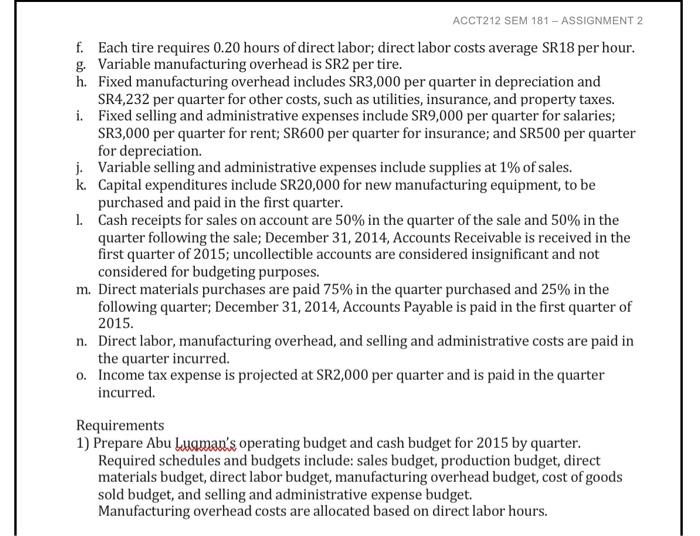

A) Abu Lugman Tire Company manufactures racing tires for bicycles. Abu Lugman sells tires for SR50 each. Abu Luqwan is planning for the next year by developing a master budget by quarters. Abu Loswan's balance sheet for December 31, 2014, follows: Other data for Abu buman Tire Company: a. Budgeted sales are 900 tires for the first quarter and expected to increase by 100 tires per quarter. Cash sales are expected to be 30% of total sales, with the remaining 70% sales on account. b. Finished Goods Inventory on December 31 consists of 200 tires at SR29 each. c. Desired ending Finished Goods lnventory is 40% of the next quarter's sales; first quarter sales for 2016 are expected be 1,300 tires. FIFO inventory costing method is used. d. Direct materials cost is SR15 per tire. e. Desired ending Raw Materials Inventory is 20% of the next quarter's direct materials needed for production; desired ending inventory for December 31 is SR3,000; indirect materials are insignificant and not considered for budgeting purposes. ACCT212 SEM 181 - ASSIGNMENT 2 f. Each tire requires 0.20 hours of direct labor; direct labor costs average SR18 per hour. g. Variable manufacturing overhead is SR2 per tire. h. Fixed manufacturing overhead includes SR3,000 per quarter in depreciation and SR4,232 per quarter for other costs, such as utilities, insurance, and property taxes. i. Fixed selling and administrative expenses include SR9,000 per quarter for salaries; SR3,000 per quarter for rent; SR600 per quarter for insurance; and SR500 per quarter for depreciation. j. Variable selling and administrative expenses include supplies at 1% of sales. k. Capital expenditures include SR20,000 for new manufacturing equipment, to be purchased and paid in the first quarter. 1. Cash receipts for sales on account are 50% in the quarter of the sale and 50% in the quarter following the sale; December 31,2014 , Accounts Receivable is received in the first quarter of 2015; uncollectible accounts are considered insignificant and not considered for budgeting purposes. m. Direct materials purchases are paid 75% in the quarter purchased and 25% in the following quarter; December 31, 2014, Accounts Payable is paid in the first quarter of 2015. n. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. o. Income tax expense is projected at SR2,000 per quarter and is paid in the quarter incurred. Requirements 1) Prepare Abu Luqman's operating budget and cash budget for 2015 by quarter. Required schedules and budgets include: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, and selling and administrative expense budget. Manufacturing overhead costs are allocated based on direct labor hours. A) Abu Lugman Tire Company manufactures racing tires for bicycles. Abu Lugman sells tires for SR50 each. Abu Luqwan is planning for the next year by developing a master budget by quarters. Abu Loswan's balance sheet for December 31, 2014, follows: Other data for Abu buman Tire Company: a. Budgeted sales are 900 tires for the first quarter and expected to increase by 100 tires per quarter. Cash sales are expected to be 30% of total sales, with the remaining 70% sales on account. b. Finished Goods Inventory on December 31 consists of 200 tires at SR29 each. c. Desired ending Finished Goods lnventory is 40% of the next quarter's sales; first quarter sales for 2016 are expected be 1,300 tires. FIFO inventory costing method is used. d. Direct materials cost is SR15 per tire. e. Desired ending Raw Materials Inventory is 20% of the next quarter's direct materials needed for production; desired ending inventory for December 31 is SR3,000; indirect materials are insignificant and not considered for budgeting purposes. ACCT212 SEM 161 - ASSIGNMENT 2 f. Each tire requires 0.20 hours of direct labor, direct labor costs average SR18 per hour. g. Variable manufacturing overhead is SR2 per tire. h. Fixed manufacturing overhead includes SR3,000 per quarter in depreciation and SR4,232 per quarter for other costs, such as utilities, insurance, and property taxes. i. Fixed selling and administrative expenses include SR9,000 per quarter for salaries; SR3,000 per quarter for rent; SR600 per quarter for insurance; and SR500 per quarter for depreciation. j. Variable selling and administrative expenses include supplies at 1% of sales. k. Capital expenditures include SR20,000 for new manufacturing equipment, to be purchased and paid in the first quarter. 1. Cash receipts for sales on account are 50% in the quarter of the sale and 50% in the quarter following the sale; December 31,2014 , Accounts Receivable is received in the first quarter of 2015 ; uncollectible accounts are considered insignificant and not considered for budgeting purposes. m. Direct materials purchases are paid 75% in the quarter purchased and 25% in the following quarter; December 31, 2014, Accounts Payable is paid in the first quarter of 2015. n. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. o. Income tax expense is projected at SR2,000 per quarter and is paid in the quarter incurred. Requirements 1) Prepare Abu bugman's operating budget and cash budget for 2015 by quarter. Required schedules and budgets include: sales budget, production budget, direct materials budget, direct labor budget, manufacturing overhead budget, cost of goods sold budget, and selling and administrative expense budget. Manufacturing overhead costs are allocated based on direct labor hours. WRITE ALL THE ANSWERS IN THE ANSWER SHEETS PROVIDED. B) Abu lJas Company expects to have a cash balance of SR45,000 on January 1, 2014. Relevant monthly budget data for the first 2 months of 2014 are as follows. - Collections from customers: ]anuary SR8S,000, February SR150,000. - Payments for direct materials: January SR50,000, February SR75,000. - Direct labor: January SR30,000, February SR45,000. Wages are paid in the month they are incurred. - Manufacturing overhead: January SR21,000, February SR25,000. These costs include depreciation of SR1,500 per month. All other overhead costs are paid as incurred. - Selling and administrative expenses: January SR15,000, February SR20,000. These costs are exclusive of depreciation. They are paid as incurred. - Sales of marketable securities in lanuary are expected to realize SR12,000 in cash. Abu llyas Company has a line of credit at a local bank that enables it to borrow up to SR25,000. The company wants to maintain a minimum monthly cash balance of SR20,000. Instructions Prepare a cash budget for January and February IN THE ANSWER SHEETS PROVIDED