Answered step by step

Verified Expert Solution

Question

1 Approved Answer

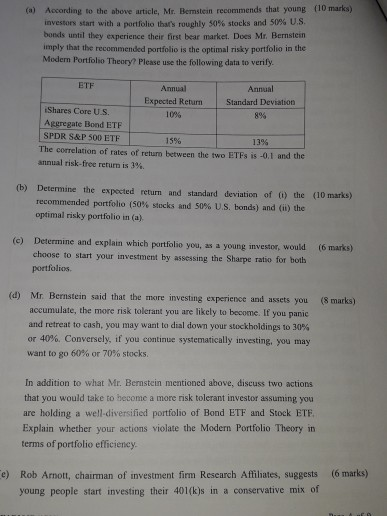

(a) According to the above article, Mr. Bemstein recommends that young (10 marks) investors start with a portfolio bars roughly 50% stocks and 50% US.

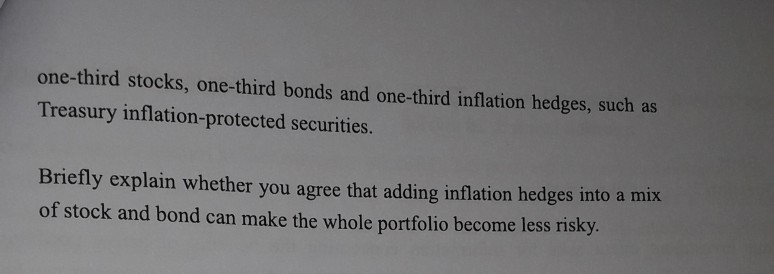

(a) According to the above article, Mr. Bemstein recommends that young (10 marks) investors start with a portfolio bars roughly 50% stocks and 50% US. bonds until they experience their first bear market. Does Mr. Bernstein imply that the recommended portfolio is the optimal risky portfolio in the Modern Portfolio Theory? Please use the following data to verify ETF Annual Annual Expected Return Standard Deviation Shares Core U.S. 10% 8% Aggregate Bond ETF SPDR S&P 500 ETF 1 596 13% The correlation of rates of return between the two ETFs is -0.1 and the annual risk-free return is 3%. (tb) Determine the expected return and standard deviation of ) the (10 marks) recommended portfolio (50% stocks and 50% US, bonds) and (ii) the optimal risky portfolio in (a) (e) Determine and explain which portfolio you, as a young investor, would (6 marks) choose to start your investment by assessing the Sharpe ratio for both portfolios. (d) Mr. Bernstein said that the more investing experience and assets you (8 marks) accumulate, the more risk tolerant you are likely to become. If you panic and retreat to cash, you may want to dal down your stockholdings to 30% or 40%. Conversely, if you continue systematically investing, you may want to go 60% or 70% stocks. In addition to what Mr. Bernstein mentioned above, discuss two actions that you would take to become a more risk tolerant investor assuming you are holding a well diversified portfolio of Bond ETF and Stock ETE Explain whether your actions violate the Modern Portfolio Theory in terms of portfolio efficieney (6 marks) e) Rob Arnott, chairman of investment firm Research Affilhates, suggests young people start investing their 401(k)s in a conservative mix of one-third stocks, one-third bonds and one-third inflation hedges, such as Treasury inflation-protected securities. Briefly explain whether you agree that adding inflation hedges into a mix of stock and bond can make the whole portfolio become less risky (a) According to the above article, Mr. Bemstein recommends that young (10 marks) investors start with a portfolio bars roughly 50% stocks and 50% US. bonds until they experience their first bear market. Does Mr. Bernstein imply that the recommended portfolio is the optimal risky portfolio in the Modern Portfolio Theory? Please use the following data to verify ETF Annual Annual Expected Return Standard Deviation Shares Core U.S. 10% 8% Aggregate Bond ETF SPDR S&P 500 ETF 1 596 13% The correlation of rates of return between the two ETFs is -0.1 and the annual risk-free return is 3%. (tb) Determine the expected return and standard deviation of ) the (10 marks) recommended portfolio (50% stocks and 50% US, bonds) and (ii) the optimal risky portfolio in (a) (e) Determine and explain which portfolio you, as a young investor, would (6 marks) choose to start your investment by assessing the Sharpe ratio for both portfolios. (d) Mr. Bernstein said that the more investing experience and assets you (8 marks) accumulate, the more risk tolerant you are likely to become. If you panic and retreat to cash, you may want to dal down your stockholdings to 30% or 40%. Conversely, if you continue systematically investing, you may want to go 60% or 70% stocks. In addition to what Mr. Bernstein mentioned above, discuss two actions that you would take to become a more risk tolerant investor assuming you are holding a well diversified portfolio of Bond ETF and Stock ETE Explain whether your actions violate the Modern Portfolio Theory in terms of portfolio efficieney (6 marks) e) Rob Arnott, chairman of investment firm Research Affilhates, suggests young people start investing their 401(k)s in a conservative mix of one-third stocks, one-third bonds and one-third inflation hedges, such as Treasury inflation-protected securities. Briefly explain whether you agree that adding inflation hedges into a mix of stock and bond can make the whole portfolio become less risky

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started