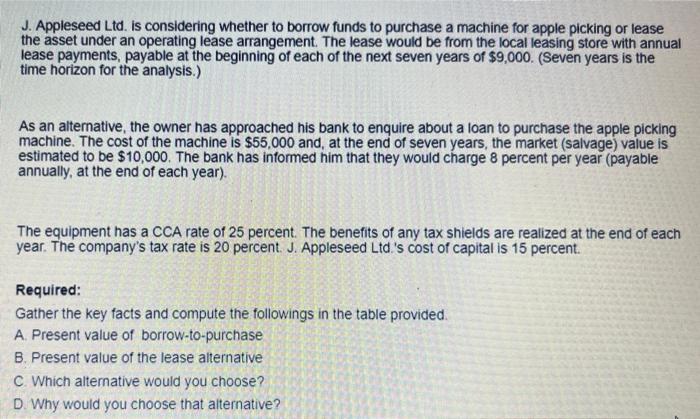

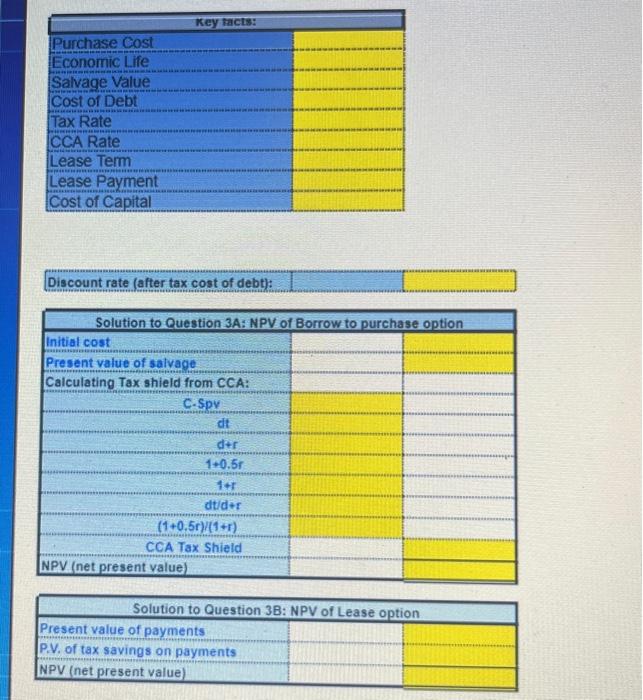

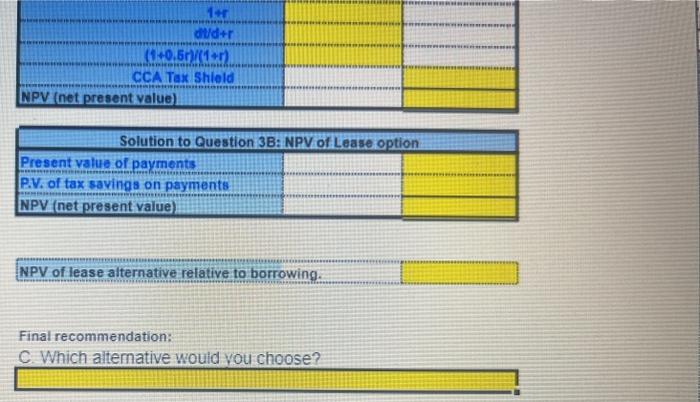

J. Appleseed Ltd. is considering whether to borrow funds to purchase a machine for apple picking or lease the asset under an operating lease arrangement. The lease would be from the local leasing store with annual lease payments, payable at the beginning of each of the next seven years of \\( \\$ 9,000 \\). (Seven years is the time horizon for the analysis.) As an alternative, the owner has approached his bank to enquire about a loan to purchase the apple picking machine. The cost of the machine is \\( \\$ 55,000 \\) and, at the end of seven years, the market (salvage) value is estimated to be \\( \\$ 10,000 \\). The bank has informed him that they would charge 8 percent per year (payable annually, at the end of each year). The equipment has a CCA rate of 25 percent. The benefits of any tax shields are realized at the end of each year. The company's tax rate is 20 percent. J. Appleseed Ltd.'s cost of capital is 15 percent. Required: Gather the key facts and compute the followings in the table provided. A. Present value of borrow-to-purchase B. Present value of the lease alternative C. Which alternative would you choose? Purchase cost Economic Life Salvage Value Cost of Debt Tax Rate CCA Rate Lease Term Lease Payment Cost of Capital Discount rate (after tax cost of debt): Solution to Question 3A: NPV of Borrow to purchase option Initial cost Present value of salvage Calculating Tax shield from CCA: \\begin{tabular}{|c|c|} \\hline Calculating Tax shield from CCA: \\\\ \\hline C.SpV & \\\\ \\hline\\( d t \\) & \\\\ \\hline \\( 1+r \\) & \\\\ \\hline \\( 1+0.5 r \\) & \\\\ \\hline \\( 1+r \\) & \\\\ \\hline dt/d+r & \\\\ \\hline CCA Tax Shield & \\\\ \\hline NPV (net present value) & \\\\ \\hline \\end{tabular} Solution to Question 3B: NPV of Lease option Present value of payments P.V. of tax savings on payments NPV (net present value) \\begin{tabular}{|l|l|} \\hline \\multicolumn{1}{|c|}{ Solution to Question \\( 3 B: \\) NPV of Lease option } \\\\ \\hline Present value of payments \\\\ \\hline P.V. of tax savings on payments & \\\\ \\hline NPV (net present value) & \\\\ \\hline \\end{tabular} NPV of lease alternative relative to borrowing. Final recommendation: C. Which altemative would vou choose