Question

a) After completing all of the entries in Exercise 2, what is the correct Net Book Value after the entries are recorded for the 2

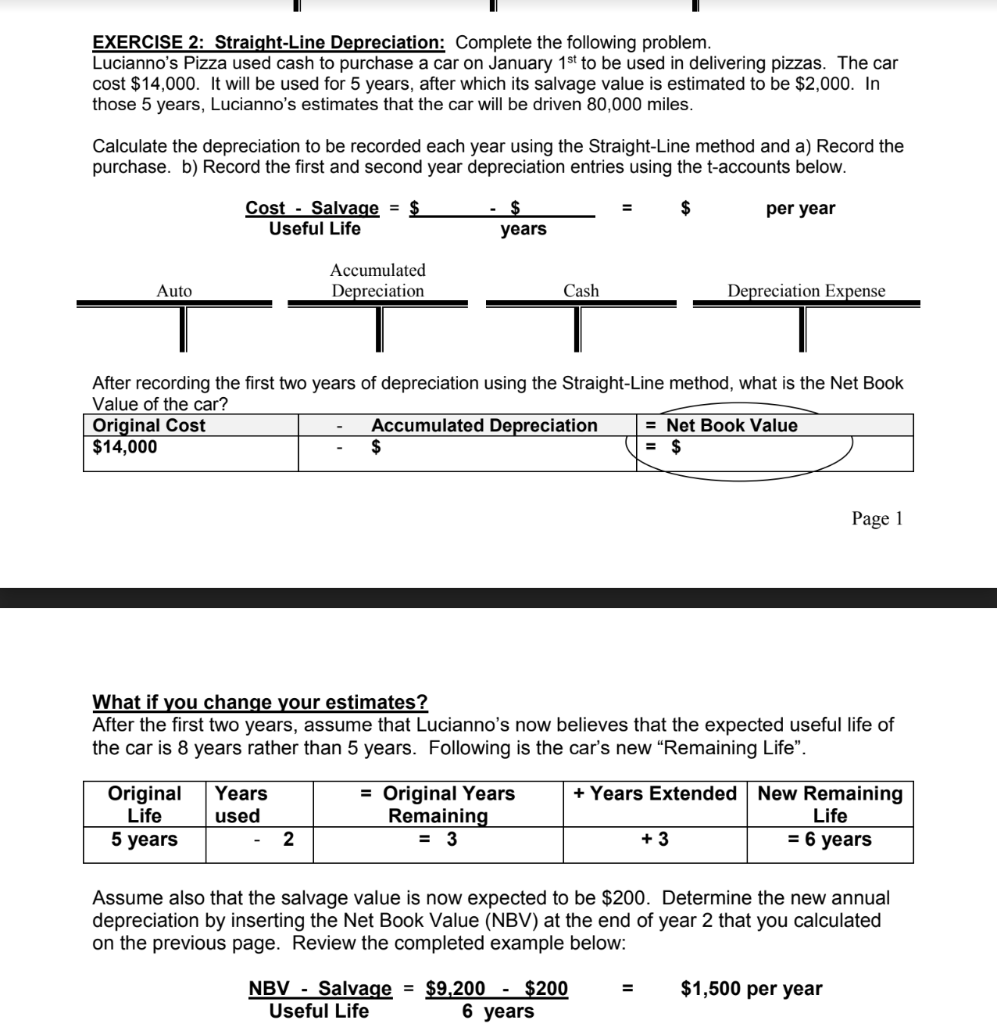

a) After completing all of the entries in Exercise 2, what is the correct Net Book Value after the entries are recorded for the 2 two years? See circle on the printed exercise.

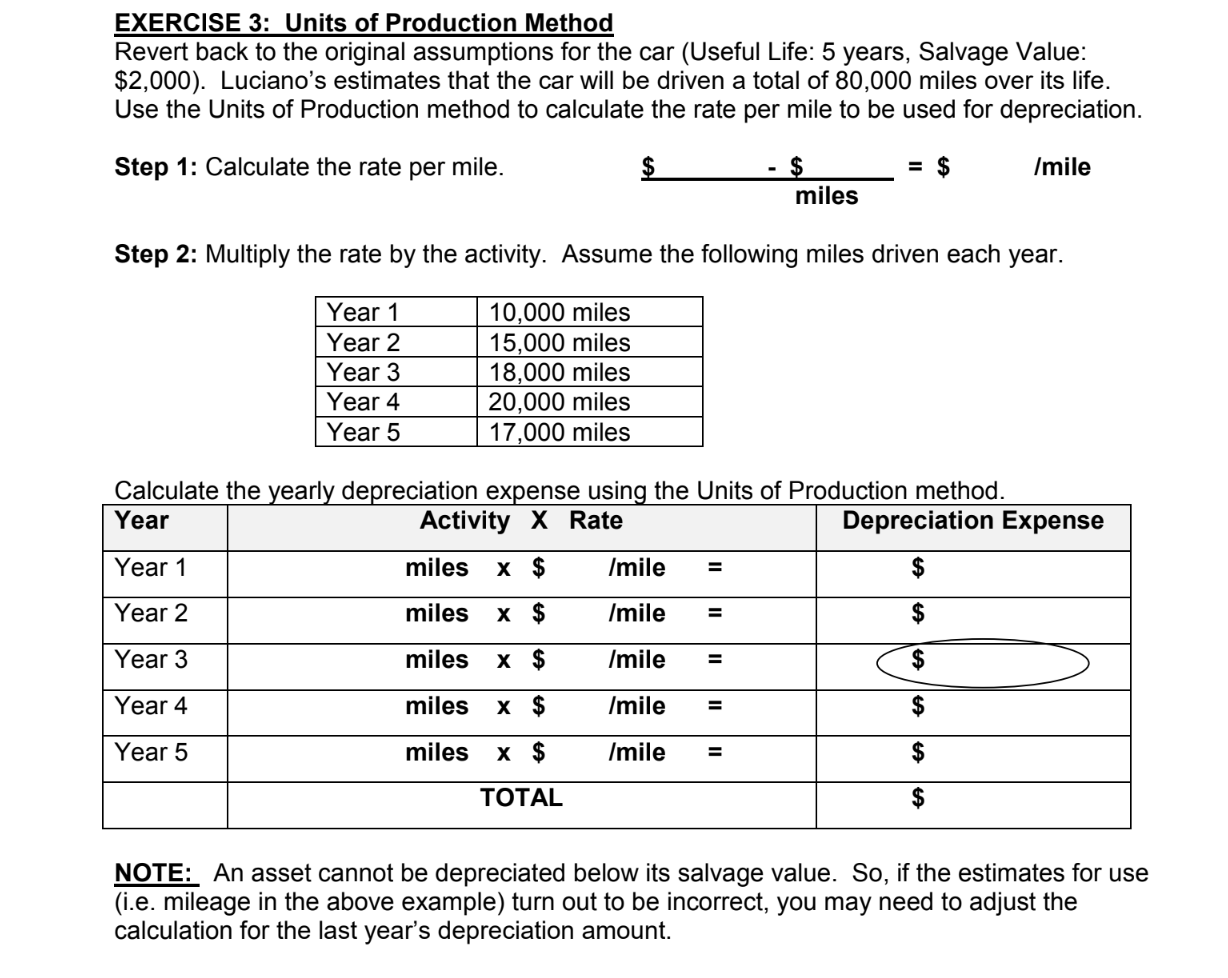

b) After completing all of the entries in Exercise 3, what is the correct depreciation expense for Year 3? See circle on the printed exercise.

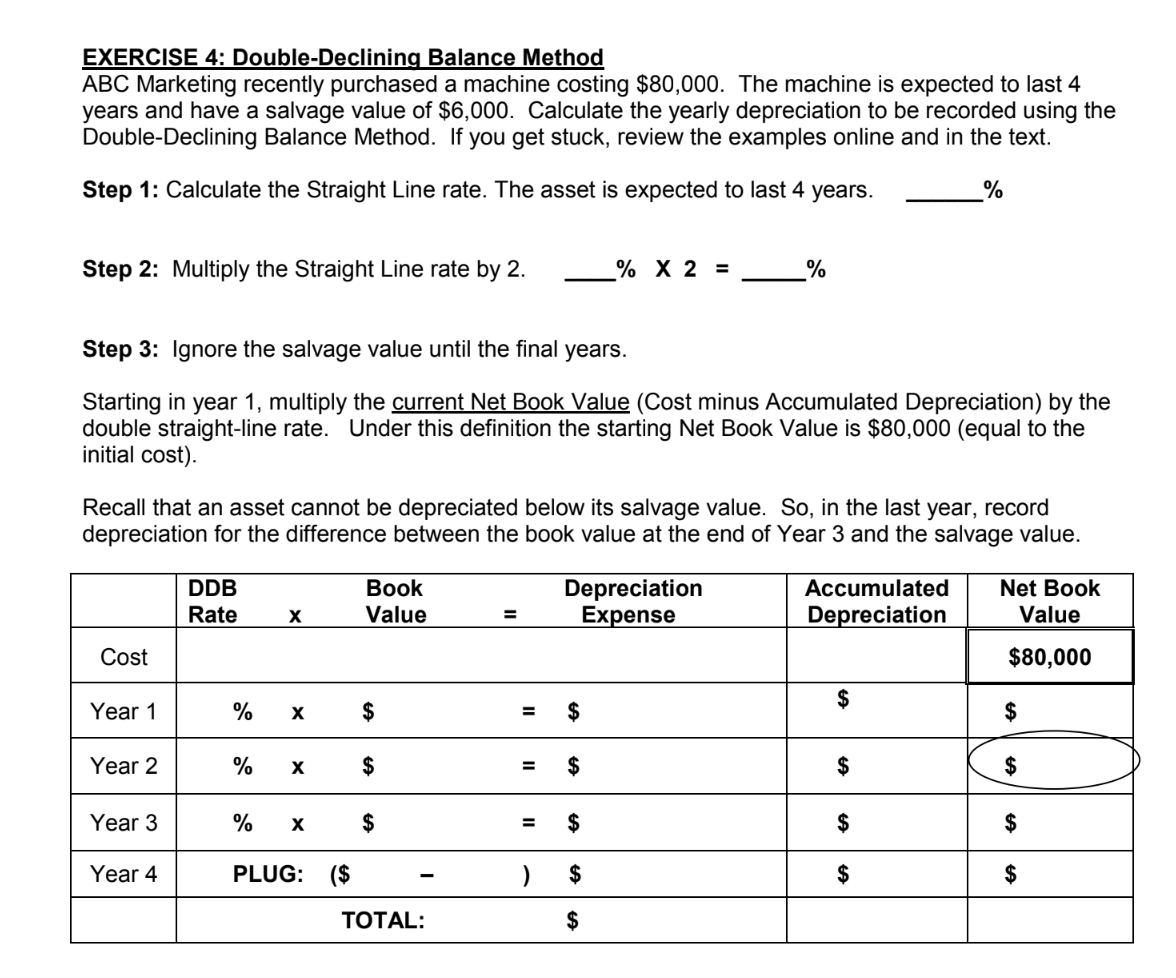

c) After completing all of the entries in Exercise 4, what is the correct Net Book Value at the end of Year 2? See circle on the printed exercise.

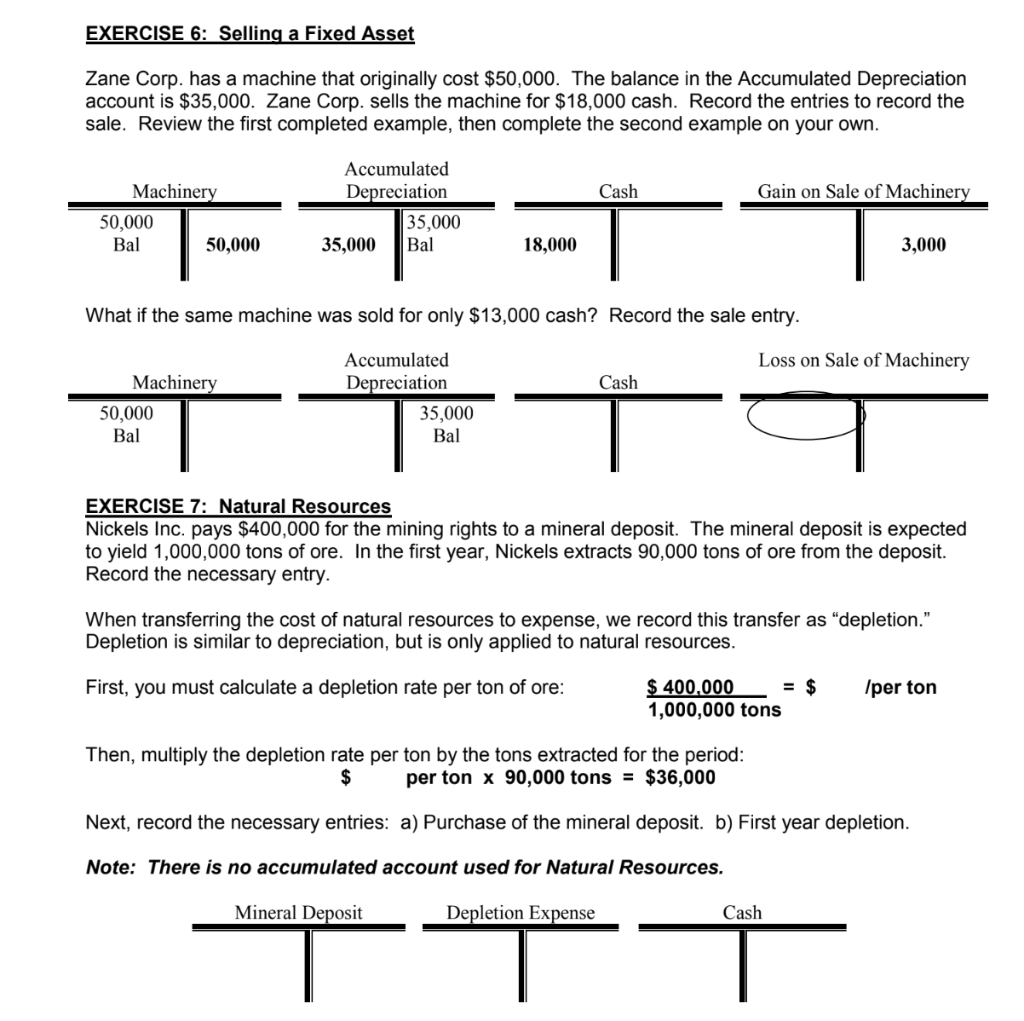

d) After completing all of the entries in Exercise 6, what is the correct amount recorded as a debit to the Loss on Sale of Machinery account? See circle on the printed exercise.

EXERCISE 2: Straight-Line Depreciation: Complete the following problem. Lucianno's Pizza used cash to purchase a car on January 1st to be used in delivering pizzas. The car cost $14,000. It will be used for 5 years, after which its salvage value is estimated to be $2,000. In those 5 years, Lucianno's estimates that the car will be driven 80,000 miles. Calculate the depreciation to be recorded each year using the Straight-Line method and a) Record the purchase. b) Record the first and second year depreciation entries using the t-accounts below. Cost - Salvage = $ Useful Life per year years Accumulated Depreciation Auto Cash Depreciation Expense After recording the first two years of depreciation using the Straight-Line method, what is the Net Book Value of the car? Original Cost Accumulated Depreciation = Net Book Value $14,000 $ $ Page 1 What if you change your estimates? After the first two years, assume that Lucianno's now believes that the expected useful life of the car is 8 years rather than 5 years. Following is the car's new Remaining Life". Original Life 5 years Years used = Original Years Remaining = 3 + Years Extended New Remaining Life + 3 = 6 years 2 Assume also that the salvage value is now expected to be $200. Determine the new annual depreciation by inserting the Net Book Value (NBV) at the end of year 2 that you calculated on the previous page. Review the completed example below: $1,500 per year NBV - Salvage = $9,200 $200 Useful Life 6 years EXERCISE 3: Units of Production Method Revert back to the original assumptions for the car (Useful Life: 5 years, Salvage Value: $2,000). Luciano's estimates that the car will be driven a total of 80,000 miles over its life. Use the Units of Production method to calculate the rate per mile to be used for depreciation. Step 1: Calculate the rate per mile. $ = $ /mile miles Step 2: Multiply the rate by the activity. Assume the following miles driven each year. Year 1 Year 2 Year 3 Year 4 Year 5 10,000 miles 15,000 miles 18,000 miles 20,000 miles 17,000 miles Calculate the yearly depreciation expense using the Units of Production method. Year Activity X Rate Depreciation Expense Year 1 miles X $ /mile $ Year 2 miles X $ /mile $ Year 3 miles X $ /mile = $ Year 4 miles X $ /mile $ Year 5 miles X $ /mile $ TOTAL $ NOTE: An asset cannot be depreciated below its salvage value. So, if the estimates for use (i.e. mileage in the above example) turn out to be incorrect, you may need to adjust the calculation for the last year's depreciation amount. EXERCISE 4: Double-Declining Balance Method ABC Marketing recently purchased a machine costing $80,000. The machine is expected to last 4 years and have a salvage value of $6,000. Calculate the yearly depreciation to be recorded using the Double-Declining Balance Method. If you get stuck, review the examples online and in the text. Step 1: Calculate the Straight Line rate. The asset is expected to last 4 years. % Step 2: Multiply the Straight Line rate by 2. % X 2 = % Step 3: Ignore the salvage value until the final years. Starting in year 1, multiply the current Net Book Value (Cost minus Accumulated Depreciation) by the double straight-line rate. Under this definition the starting Net Book Value is $80,000 (equal to the initial cost). Recall that an asset cannot be depreciated below its salvage value. So, in the last year, record depreciation for the difference between the book value at the end of Year 3 and the salvage value. DDB Rate Book Value Depreciation Expense Accumulated Depreciation Net Book Value = Cost $80,000 $ Year 1 % $ = $ $ Year 2 % $ $ $ $ Year 3 % $ $ $ $ Year 4 PLUG: ) $ $ TOTAL: $ EXERCISE 6: Selling a Fixed Asset Zane Corp. has a machine that originally cost $50,000. The balance in the Accumulated Depreciation account is $35,000. Zane Corp. sells the machine for $18,000 cash. Record the entries to record the sale. Review the first completed example, then complete the second example on your own. Cash Gain on Sale of Machinery Machinery 50,000 Bal 50,000 Accumulated Depreciation 35,000 35,000 Bal 18,000 3,000 What if the same machine was sold for only $13,000 cash? Record the sale entry. Loss on Sale of Machinery Cash Machinery 50,000 Bal Accumulated Depreciation 35,000 Bal EXERCISE 7: Natural Resources Nickels Inc. pays $400,000 for the mining rights to a mineral deposit. The mineral deposit is expected to yield 1,000,000 tons of ore. In the first year, Nickels extracts 90,000 tons of ore from the deposit. Record the necessary entry. When transferring the cost of natural resources to expense, we record this transfer as "depletion. Depletion is similar to depreciation, but is only applied to natural resources. First, you must calculate a depletion rate per ton of ore: $ 400.000 = $ 1,000,000 tons per ton Then, multiply the depletion rate per ton by the tons extracted for the period: $ per ton x 90,000 tons = $36,000 Next, record the necessary entries: a) Purchase of the mineral deposit. b) First year depletion. Note: There is no accumulated account used for Natural Resources. Mineral Deposit Depletion Expense CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started