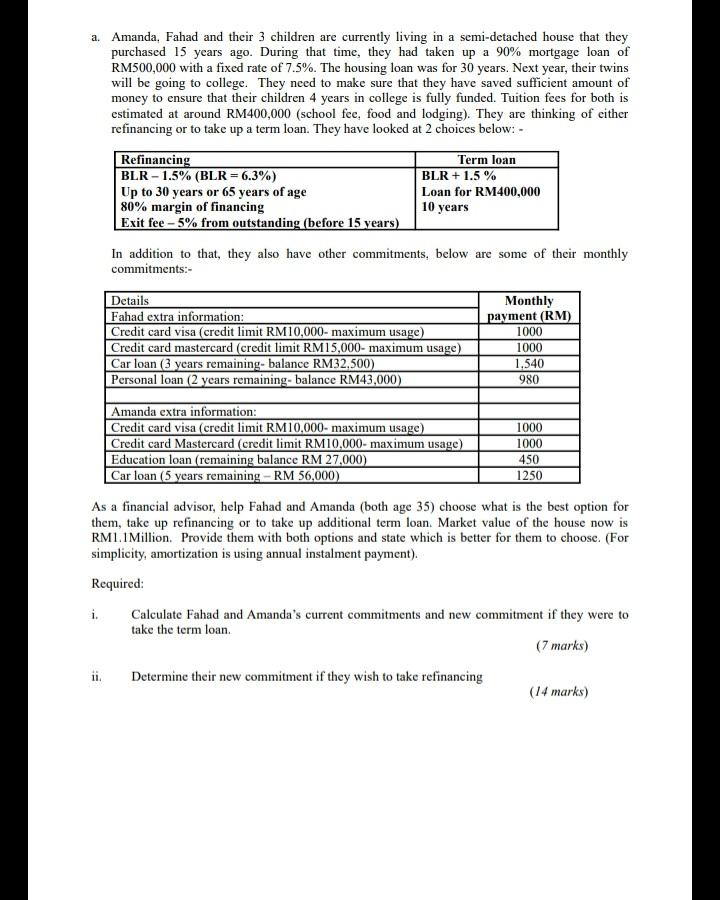

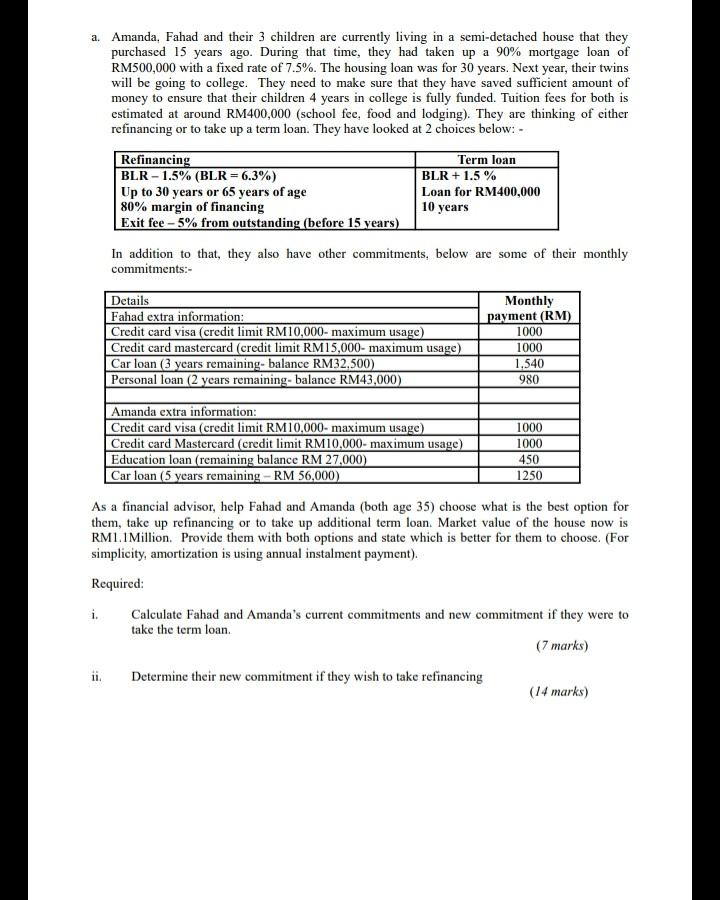

a. Amanda, Fahad and their 3 children are currently living in a semi-detached house that they purchased 15 years ago. During that time, they had taken up a 90% mortgage loan of RM500,000 with a fixed rate of 7.5%. The housing loan was for 30 years. Next year, their twins will be going to college. They need to make sure that they have saved sufficient amount of money to ensure that their children 4 years in college is fully funded. Tuition fees for both is estimated at around RM400,000 (school fee, food and lodging). They are thinking of either refinancing or to take up a term loan. They have looked at 2 choices below:- Refinancing Term loan BLR - 1.5% (BLR = 6.3%) BLR + 1.5% Up to 30 years or 65 years of age Loan for RM400,000 80% margin of financing Exit fee - 5% from outstanding (before 15 years) In addition to that, they also have other commitments, below are some of their monthly commitments:- 10 years Details Fahad extra information: Credit card visa (credit limit RM10,000-maximum usage) Credit card mastercard (credit limit RM15,000- maximum usage) Car loan (3 years remaining-balance RM32.500) Personal loan (2 years remaining-balance RM43,000) Monthly payment (RM) 1000 1000 1.540 980 Amanda extra information: Credit card visa (credit limit RM10,000-maximum usage) Credit card Mastercard (credit limit RM10,000-maximum usage) Education loan (remaining balance RM 27,000) Car loan (5 years remaining - RM 56,000) 1000 1000 450 1250 As a financial advisor, help Fahad and Amanda (both age 35) choose what is the best option for them, take up refinancing or to take up additional term loan. Market value of the house now is RM11 Million. Provide them with both options and state which is better for them to choose. (For simplicity, amortization is using annual instalment payment). Required: i. Calculate Fahad and Amanda's current commitments and new commitment if they were to take the term loan (7 marks) Determine their new commitment if they wish to take refinancing (14 marks) a. Amanda, Fahad and their 3 children are currently living in a semi-detached house that they purchased 15 years ago. During that time, they had taken up a 90% mortgage loan of RM500,000 with a fixed rate of 7.5%. The housing loan was for 30 years. Next year, their twins will be going to college. They need to make sure that they have saved sufficient amount of money to ensure that their children 4 years in college is fully funded. Tuition fees for both is estimated at around RM400,000 (school fee, food and lodging). They are thinking of either refinancing or to take up a term loan. They have looked at 2 choices below:- Refinancing Term loan BLR - 1.5% (BLR = 6.3%) BLR + 1.5% Up to 30 years or 65 years of age Loan for RM400,000 80% margin of financing Exit fee - 5% from outstanding (before 15 years) In addition to that, they also have other commitments, below are some of their monthly commitments:- 10 years Details Fahad extra information: Credit card visa (credit limit RM10,000-maximum usage) Credit card mastercard (credit limit RM15,000- maximum usage) Car loan (3 years remaining-balance RM32.500) Personal loan (2 years remaining-balance RM43,000) Monthly payment (RM) 1000 1000 1.540 980 Amanda extra information: Credit card visa (credit limit RM10,000-maximum usage) Credit card Mastercard (credit limit RM10,000-maximum usage) Education loan (remaining balance RM 27,000) Car loan (5 years remaining - RM 56,000) 1000 1000 450 1250 As a financial advisor, help Fahad and Amanda (both age 35) choose what is the best option for them, take up refinancing or to take up additional term loan. Market value of the house now is RM11 Million. Provide them with both options and state which is better for them to choose. (For simplicity, amortization is using annual instalment payment). Required: i. Calculate Fahad and Amanda's current commitments and new commitment if they were to take the term loan (7 marks) Determine their new commitment if they wish to take refinancing (14 marks)