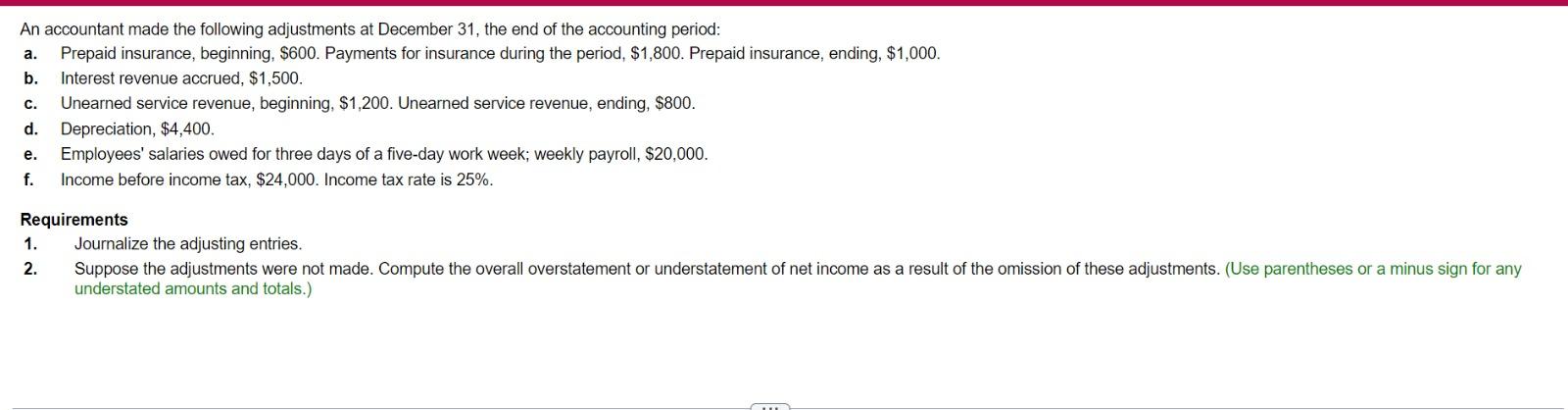

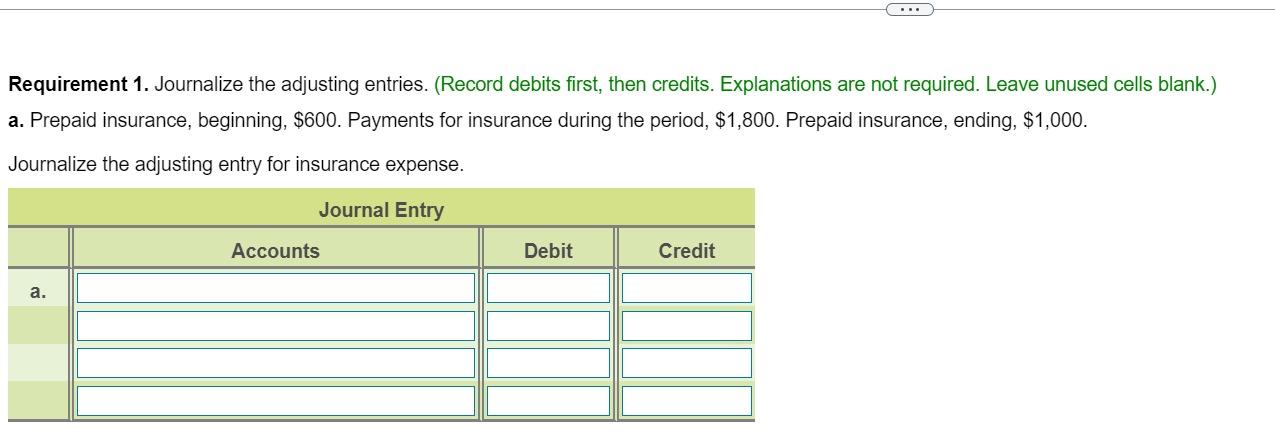

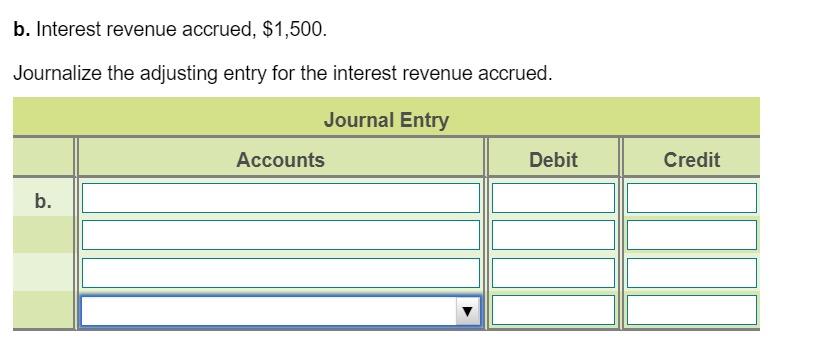

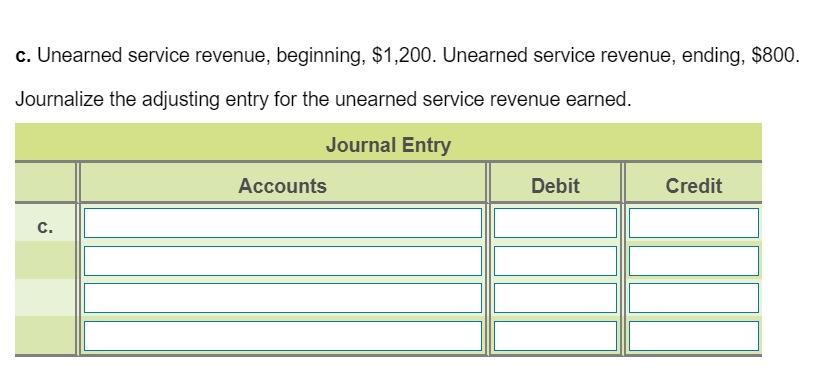

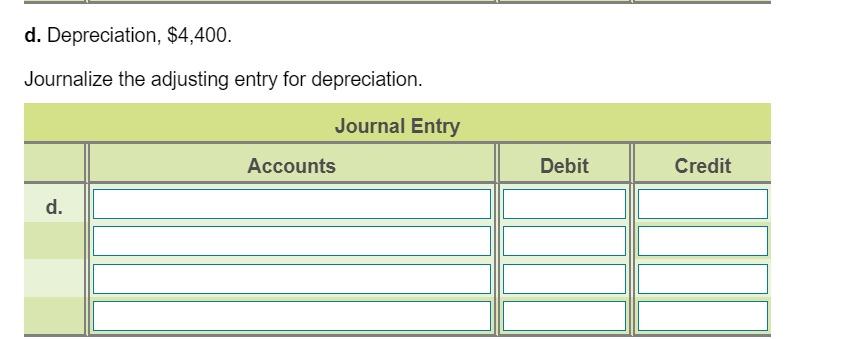

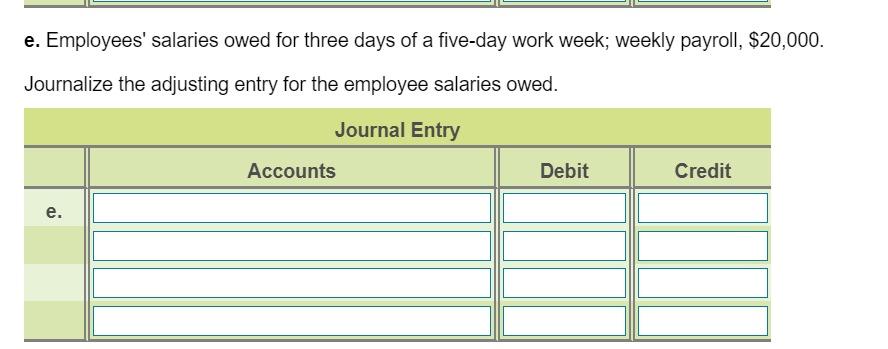

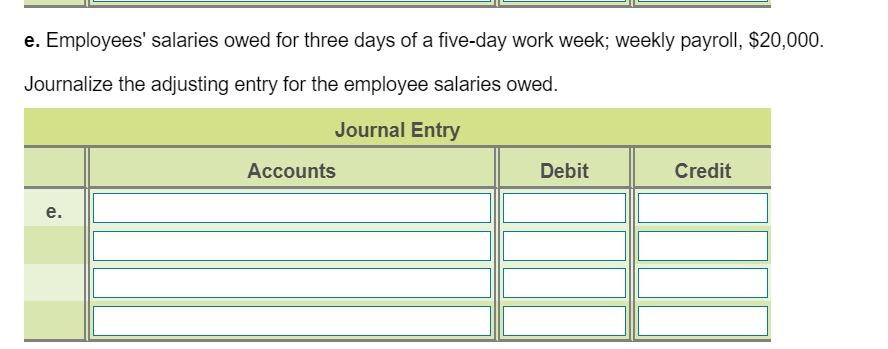

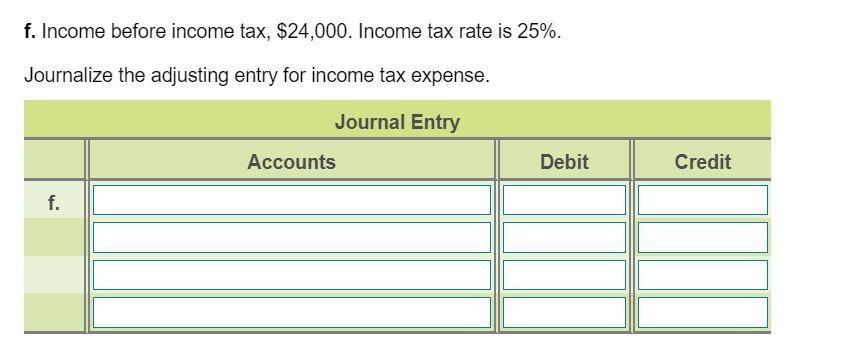

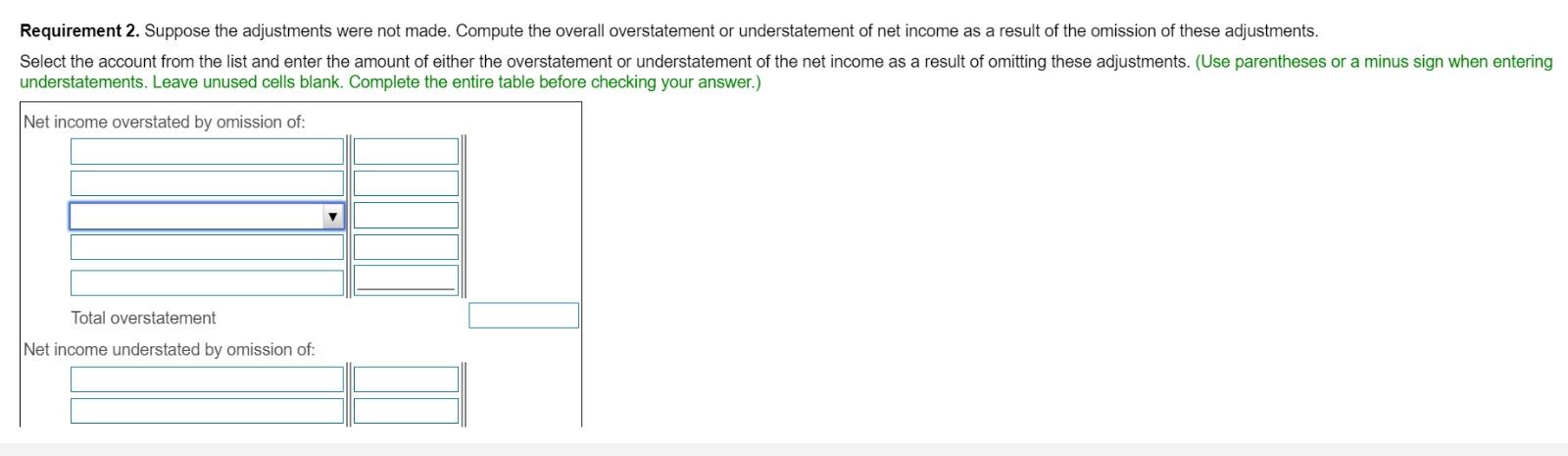

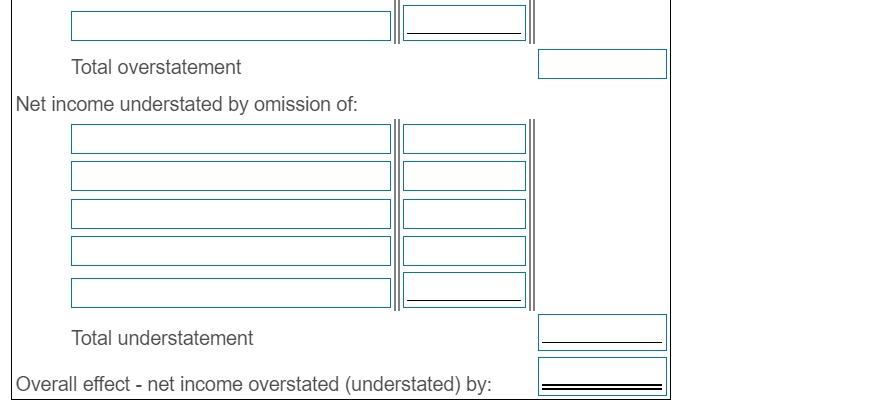

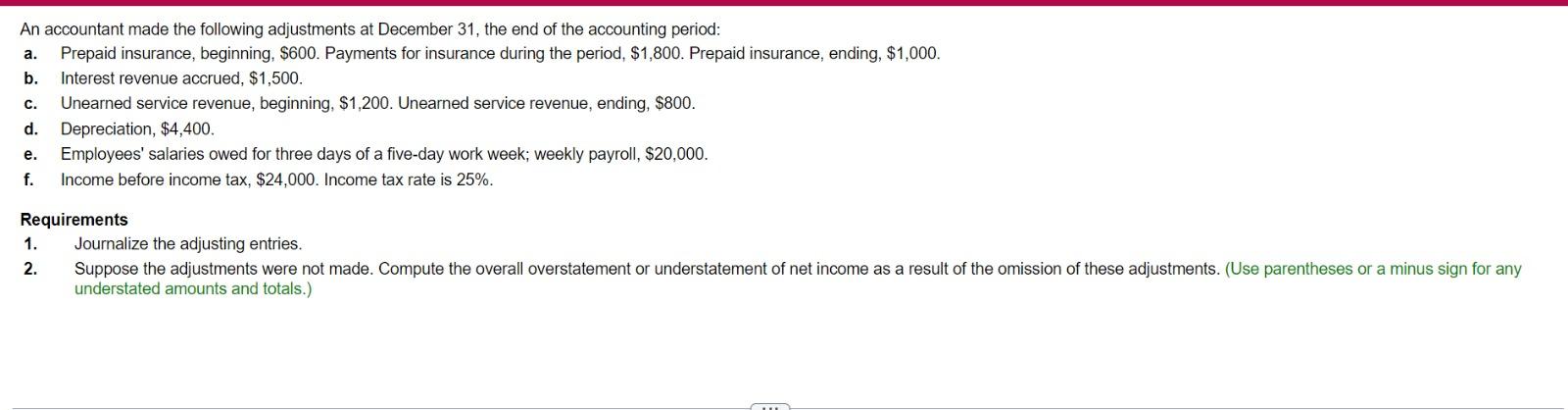

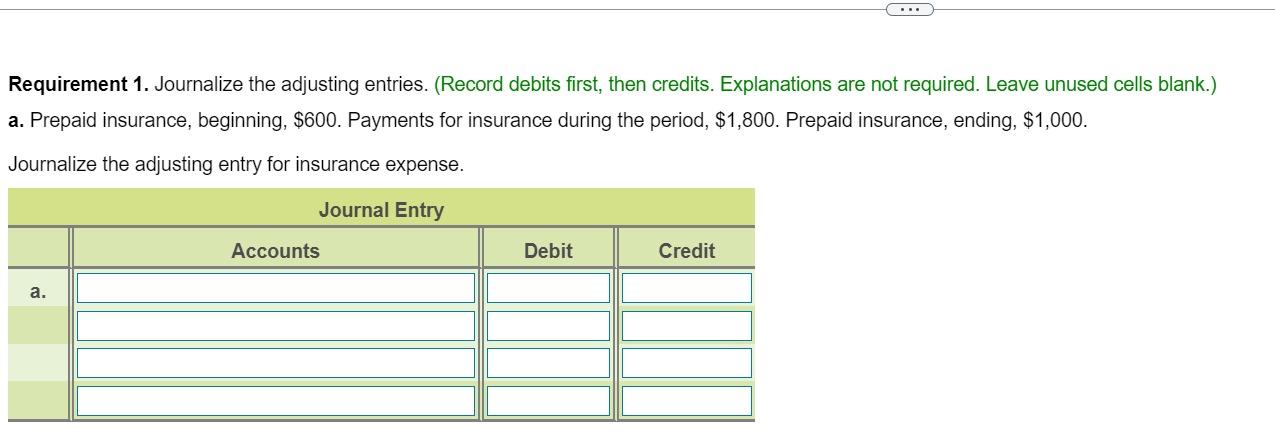

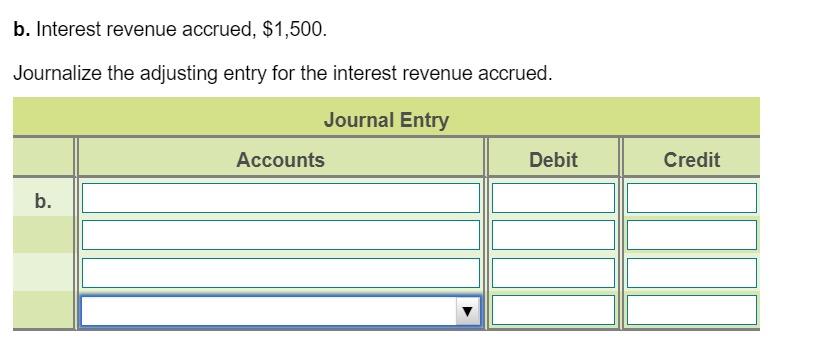

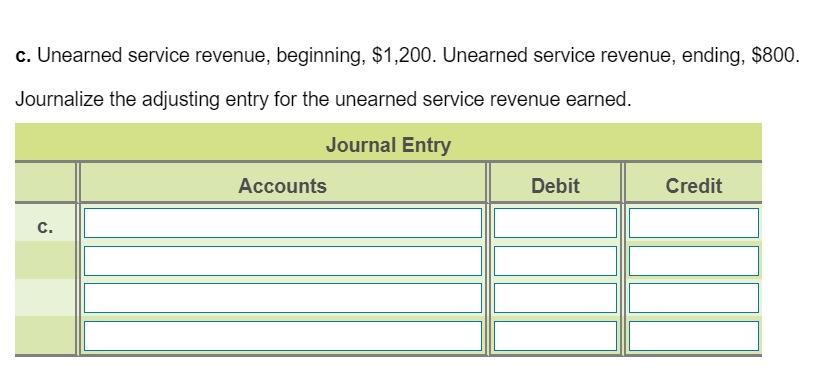

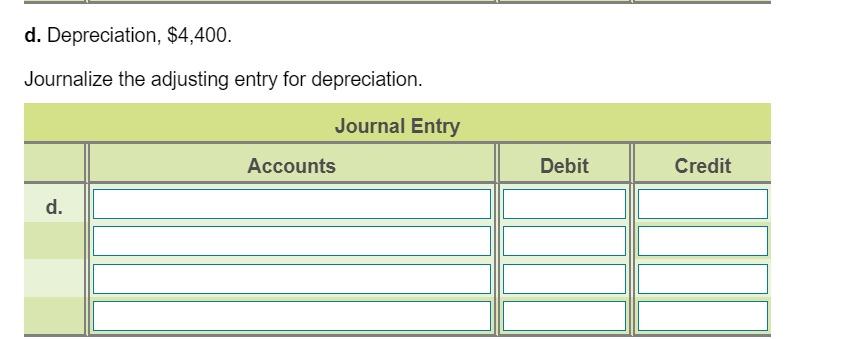

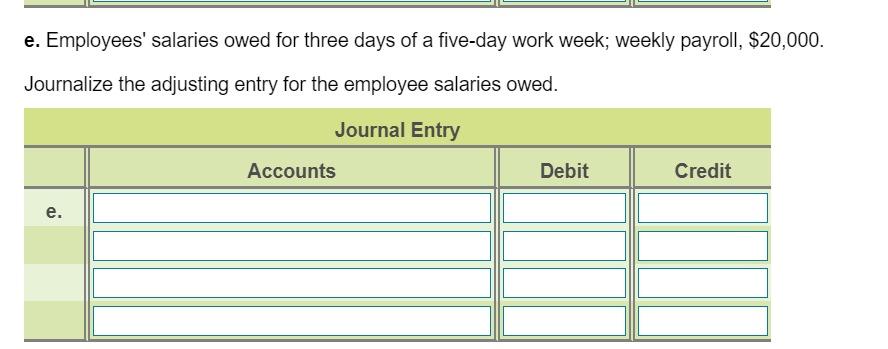

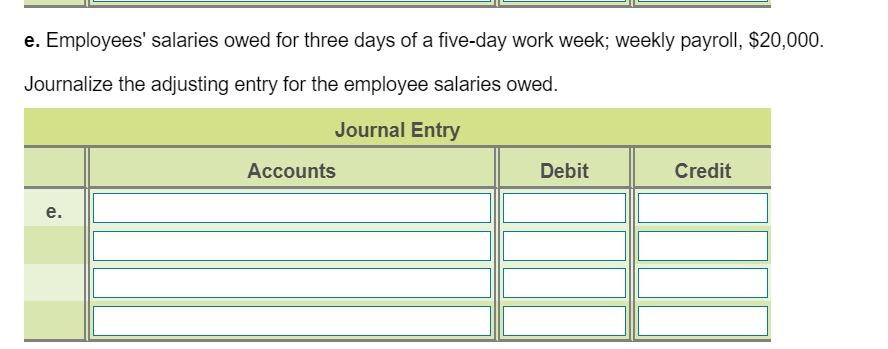

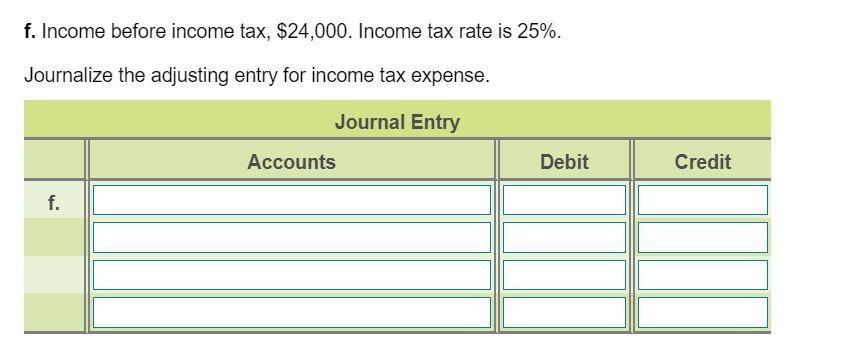

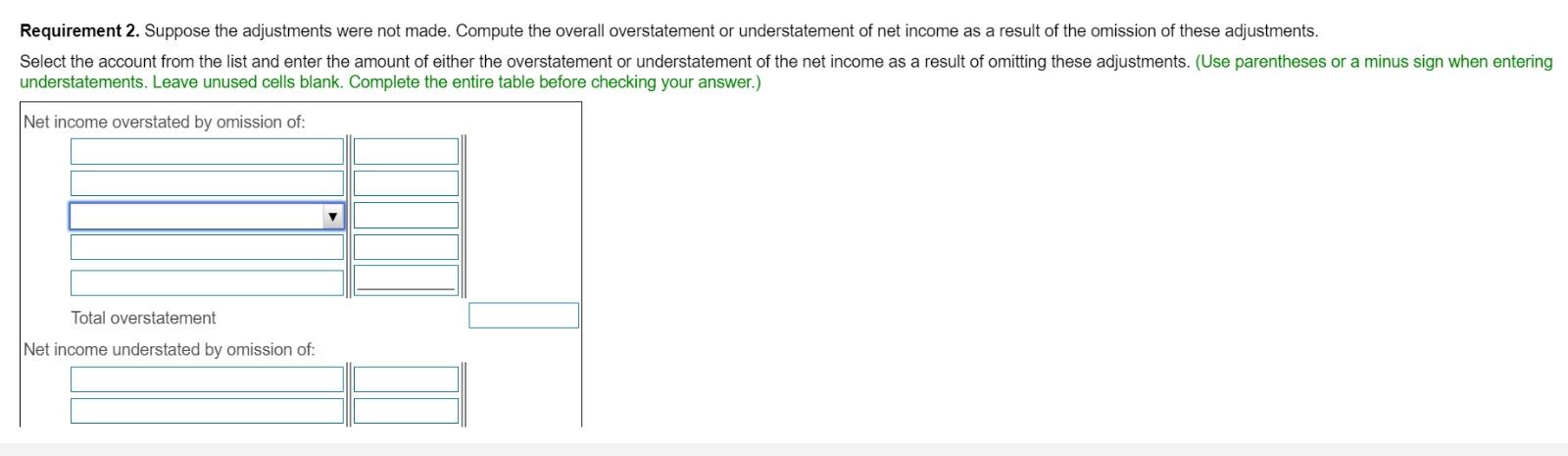

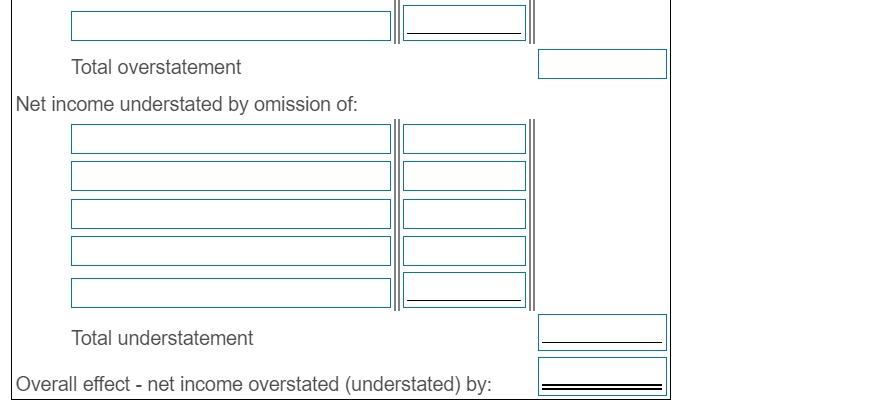

a. An accountant made the following adjustments at December 31, the end of the accounting period: Prepaid insurance, beginning, $600. Payments for insurance during the period, $1,800. Prepaid insurance, ending, $1,000. b. Interest revenue accrued, $1,500. Unearned service revenue, beginning, $1,200. Unearned service revenue, ending, $800. d. Depreciation, $4,400. Employees' salaries owed for three days of a five-day work week; weekly payroll, $20,000. f. Income before income tax, $24,000. Income tax rate is 25%. C. e. Requirements 1. Journalize the adjusting entries. 2. Suppose the adjustments were not made. Compute the overall overstatement or understatement of net income as a result of the omission of these adjustments. (Use parentheses or a minus sign for any understated amounts and totals.) . Requirement 1. Journalize the adjusting entries. (Record debits first, then credits. Explanations are not required. Leave unused cells blank.) a. Prepaid insurance, beginning, $600. Payments for insurance during the period, $1,800. Prepaid insurance, ending, $1,000. Journalize the adjusting entry for insurance expense. Journal Entry Accounts Debit Credit a. b. Interest revenue accrued, $1,500. Journalize the adjusting entry for the interest revenue accrued. Journal Entry Accounts Debit Credit b. c. Unearned service revenue, beginning, $1,200. Unearned service revenue, ending, $800. Journalize the adjusting entry for the unearned service revenue earned. Journal Entry Accounts Debit Credit C. d. Depreciation, $4,400. Journalize the adjusting entry for depreciation. Journal Entry Accounts Debit Credit d. e. Employees' salaries owed for three days of a five-day work week; weekly payroll, $20,000. Journalize the adjusting entry for the employee salaries owed. Journal Entry Accounts Debit Credit e. e. Employees' salaries owed for three days of a five-day work week; weekly payroll, $20,000. Journalize the adjusting entry for the employee salaries owed. Journal Entry Accounts Debit Credit e. f. Income before income tax, $24,000. Income tax rate is 25%. Journalize the adjusting entry for income tax expense. Journal Entry Accounts Debit Credit f. f Requirement 2. Suppose the adjustments were not made. Compute the overall overstatement or understatement of net income as a result of the omission of these adjustments. Select the account from the list and enter the amount of either the overstatement or understatement of the net income as a result of omitting these adjustments. (Use parentheses or a minus sign when entering understatements. Leave unused cells blank. Complete the entire table before checking your answer.) Net income overstated by omission of: Total overstatement Net income understated by omission of: Total overstatement Net income understated by omission of: Total understatement Overall effect - net income overstated (understated) by