Answered step by step

Verified Expert Solution

Question

1 Approved Answer

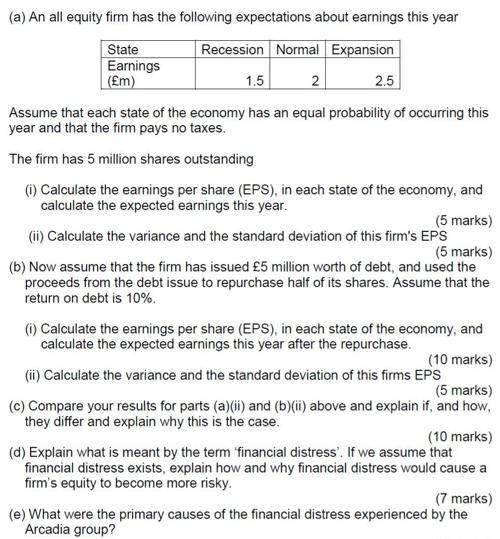

(a) An all equity firm has the following expectations about earnings this year Recession Normal Expansion State Earnings (m) 1.5 2 2.5 Assume that

(a) An all equity firm has the following expectations about earnings this year Recession Normal Expansion State Earnings (m) 1.5 2 2.5 Assume that each state of the economy has an equal probability of occurring this year and that the firm pays no taxes. The firm has 5 million shares outstanding (i) Calculate the earnings per share (EPS), in each state of the economy, and calculate the expected earnings this year. (5 marks) (ii) Calculate the variance and the standard deviation of this firm's EPS (5 marks) (b) Now assume that the firm has issued 5 million worth of debt, and used the proceeds from the debt issue to repurchase half of its shares. Assume that the return on debt is 10%. (i) Calculate the earnings per share (EPS), in each state of the economy, and calculate the expected earnings this year after the repurchase. (10 marks) (ii) Calculate the variance and the standard deviation of this firms EPS (5 marks) (c) Compare your results for parts (a)(ii) and (b)(ii) above and explain if, and how, they differ and explain why this is the case. (10 marks) (d) Explain what is meant by the term 'financial distress'. If we assume that financial distress exists, explain how and why financial distress would cause a firm's equity to become more risky. (7 marks) (e) What were the primary causes of the financial distress experienced by the Arcadia group?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a i Earnings per Share EPS EPS Recession 15 5 million 03 EPS Normal 2 5 million 04 EPS Expansion 25 5 million 05 Expected Earnings this year Expected ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started