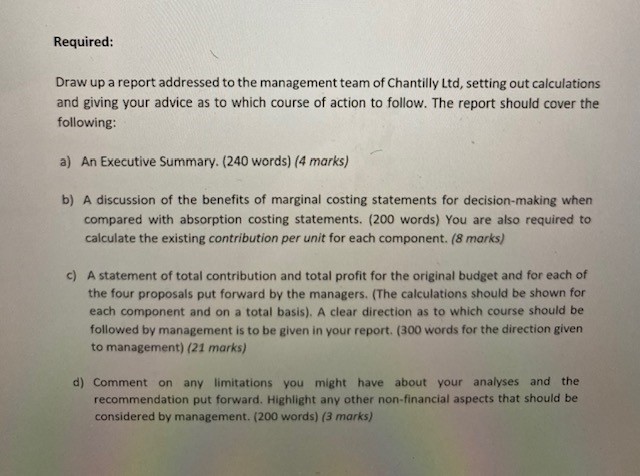

a) An Executive Summary. (4 marks)

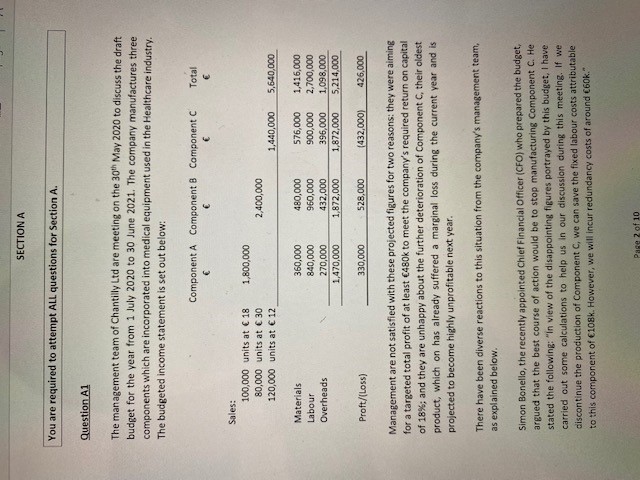

SECTION A You are required to attempt ALL questions for Section A. Question Al The management team of Chantilly Lid are meeting on the 30th May 2020 to discuss the draft budget for the year from 1 July 2020 to 30 June 2021. The company manufactures three components which are incorporated into medical equipment used in the Healthcare industry. The budgeted income statement is set out below: Component A Component 8 Component C Total E Sales: 100,000 units at C 18 1,800,000 80,000 units at C 30 2,400,000 120,000 units at C 12 1,440,000 5,640,000 Materials 360,000 180,000 576,000 1,416,000 Labour 840,000 960,000 900,000 2,700,000 Overheads 270,000 432,000 396,000 1,098,000 1,470,000 1,872,000 1,872,000 5,214,000 Proft/[Loss) 330,000 528,000 (432,000) 426,000 Management are not satisfied with these projected figures for two reasons: they were aiming for a targeted total profit of at least (480k to meet the company's required return on capital of 16%; and they are unhappy about the further deterioration of Component C, their oldest product, which on has already suffered a marginal loss during the current year and is projected to become highly unprofitable next year. There have been diverse reactions to this situation from the company's management team, as explained below. Simon Bonello, the recently appointed Chief Financial Officer (CFO) who prepared the budget, argued that the best course of action would be to stop manufacturing Component C. He stated the following: "In view of the disappointing figures portrayed by this budget, I have carried out some calculations to help us In our discussion during this meeting. If we discontinue the production of Component C, we can save the fixed labour costs attributable to this component of C108k. However, we will incur redundancy costs of around (60k."+ Ajuster a la page [ Mode page A" Lire a The Chief Operations Officer (COO), Ivan Zerafa, who has been with the company since its inception, was infuriated. He said, "The company has been producing Component C since we started two decades ago and demand for this component is still steady. And don't forget that some of the people involved in the production of C have been with the company a long time Can I at least be given a few days to identify possible cost savings on the production line?" Simon Bonello (CFO) replied, "Last year, when I joined the company, I offered to sit down with you to go through your costs, but as soon as I mentioned the possibility of exploring the merits of Activity Based Costing (ABC), you said that it's nonsense and a waste of time. Now you can't blame me for this mess!" The Marketing Manager, Sera Sammut, intervened, stating, "Guys, let's try to calm down and discuss this rationally! What if we lower the price of Component C by (1.20 per unit? My calculations show that this would increase demand for C by circa 25%. If Ivan can somehow save (1.20 per unit in variable production costs (for Component C), why don't we try this strategy?" At this point, Kate Mallia, the Chief Executive Officer (CEO] spoke up. "I'd like to compare the results of going with Simon's proposal versus Sera's. Ivan, I'd like you to take a couple of days to think on how you might re-organise production in order to see some improvements, and then you can liaise with Simon for him to translate your plans into numbers. And Simon, would you please make some calculations to see what an overall 10% increase in sales and activity would do, holding prices and everything else constant?" The management team meeting came to an end, agreeing to proceed as directed by the CEO. The following day, the COO held a meeting with the CFO. Ivan Zerafa explained that, after looking into things, he believes that labour supervision on Component C could be reduced, which would result in a decrease in labour fixed costs by 690k. However, variable overhead would go up by 10%. The COO also suggested that C could be replaced by a cheaper component which would result in savings of 60.90 per unit. Before proceeding with the budget revision, Simon took note of the information set out below, which he had used in preparing the original budget: . All material costs are fully variable The fixed element of labour cost for Components A, B and C is (120k, (192k and C108k respectively The overheads comprise both variable and fixed elements. The fixed element has been absorbed at the rate of C6 per machine hour. The machine time per unit for each component is as follows: Component A - 15 minutes; Component B - 30 minutes and Component C - 15 minutes. The management team of Chantilly met again a few days later to look at the revised budget calculations.Required: Draw up a report addressed to the management team of Chantilly Ltd, setting out calculations and giving your advice as to which course of action to follow. The report should cover the following: a) An Executive Summary. (240 words) (4 marks) b) A discussion of the benefits of marginal costing statements for decision-making when compared with absorption costing statements. (200 words) You are also required to calculate the existing contribution per unit for each component. (8 marks) c) A statement of total contribution and total profit for the original budget and for each of the four proposals put forward by the managers. (The calculations should be shown for each component and on a total basis). A clear direction as to which course should be followed by management is to be given in your report. (300 words for the direction given to management) (21 marks) d) Comment on any limitations you might have about your analyses and the recommendation put forward. Highlight any other non-financial aspects that should be considered by management. (200 words)