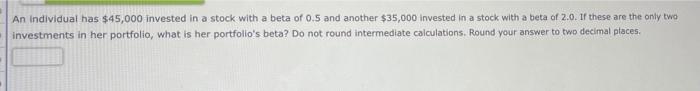

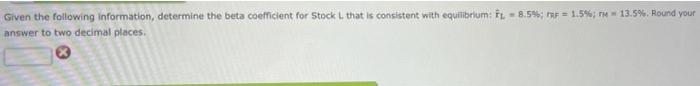

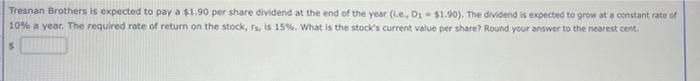

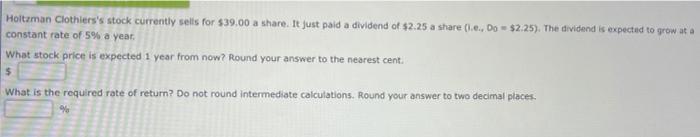

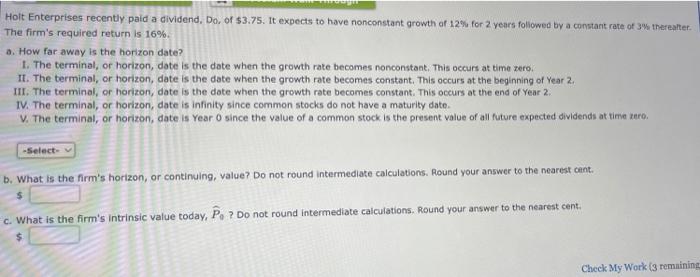

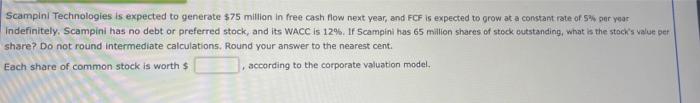

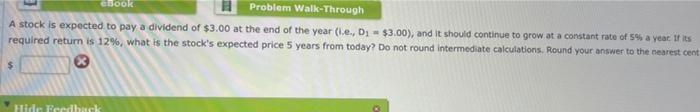

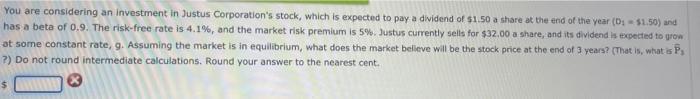

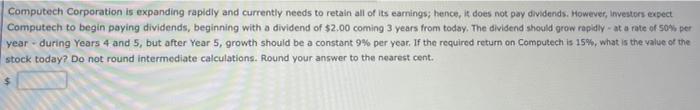

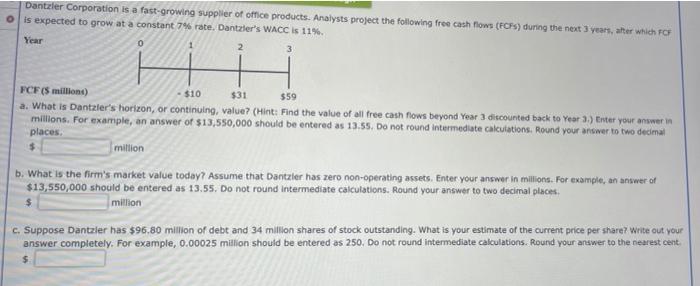

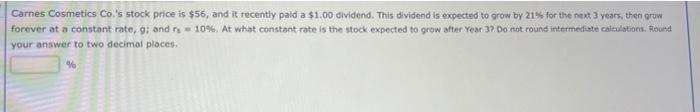

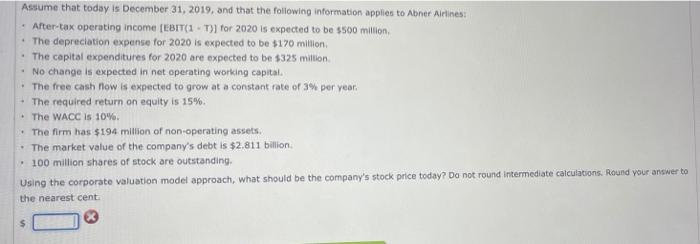

a An individual has $45,000 invested in a stock with a beta of 0.5 and another $35,000 invested in a stock with a beta of 2.0. If these are the only two investments in her portfolio, what is her portfolio's beta? Do not round intermediate calculations. Round your answer to two decimal places. Given the following information, determine the beta coefficient for Stock L that is consistent with equilibrium: 7. - 8.5%; F = 1.5%;" 13.5%. Round your answer to two decimal places Tresnan Brothers is expected to pay a $1.90 per share dividend at the end of the year, D1 - 51.90). The dividend is expected to grow at a constant rate of 10% a year. The required rate of return on the stock, s, is 15%. What is the stock's current value per share? Round your answer to the nearest cent. $ Holtzman Clothiers's stock currently sells for $39.00 a share. It just paid a dividend of $2.25 a share (1.c., Do = $2,25). The dividend is expected to grow at a constant rate of 5% a year What stock price is expected 1 year from now? Round your answer to the nearest cent. $ What is the required rate of return? Do not round Intermediate calculations. Round your answer to two decimal places. % Holt Enterprises recently paid a dividend. Do, of $3.75. It expects to have nonconstant growth of 129 for 2 years followed by a constant rate of 3% thereafter. The firm's required return is 16% a. How far away is the horizon date? 1. The terminal, or horizon, date is the date when the growth rate becomes nonconstant. This occurs at time sero II. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2 III. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2 IV. The terminal, or horizon, date is infinity since common stocks do not have a maturity date. V. The terminal, or horizon, date is Year O since the value of a common stock is the present value of all future expected dividends at time koro. -Select- b. What is the firm's horizon, or continuing, value? Do not round intermediate calculations, Round your answer to the nearest cent. c. What is the firm's intrinsic value today, P. ? Do not round intermediate calculations. Round your answer to the nearest cent. Check My Work (3 remaining Scampini Technologies is expected to generate $75 million in free cash flow next year, and FCF is expected to grow at a constant rate of 5% per year Indefinitely. Scampini has no debt or preferred stock, and its WACC is 12%. If Scampini has 65 million shares of stock outstanding, what is the stock's value bet share? Do not round intermediate calculations. Round your answer to the nearest centi Each share of common stock is worth $ according to the corporate valuation model. cook Problem Walk-Through A stock is expected to pay a dividend of $3.00 at the end of the year (le, D1 - $3.00), and it should continue to grow at a constant rate of 5% a year. It is required return is 12%, what is the stock's expected price 5 years from today? Do not round intermediate calculations. Round your answer to the nearest cent Hide Feedback You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (D): - $1.50) and has a beta of 0.9. The risk-free rate is 4.1%, and the market risk premium is 5%. Justus currently sells for $32.00 a share, and its dividend is expected to grow at some constant rate, 9. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is what is B, 2) Do not round intermediate calculations. Round your answer to the nearest cent. Computech Corporation is expanding rapidly and currently needs to retain all of its earnings, hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $2.00 coming 3 years from today. The dividend should grow rapidly at a rate of 50% per year - during Years 4 and 5, but after Year 5, growth should be a constant 9% per year. If the required return on Computech is 15%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. $ Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years after which FCF is expected to grow at a constant 7% rate. Dantzer's WACC is 11% Year ii TH FCF (5 million) $10 $31 $59 a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13:55. Do not round intermediate calculations. Round your answer to two decimal places $ million b. What is the firm's market value today? Assume that Dantzler has zero non-operating assets. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13,55. Do not round intermediate calculations. Round your answer to two decimal places million $ c. Suppose Dantzler has $96.80 million of debt and 34 million shares of stock outstanding. What is your estimate of the current price per share? Write out your answer completely. For example, 0.00025 million should be entered as 250. Do not round intermediate calculations. Round your answer to the nearest cent $ Carnes Cosmetics Co.'s stock price is $56, and it recently paid a $1.00 dividend. This dividend is expected to grow by 21% for the next 3 years, then prow forever at a constant rate, g; and rs = 10%. At what constant rate is the stock expected to grow after year 3? Do not round intermediate calculations. Round your answer to two decimal places, % Assume that today is December 31, 2019, and that the following information applies to Abner Airlines: After-tax operating income (EBIT(1 T) for 2020 is expected to be $500 million, The depreciation expense for 2020 is expected to be $170 million The capital expenditures for 2020 are expected to be $325 million . No change is expected in net operating working capital The free cash flow is expected to grow at a constant rate of 3% per year. + The required return on equity is 15%. . The WACC IS 10%. The firm has $194 million of non-operating assets The market value of the company's debt is $2.811 billion 100 million shares of stock are outstanding, Using the corporate valuation model approach, what should be the company's stock price today? Do not round intermediate calculations. Round your answer to the nearest cent