Answered step by step

Verified Expert Solution

Question

1 Approved Answer

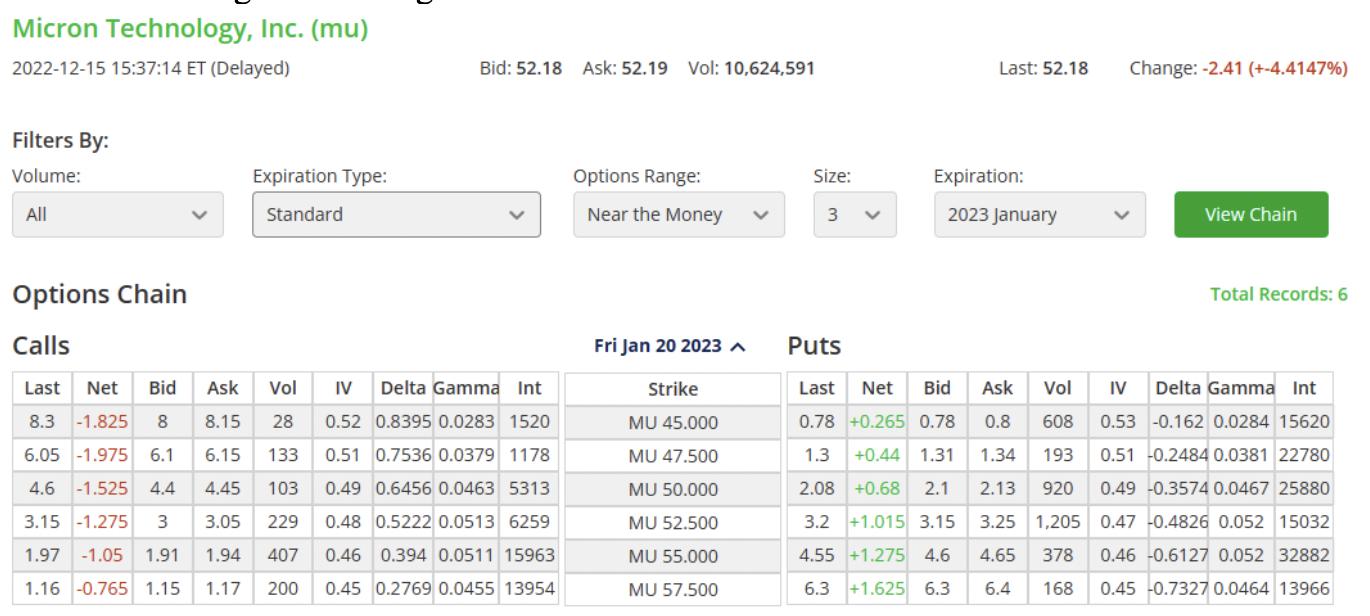

a. An investor owns 100,000 shares of Micron. He considers hedging his position with a protective put. He considers the 55 strike or the 47.50

a. An investor owns 100,000 shares of Micron. He considers hedging his position with a protective put. He considers the 55 strike or the 47.50 strike to be held to maturity. Show the investor the cost, break-even and potential loss of either option. Use the Ask for cost of purchase.

b. The investor changes his mind, given a special Micron imminent announcement he wants a very short-term hedge (about a day). How many contracts should he buy of the 55 strike? Repeat with the 47.5 strike?

Micron Technology, Inc. (mu) 2022-12-15 15:37:14 ET (Delayed) Filters By: Volume: All Expiration Type: Standard Bid: 52.18 Ask: 52.19 Vol: 10,624,591 Options Chain Calls Last Net Bid Ask Vol IV Delta Gamma Int 8.3 -1.825 8 8.15 28 0.52 0.8395 0.0283 1520 6.05 -1.975 6.1 6.15 133 0.51 0.7536 0.0379 1178 4.6 -1.525 4.4 4.45 103 0.49 0.6456 0.0463 5313 3.15 -1.275 3 3.05 229 0.48 0.5222 0.0513 6259 1.97 -1.05 1.91 1.94 407 0.46 0.394 0.0511 15963 1.16 -0.765 1.15 1.17 200 0.45 0.2769 0.0455 13954 Options Range: Near the Money Fri Jan 20 2023 A Strike MU 45.000 MU 47.500 MU 50.000 MU 52.500 MU 55.000 MU 57.500 V Size: 3 v Last: 52.18 Expiration: 2023 January Puts Last Net Bid 0.78 +0.265 0.78 1.3 +0.44 1.31 2.08 +0.68 2.1 3.2 +1.015 3.15 4.55 +1.275 4.6 6.3 +1.625 6.3 Ask Vol 0.8 608 1.34 193 2.13 920 3.25 1,205 4.65 378 168 6.4 Change: -2.41 (+-4.4147%) View Chain Total Records: 6 IV Delta Gamma Int 0.53 -0.162 0.0284 15620 0.51 -0.2484 0.0381 22780 0.49 -0.3574 0.0467 25880 0.47 -0.4826 0.052 15032 0.46 -0.6127 0.052 32882 0.45 0.7327 0.0464 13966

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started