Answered step by step

Verified Expert Solution

Question

1 Approved Answer

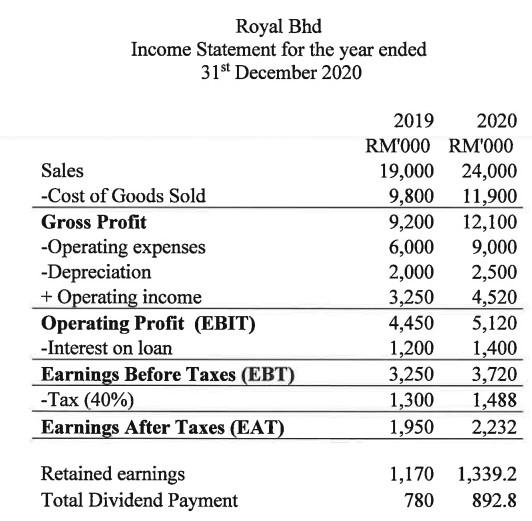

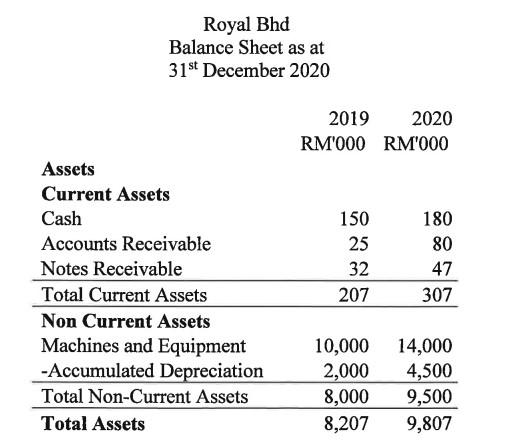

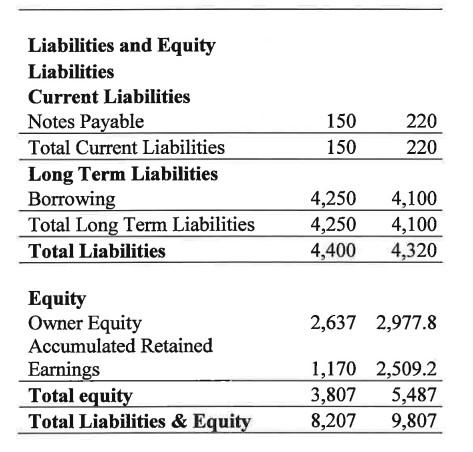

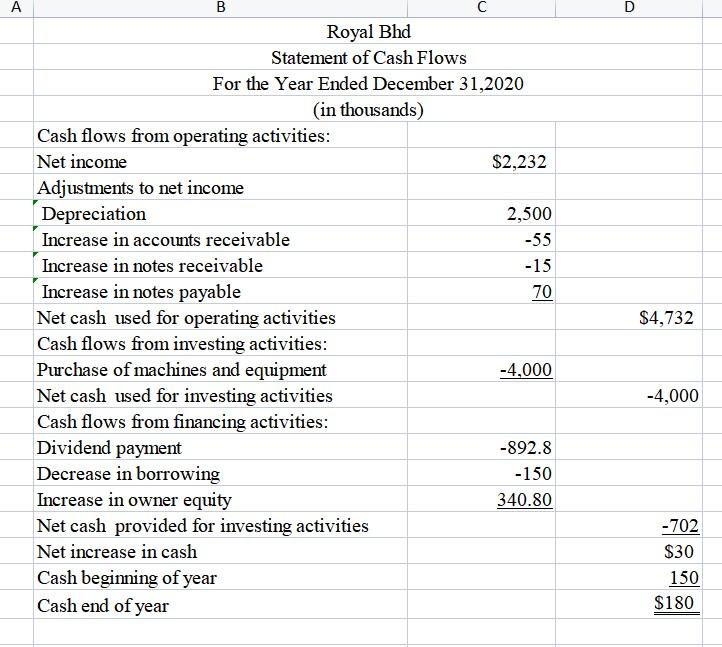

a. Analyse Royal Bhd's cash flows performance based on operating, investing and financing activities. b. Currently, Royal Bhd.'s director announce that company expected to issue

a. Analyse Royal Bhd's cash flows performance based on operating, investing and financing activities.

b. Currently, Royal Bhd.'s director announce that company expected to issue 10,000 units of bond with the coupon rate of 6% and selling at par six months from now. Based on the current financial position of Royal Bhd, analyse the impact of this announcement toward company' s major stakeholders and potential stakeholders.

c. Discuss the approaches in preparing Cash Flows Statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started