Answered step by step

Verified Expert Solution

Question

1 Approved Answer

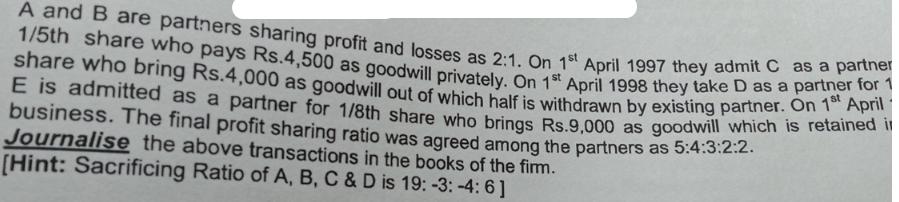

A and B are partners sharing profit and losses as 2:1. On 1st April 1997 they admit C as a partner 1/5th share who

A and B are partners sharing profit and losses as 2:1. On 1st April 1997 they admit C as a partner 1/5th share who pays Rs.4,500 as goodwill privately. On 1st April 1998 they take D as a partner for 1 share who E is admitted as a partner for 1/8th share who brings Rs.9,000 as goodwill which is retained i business. The final profit sharing ratio was agreed among the partners as 5:4:3:2:2. Journalise the above transactions in the books of the firm. [Hint: Sacrificing Ratio of A, B, C & D is 19: -3: -4: 6]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Transaction 1 Admission of Partner C April 1 1997 ABs Capital Ac Dr Rs 4500 23 sacrificing ratio of A B Cs Capital Ac Cr Rs 4500 23 Explanation A B sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dafc12e446_963629.pdf

180 KBs PDF File

663dafc12e446_963629.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started