Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A and B are partners sharing profits in the ratio of 2:1 and their Balance Sheet on 31.12.2014 was as follows: Liabilities Creditors Bills

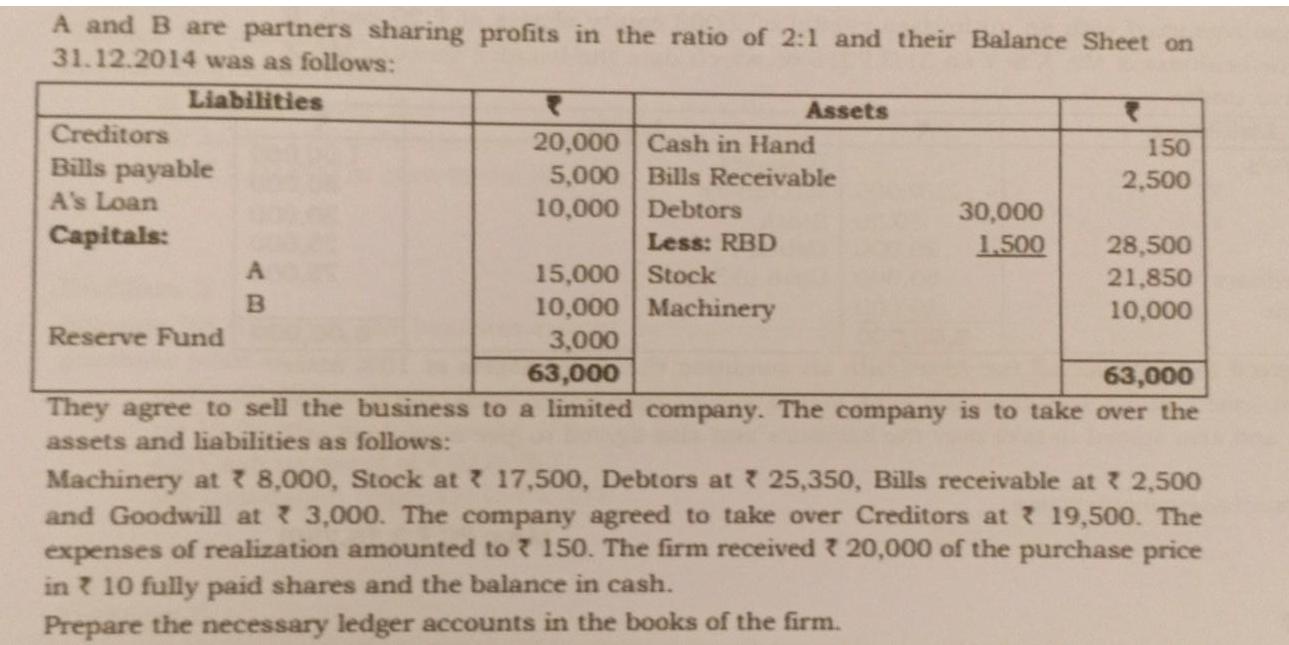

A and B are partners sharing profits in the ratio of 2:1 and their Balance Sheet on 31.12.2014 was as follows: Liabilities Creditors Bills payable A's Loan Capitals: A B Reserve Fund Assets 20,000 Cash in Hand 5,000 Bills Receivable 10,000 Debtors Less: RBD Stock Machinery 30,000 1,500 150 2,500 28,500 21,850 10,000 15,000 10,000 3,000 63,000 63,000 They agree to sell the business to a limited company. The company is to take over the assets and liabilities as follows: Machinery at 78,000, Stock at 17,500, Debtors at 25,350, Bills receivable at * 2,500 and Goodwill at 7 3,000. The company agreed to take over Creditors at 19,500. The expenses of realization amounted to 150. The firm received 720,000 of the purchase price in ? 10 fully paid shares and the balance in cash. Prepare the necessary ledger accounts in the books of the firm.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started