Answered step by step

Verified Expert Solution

Question

1 Approved Answer

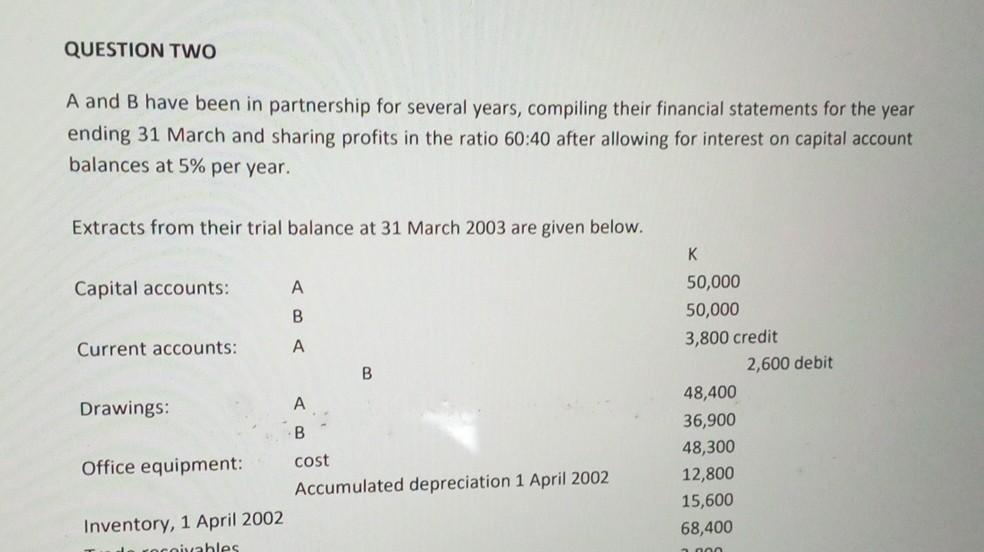

A and B have been in partnership for several years, compiling their financial statements for the year ending 31 March and sharing profits in the

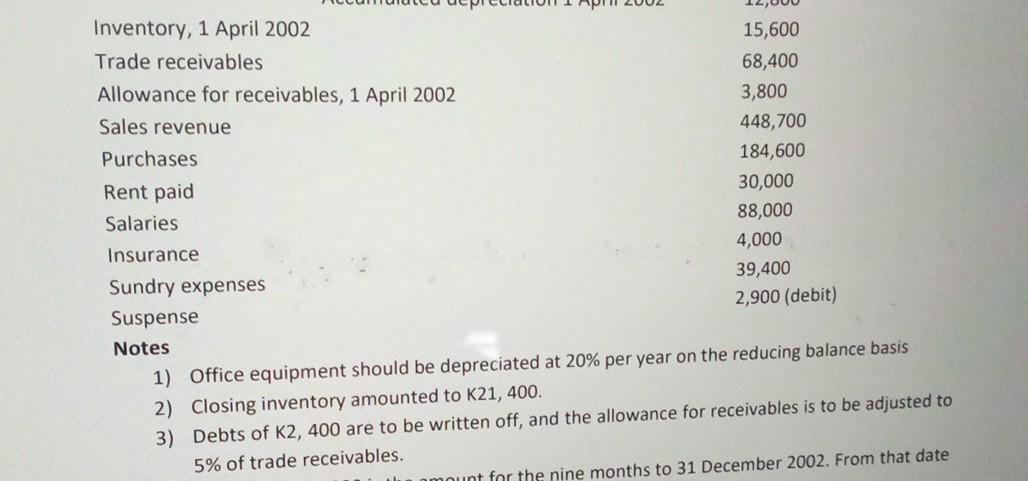

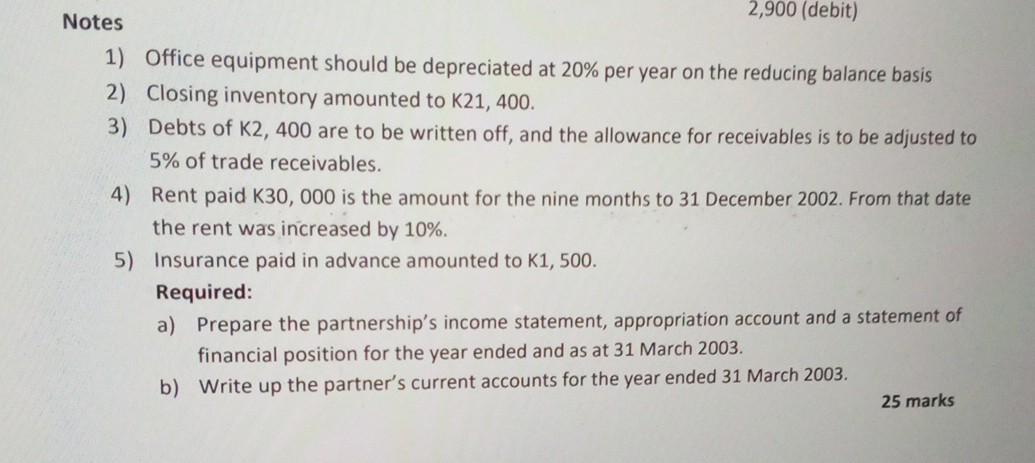

A and B have been in partnership for several years, compiling their financial statements for the year ending 31 March and sharing profits in the ratio 60:40 after allowing for interest on capital account balances at 5% per year. Extracts from their trial balance at 31 March 2003 are given below. Notes 1) Office equipment should be depreciated at 20% per year on the reducing balance basis 2) Closing inventory amounted to K21,400. 3) Debts of K2, 400 are to be written off, and the allowance for receivables is to be adjusted to 5% of trade receivables. Notes 1) Office equipment should be depreciated at 20% per year on the reducing balance basis 2) Closing inventory amounted to K21,400. 3) Debts of K2, 400 are to be written off, and the allowance for receivables is to be adjusted to 5% of trade receivables. 4) Rent paid K30, 000 is the amount for the nine months to 31 December 2002 . From that date the rent was increased by 10%. 5) Insurance paid in advance amounted to K1, 500. Required: a) Prepare the partnership's income statement, appropriation account and a statement of financial position for the year ended and as at 31 March 2003. b) Write up the partner's current accounts for the year ended 31 March 2003. 25 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started