Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. and B. (Quation provided for A.) Homework: Problem Set #3 Question 3, P6-13 (similar to) Part 1 of 2 HW Score: 20%, 10 of

A. and B.

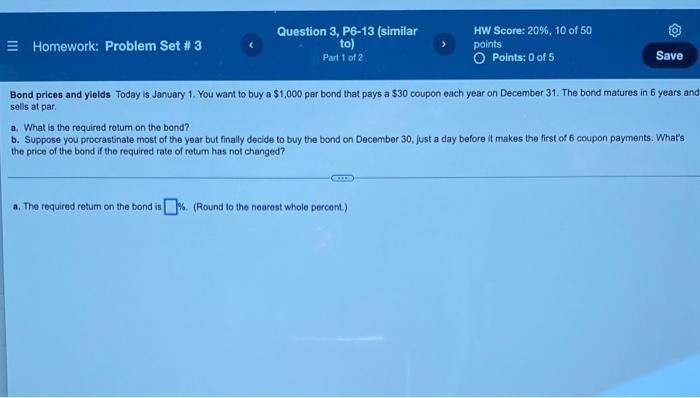

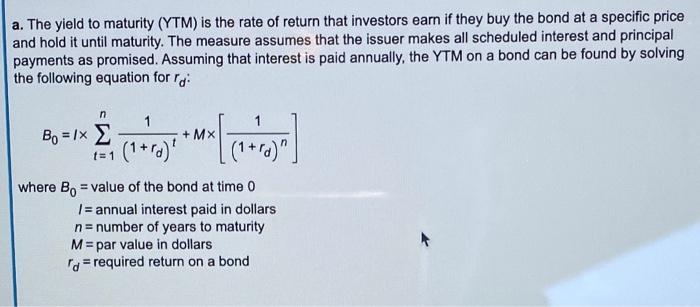

Homework: Problem Set #3 Question 3, P6-13 (similar to) Part 1 of 2 HW Score: 20%, 10 of 50 paints O Points: 0 of 5 Save Bond prices and yields Today's January 1. You want to buy a $1,000 par bond that pays a $30 coupon each year on December 31. The bond matures in 6 years and sells at par a. What is the required return on the bond? 6. Suppose you procrastinate most of the year but finally decide to buy the bond on December 30, just a day before it makes the first of 6 coupon payments. What's the price of the bond if the required rate of return has not changed? a. The required return on the bond is % (Round to the nearest wholo percent.) a. The yield to maturity (YTM) is the rate of return that investors earn if they buy the bond at a specific price and hold it until maturity. The measure assumes that the issuer makes all scheduled interest and principal payments as promised. Assuming that interest is paid annually, the YTM on a bond can be found by solving the following equation for : n 1 Bo = 1x + MX t=1 = where Bo = value of the bond at time 0 I = annual interest paid in dollars n=number of years to maturity M = par value in dollars ro= required return on a bond (Quation provided for A.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started