Question

a) Angela took a RM100,000 bank loan from Bank AA. The bank charged Angela an interest rate of 7% p.a. and requires him to pay

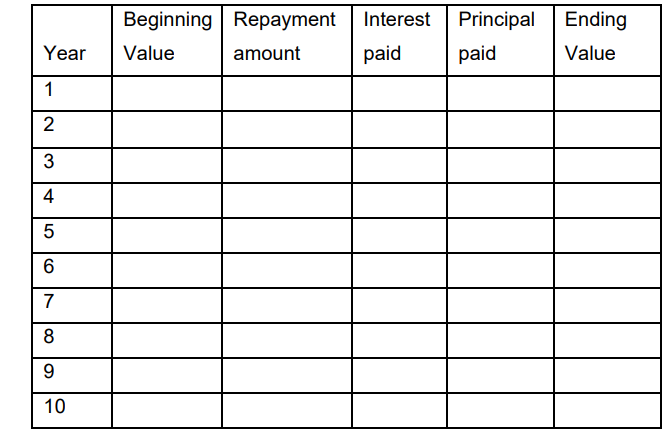

a) Angela took a RM100,000 bank loan from Bank AA. The bank charged Angela an interest rate of 7% p.a. and requires him to pay at the end of each year for 10 years. (i) Calculate the yearly repayment amount and complete the following loan amortization schedule.

(ii) By the end of year 5, Angela not only services the yearly repayment amount but also pays an additional RM10,000 to partially pay off the loan. Prepare another loan amortization table starting from year 6.

(iii) Compute the interest saved when repays an additional of RM10,000 at the end of year 5.

b) Ramesh invested RM10,000 in Bank XX three years ago. The bank pays 10% simple interest per annum. He decided to withdraw all the money accumulated in Bank XX and invest in Bank ZZ that gives 6% interest p.a. compounded quarterly. He plans to keep the money for 4 years in Bank ZZ. Calculate the accumulated amount at the end of the fourth year.

\begin{tabular}{|l|l|l|l|l|l|} \hline Year & BeginningValue & Repaymentamount & Interestpaid & Principalpaid & EndingValue \\ \hline 1 & & & & & \\ \hline 2 & & & & & \\ \hline 3 & & & & & \\ \hline 4 & & & & & \\ \hline 5 & & & & & \\ \hline 6 & & & & & \\ \hline 7 & & & & & \\ \hline 8 & & & & & \\ \hline 9 & & & & & \\ \hline 10 & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started