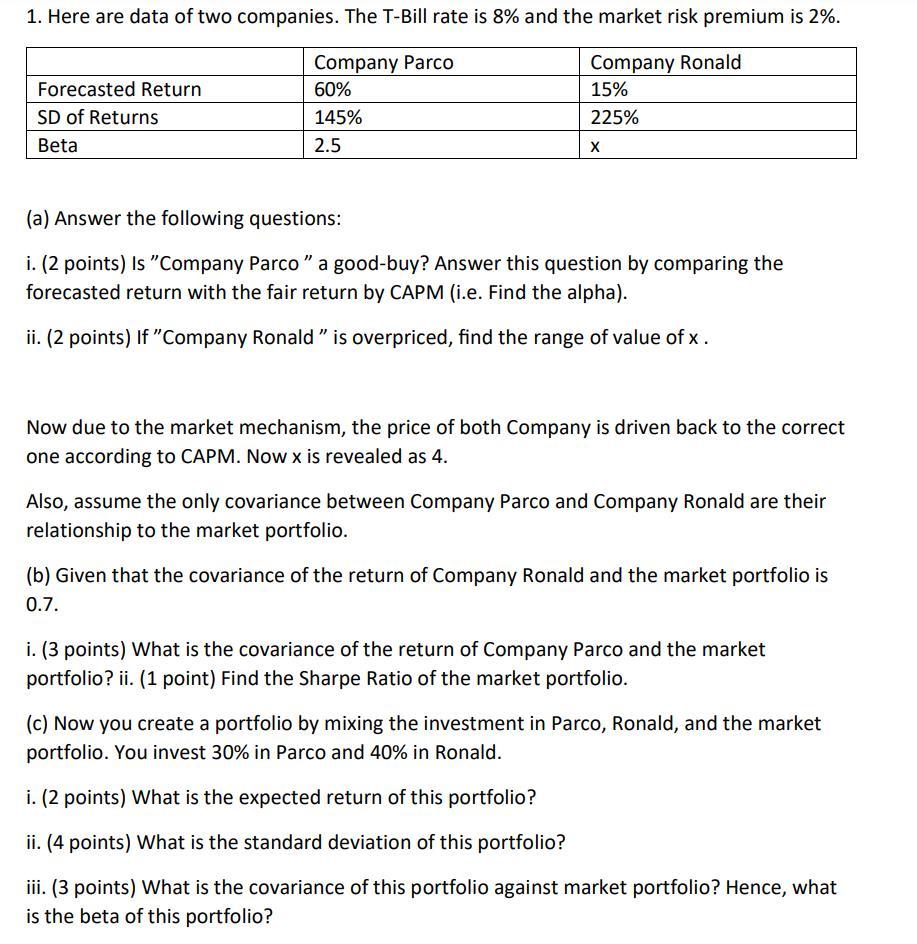

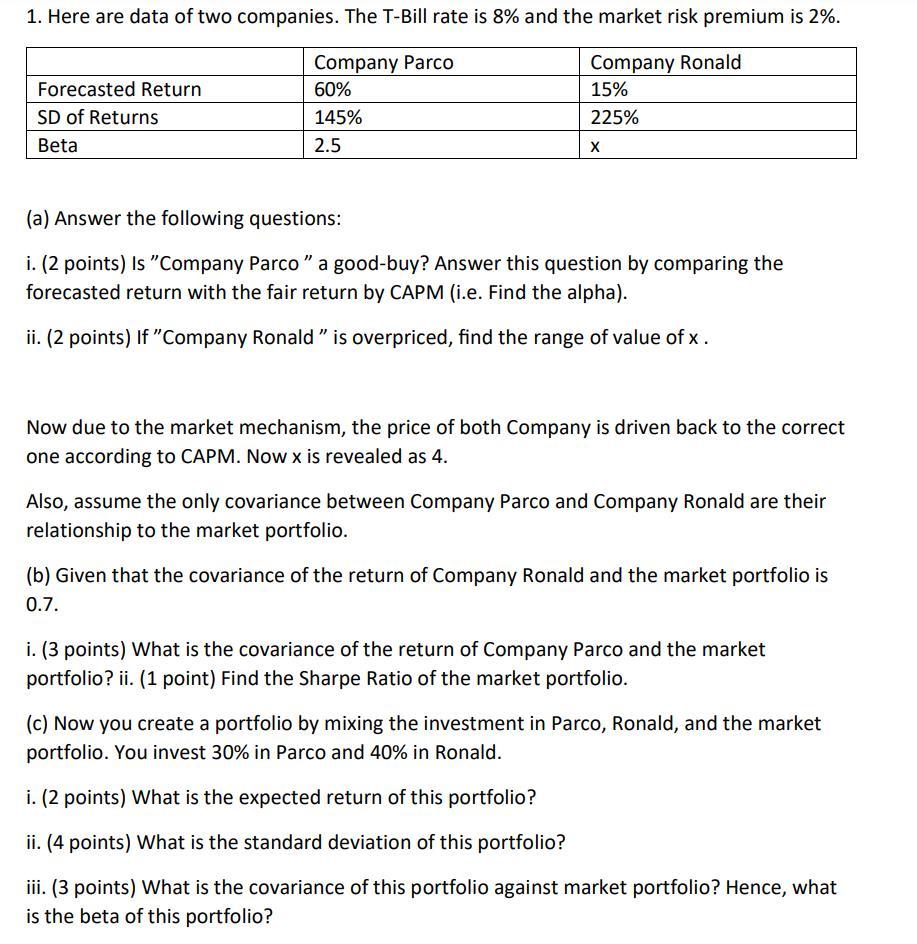

(a) Answer the following questions: i. (2 points) Is "Company Parco " a good-buy? Answer this question by comparing the forecasted return with the fair return by CAPM (i.e. Find the alpha). ii. ( 2 points) If "Company Ronald" is overpriced, find the range of value of x. Now due to the market mechanism, the price of both Company is driven back to the correct one according to CAPM. Now x is revealed as 4 . Also, assume the only covariance between Company Parco and Company Ronald are their relationship to the market portfolio. (b) Given that the covariance of the return of Company Ronald and the market portfolio is 0.7. i. (3 points) What is the covariance of the return of Company Parco and the market portfolio? ii. (1 point) Find the Sharpe Ratio of the market portfolio. (c) Now you create a portfolio by mixing the investment in Parco, Ronald, and the market portfolio. You invest 30% in Parco and 40% in Ronald. i. (2 points) What is the expected return of this portfolio? ii. (4 points) What is the standard deviation of this portfolio? iii. (3 points) What is the covariance of this portfolio against market portfolio? Hence, what is the beta of this portfolio? (a) Answer the following questions: i. (2 points) Is "Company Parco " a good-buy? Answer this question by comparing the forecasted return with the fair return by CAPM (i.e. Find the alpha). ii. ( 2 points) If "Company Ronald" is overpriced, find the range of value of x. Now due to the market mechanism, the price of both Company is driven back to the correct one according to CAPM. Now x is revealed as 4 . Also, assume the only covariance between Company Parco and Company Ronald are their relationship to the market portfolio. (b) Given that the covariance of the return of Company Ronald and the market portfolio is 0.7. i. (3 points) What is the covariance of the return of Company Parco and the market portfolio? ii. (1 point) Find the Sharpe Ratio of the market portfolio. (c) Now you create a portfolio by mixing the investment in Parco, Ronald, and the market portfolio. You invest 30% in Parco and 40% in Ronald. i. (2 points) What is the expected return of this portfolio? ii. (4 points) What is the standard deviation of this portfolio? iii. (3 points) What is the covariance of this portfolio against market portfolio? Hence, what is the beta of this portfolio