Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) As a student of financial management course, how do you evaluate and compare Profitability and Liquidity performance of ABC Builders with the support of

a) As a student of financial management course, how do you evaluate and compare Profitability and Liquidity performance of ABC Builders with the support of the ratio analysis for the two years given above?

b) You are required to offer an advice to Mohammed Abdullah based on your calculations with regards to the viability of engaging in a credit relationship with ABC Builders. Justify with logical reasons.

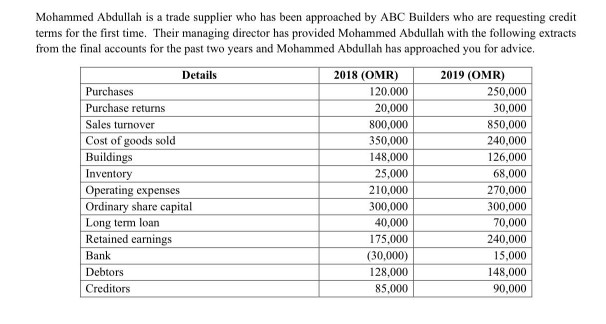

Mohammed Abdullah is a trade supplier who has been approached by ABC Builders who are requesting credit terms for the first time. Their managing director has provided Mohammed Abdullah with the following extracts from the final accounts for the past two years and Mohammed Abdullah has approached you for advice. Details 2018 (OMR) 2019 (OMR) Purchases 120.000 250,000 Purchase returns 20,000 30.000 Sales turnover 800,000 850,000 Cost of goods sold 350,000 240,000 Buildings 148.000 126,000 Inventory 25,000 68,000 Operating expenses 210.000 270,000 Ordinary share capital 300,000 300,000 Long term loan 40,000 70,000 Retained earnings 175,000 240,000 Bank (30,000) 15,000 Debtors 128.000 148,000 Creditors 85,000 90,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started