Answered step by step

Verified Expert Solution

Question

1 Approved Answer

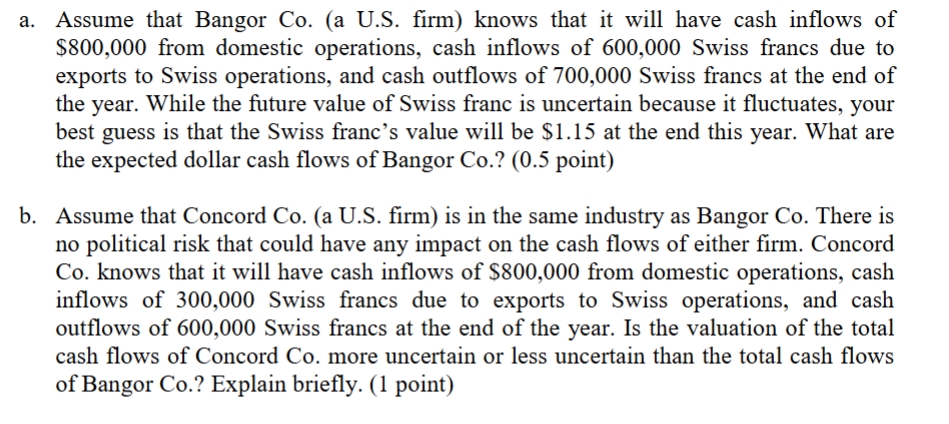

a . Assume that Bangor Co . ( a U . S . firm ) knows that it will have cash inflows of $ 8

a Assume that Bangor Coa US firm knows that it will have cash inflows of

$ from domestic operations, cash inflows of Swiss francs due to

exports to Swiss operations, and cash outflows of Swiss francs at the end of

the year. While the future value of Swiss franc is uncertain because it fluctuates, your

best guess is that the Swiss franc's value will be $ at the end this year. What are

the expected dollar cash flows of Bangor Co point

b Assume that Concord Coa US firm is in the same industry as Bangor Co There is

no political risk that could have any impact on the cash flows of either firm. Concord

Co knows that it will have cash inflows of $ from domestic operations, cash

inflows of Swiss francs due to exports to Swiss operations, and cash

outflows of Swiss francs at the end of the year. Is the valuation of the total

cash flows of Concord Co more uncertain or less uncertain than the total cash flows

of Bangor Co Explain briefly. point

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started