Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Assume that DD Construction Inc (a UK firm) expect to receive 1 million euros in one year. The existing spot rate for euro

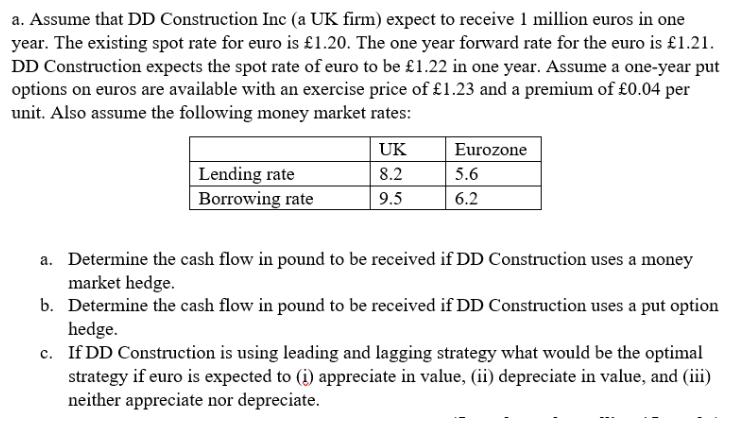

a. Assume that DD Construction Inc (a UK firm) expect to receive 1 million euros in one year. The existing spot rate for euro is 1.20. The one year forward rate for the euro is 1.21. DD Construction expects the spot rate of euro to be 1.22 in one year. Assume a one-year put options on euros are available with an exercise price of 1.23 and a premium of 0.04 per unit. Also assume the following money market rates: UK Eurozone Lending rate 8.2 5.6 Borrowing rate 9.5 6.2 a. Determine the cash flow in pound to be received if DD Construction uses a money market hedge. b. Determine the cash flow in pound to be received if DD Construction uses a put option hedge. c. If DD Construction is using leading and lagging strategy what would be the optimal strategy if euro is expected to (i) appreciate in value, (ii) depreciate in value, and (iii) neither appreciate nor depreciate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started