Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Assume that Majestic of the Seas has relied on the capital markets for financing in the past by issuing shares of stock. Over

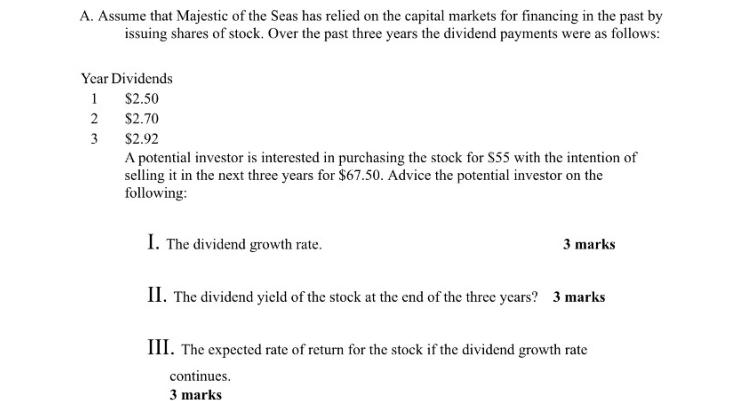

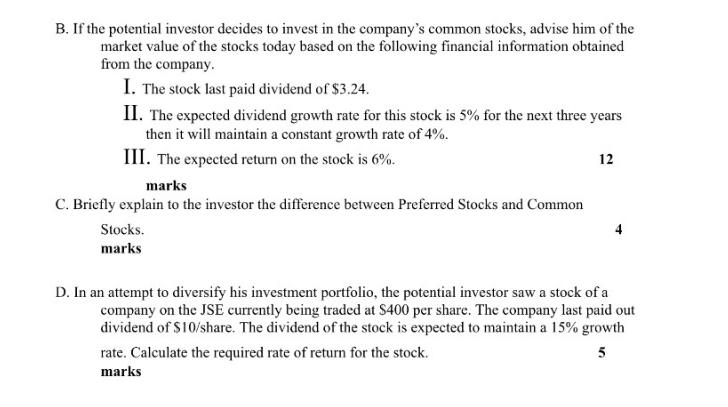

A. Assume that Majestic of the Seas has relied on the capital markets for financing in the past by issuing shares of stock. Over the past three years the dividend payments were as follows: Year Dividends 1 $2.50 2 $2.70 3 $2.92 A potential investor is interested in purchasing the stock for $55 with the intention of selling it in the next three years for $67.50. Advice the potential investor on the following: I. The dividend growth rate. 3 marks II. The dividend yield of the stock at the end of the three years? 3 marks III. The expected rate of return for the stock if the dividend growth rate continues. 3 marks B. If the potential investor decides to invest in the company's common stocks, advise him of the market value of the stocks today based on the following financial information obtained from the company. I. The stock last paid dividend of $3.24. II. The expected dividend growth rate for this stock is 5% for the next three years then it will maintain a constant growth rate of 4%. III. The expected return on the stock is 6%. marks C. Briefly explain to the investor the difference between Preferred Stocks and Common Stocks. marks 12 D. In an attempt to diversify his investment portfolio, the potential investor saw a stock of a company on the JSE currently being traded at $400 per share. The company last paid out dividend of $10/share. The dividend of the stock is expected to maintain a 15% growth 5 rate. Calculate the required rate of return for the stock. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Advice for the Potential Investor I Dividend Growth Rate We can calculate the Average Growth Rate AGR to estimate the dividend growth rate Formula A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started