Answered step by step

Verified Expert Solution

Question

1 Approved Answer

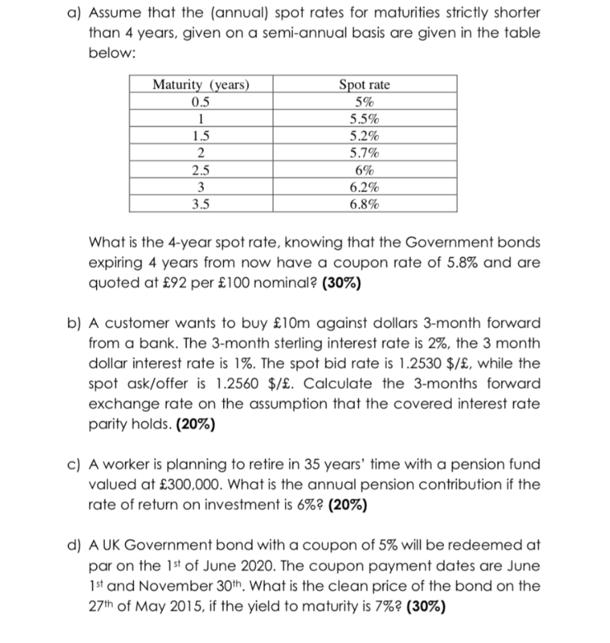

a) Assume that the (annual) spot rates for maturities strictly shorter than 4 years, given on a semi-annual basis are given in the table

a) Assume that the (annual) spot rates for maturities strictly shorter than 4 years, given on a semi-annual basis are given in the table below: Maturity (years) 0.5 1 1.5 2 2.5 3 3.5 Spot rate 5% 5.5% 5.2% 5.7% 6% 6.2% 6.8% What is the 4-year spot rate, knowing that the Government bonds expiring 4 years from now have a coupon rate of 5.8% and are quoted at 92 per 100 nominal? (30%) b) A customer wants to buy 10m against dollars 3-month forward from a bank. The 3-month sterling interest rate is 2%, the 3 month dollar interest rate is 1%. The spot bid rate is 1.2530 $/, while the spot ask/offer is 1.2560 $/. Calculate the 3-months forward exchange rate on the assumption that the covered interest rate parity holds. (20%) c) A worker is planning to retire in 35 years' time with a pension fund valued at 300,000. What is the annual pension contribution if the rate of return on investment is 6%? (20%) d) A UK Government bond with a coupon of 5% will be redeemed at par on the 1st of June 2020. The coupon payment dates are June 1st and November 30th. What is the clean price of the bond on the 27th of May 2015, if the yield to maturity is 7%? (30%)

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the 4year spot rate we can use the concept of bootstrapping Since we have spot rates for various maturities we can use them to derive t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started