Answered step by step

Verified Expert Solution

Question

1 Approved Answer

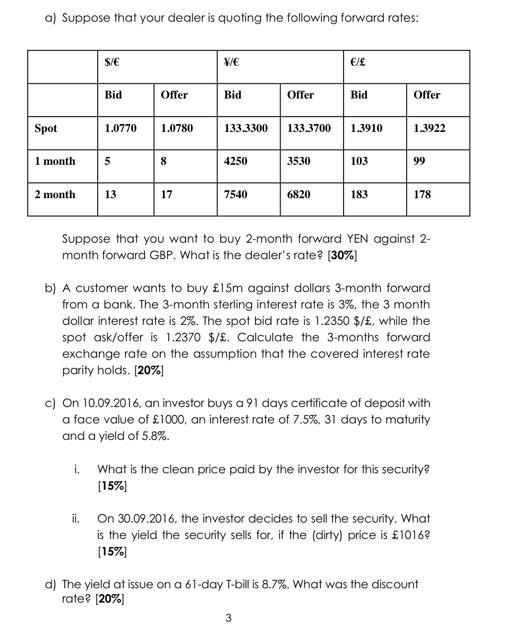

a) Suppose that your dealer is quoting the following forward rates: Spot 1 month 2 month $/ Bid 1.0770 5 13 Offer 1.0780 8

a) Suppose that your dealer is quoting the following forward rates: Spot 1 month 2 month $/ Bid 1.0770 5 13 Offer 1.0780 8 17 X/ Bid 133.3300 133.3700 4250 7540 Offer 3530 6820 / Bid 1.3910 3 103 183 Offer 1.3922 99 178 Suppose that you want to buy 2-month forward YEN against 2- month forward GBP. What is the dealer's rate? [30%] b) A customer wants to buy 15m against dollars 3-month forward from a bank. The 3-month sterling interest rate is 3%, the 3 month dollar interest rate is 2%. The spot bid rate is 1.2350 $/, while the spot ask/offer is 1.2370 $/. Calculate the 3-months forward exchange rate on the assumption that the covered interest rate parity holds. [20%] c) On 10.09.2016. an investor buys a 91 days certificate of deposit with a face value of 1000, an interest rate of 7.5%, 31 days to maturity and a yield of 5.8%. i. What is the clean price paid by the investor for this security? [15%] ii. On 30.09.2016, the investor decides to sell the security. What is the yield the security sells for, if the (dirty) price is 1016? [15%) d) The yield at issue on a 61-day T-bill is 8.7%. What was the discount rate? [20%]

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a The dealers rate for buying 2month forward YEN against 2month forward GBP is 13 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started