Question

a) Assume that the low-value market is distinct from the high-value market, and products can be sold at different prices in these two markets. That

a) Assume that the low-value market is distinct from the high-value market, and products can be sold at different prices in these two markets. That is, selling at a lower price in the low-value market would not undermine widget price in the high-value market. What is the incremental profit that would accrue to ABC and XYZ, if sales volume increases by 40% (2,000 units)? Given our set of assumptions, for which firm it is a viable strategy to sell to the low-value market? b) On studying more about the two market segments, it was clear that it is impossible to sell the widgets at a low price in the low-value without undermining the price for the high value segment. Therefore, assume that the price is same for both the market segments. Compute for each firm the change in breakeven volume, if they choose to sell the widget at $8.50 for both segments. c) Based on your breakeven analysis for section (b), discuss which company is better geared to exploit this opportunity.

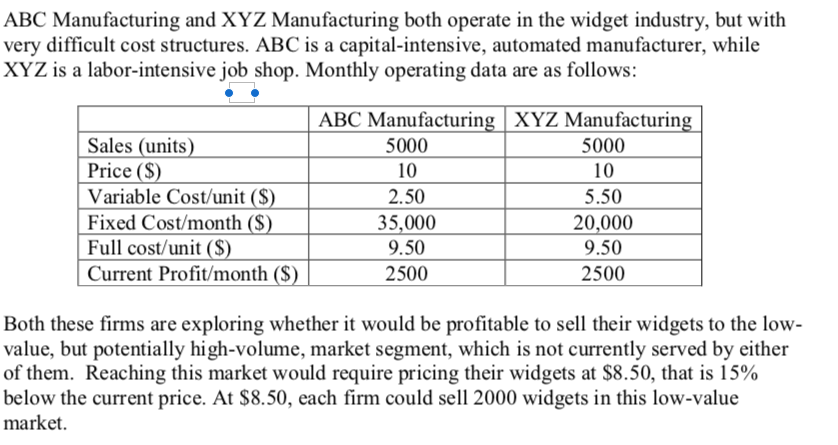

ABC Manufacturing and XYZ Manufacturing both operate in the widget industry, but with very difficult cost structures. ABC is a capital-intensive, automated manufacturer, while XYZ is a labor-intensive job shop. Monthly operating data are as follows: ABC Manufacturing XYZ Manufacturin Sales (units Price ($) Variable Cost/unit ($ Fixed Cost/month (S Full cost/unit ($) Current Profit/month (S 5000 10 2.50 35,000 9.50 2500 5000 10 5.50 20,000 9.50 2500 Both these firms are exploring whether it would be profitable to sell their widgets to the low value, but potentially high-volume, market segment, which is not currently served by either of them. Reaching this market would require pricing their widgets at $8.50, that is 15% below the current price. At $8.50, each firm could sell 2000 widgets in this low-value marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started