Question

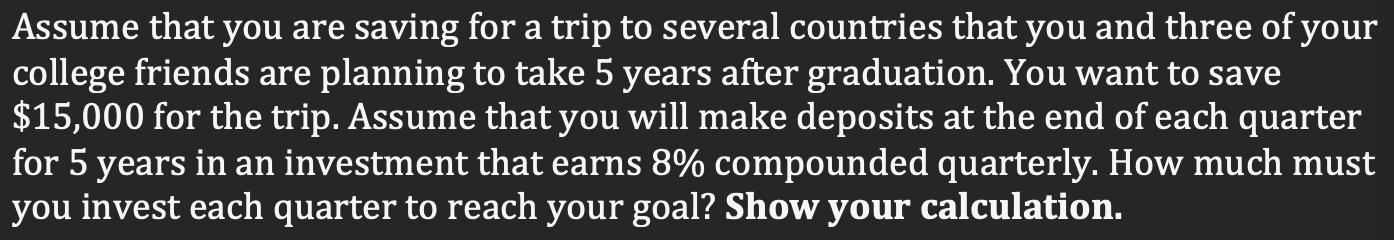

a Assume that you are saving for a trip to several countries that you and three of your college friends are planning to take 5

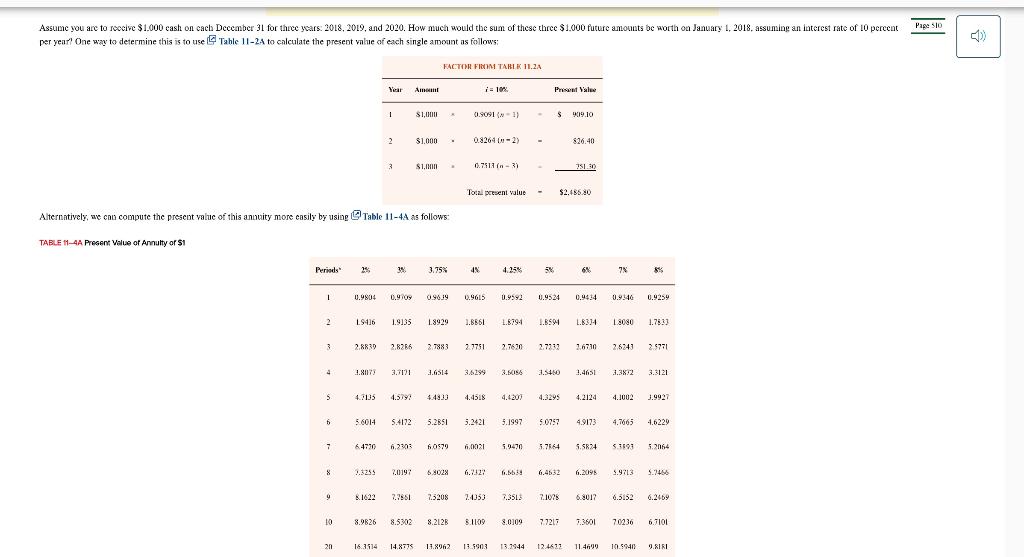

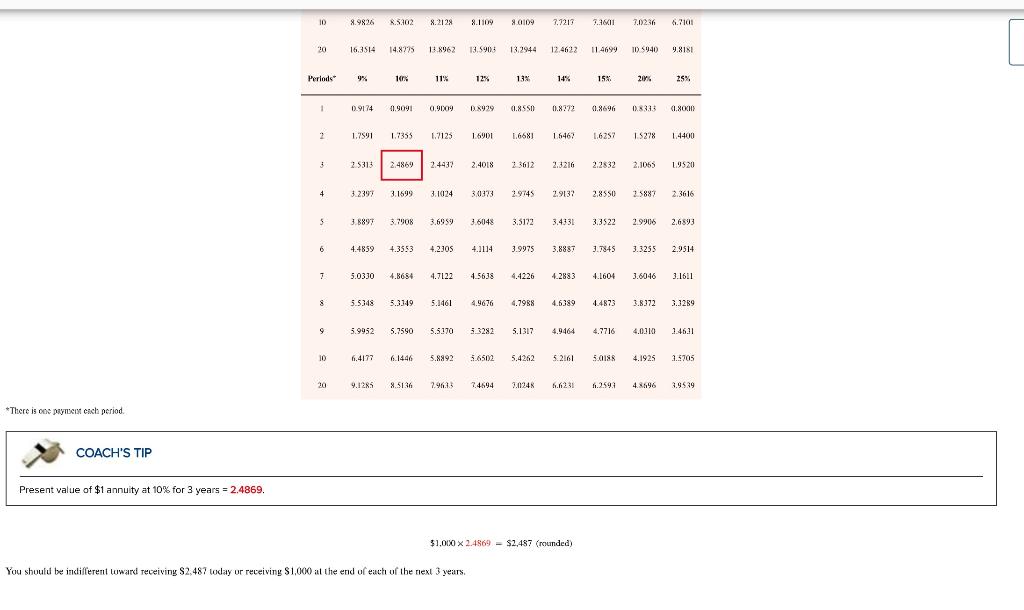

FACTOR FIMM TARIK 11.20 Year Aiman i = 10%. Presle 1 S. 0.909) $ 09.10 2 $1.000 0.8264-2) $26.40 3 $1,1 0.7511 In - 33 750.30 Tocal persent value - $2.455.80 Alternatively, we Con Compute the present value of this annuity more casily by using Table 11-4A as follows: TABLE 11-4A Present Value of Annulty or $1 Periods 2% 39 . 3.75% AN 11 5 6 7 1 0.9804 0.9 0.969 0.9615 1.9592 1.9524 0.9614 0.9340 0.9259 2 1946 1.9135 1.8929 1.8561 1.6794 1.8591 L.834 L8080 1.7833 3 28630 2,826 2.7883 2.7751 2.7670 2.7212 1.6710 26243 2.5771 3 1.8023 3.711 1.6514 3.6199 3.MISS 1.4651 ..382 3.3121 5 4:135 4.4515 4.4201 4.3295 4.2124 4.1002 3.9927 6 56014 5.4172 5.2851 5.2421 5.1997 5.0757 4.9173 4.7663 4.6229 7 64730 6.3 f0579 0021 5,0470 5.7164 5.5824 5.1991 5.2014 8 0.3255 2.0197 6.8028 6.2.17 6.6639 6.4532 6.2095 5.9213 5.2456 9 81622 2.2951 7.5205 2.05) 7.3512 7.1075 6.2017 6.5152 6.2469 10 8.9826 8.5332 8.212B 8.1109 3.0]09 77217 1.3601 70236 6.7101 2n 163514 14.8775 11.8962 11.5901 13.2944 12.4611 11.4699 10.59401 9.8161 ID 8.9826 X.5702 8.2128 8.1109 80109 7.7213 2.1 3.0236 6.7101 30 16.3514 14.8275 13.8962 13.5904 13.29444 12.4622 114699 ID 5940 9.815 Periods 9% 11% 12% 138 14% 15% 20% ZS% 1 0.9174 11.9091 0.9009 0.8929 0.8550 0.8972 (1.8696 1.8333 (IXCH ) 2 1.7591 1.7355 1.2125 16901 16681 L6467 16257 15228 1.4400 25313 2.4869 2.4437 2.4018 23612 2.3216 2.2832 2.3055 1.9520 4 3.2397 3.1999 3.1024 30973 2.9745 2.9132 2.8550 25887 2.3616 5 3.8899 3.7908 3.6959 3.6048 3.5172 3.4331 3.3522 29906 2.6893 6 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 3.7845 3.3255 2.9514 7 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 4.1604 3.6046 3.1611 8 5.5348 5.3349 5.1461 4.9676 4.7988 4.6399 4.4873 3.8372 3.3289 9 5.9952 5.7590 5.5170 13282 5.1317 4.9464 4.7716 4.0.710 1.46.1 10 6.4172 6.1446 5.8892 5.6502 5.4262 5261 5015 4.1925 3.5705 30 9.1285 8.5136 7.96.43 7.4694 3.024 6.623 6.2593 4.8596 3.9529 *There is one payment cach period. COACH'S TIP Present value of $1 annuity at 10% for 3 years = 2.4869 $1,000 x 2.4569 = $2,487 (rounded) You should be indifferent toward receiving $2,487 today or receiving $1,000 at the end of each of the next 3 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started