Question

(a) Assume the company uses perpetual inventory system. Prepare journal entries to record the following activities of the company for April. (14 marks)i. The accumulation

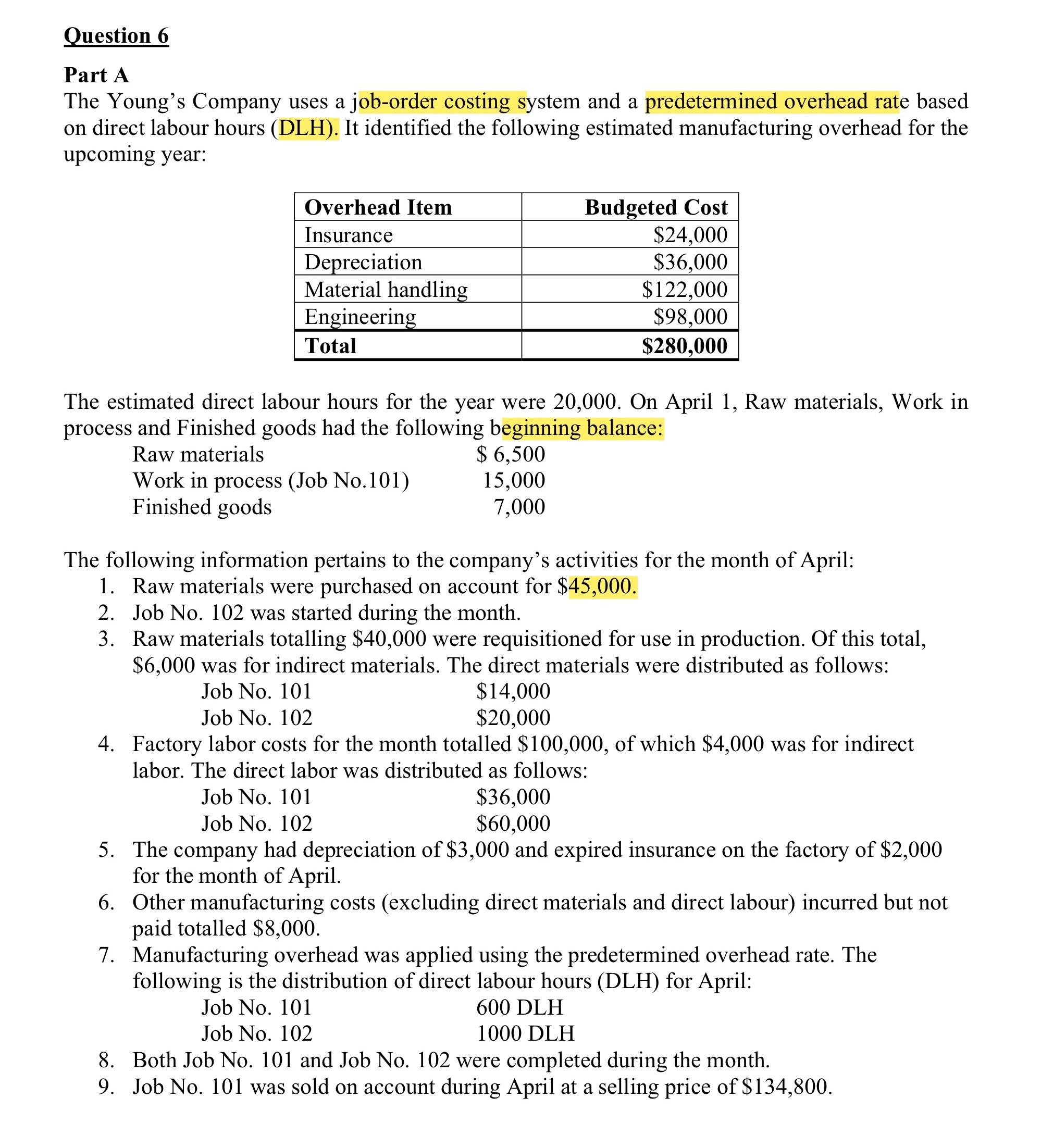

(a) Assume the company uses perpetual inventory system. Prepare journal entries to record the following activities of the company for April. (14 marks)i. The accumulation of raw materials costs.ii. The accumulation of manufacturing overhead costs.iii. The assignment of raw materials costs to production.iv. The assignment of factory labor costs to production.v. The assignment of manufacturing overhead costs to production using the predetermined overhead rate based on direct labour hours.(b) What is the cost of goods manufactured under Job No. 101? (2 marks)(c) Prepare the journal entry to adjust for the underapplied or overapplied overhead. Assume the amount is considered immaterial. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started