Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Assume you just deposited $1,100 into a bank account. The current real interest rate is 4.5% and inflation expected to be 8% over the

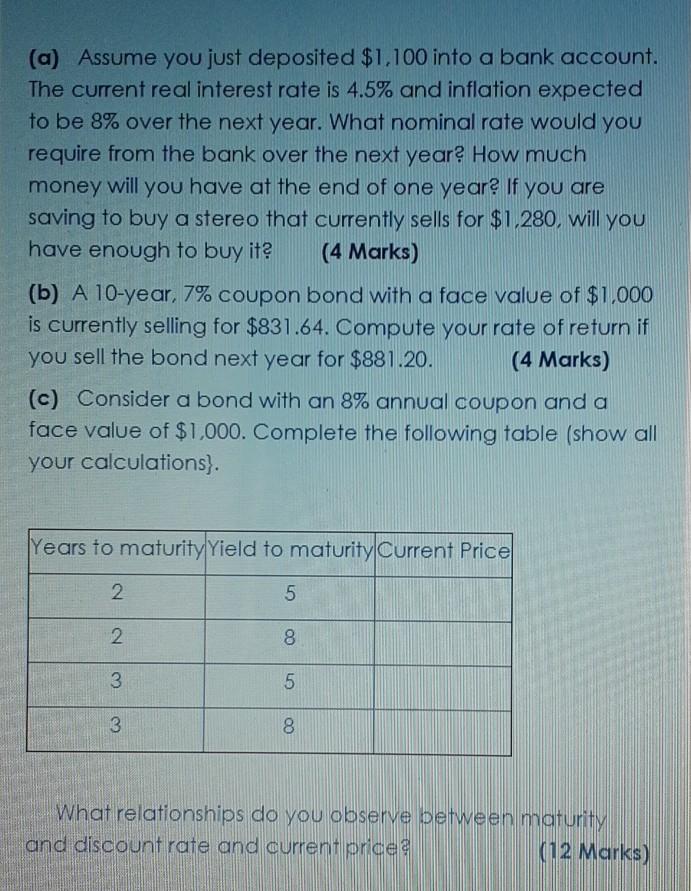

(a) Assume you just deposited $1,100 into a bank account. The current real interest rate is 4.5% and inflation expected to be 8% over the next year. What nominal rate would you require from the bank over the next year? How much money will you have at the end of one year? If you are saving to buy a stereo that currently sells for $1.280, will you have enough to buy it? (4 Marks) (b) A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for $831.64. Compute your rate of return if you sell the bond next year for $881.20. (4 Marks) (c) Consider a bond with an 8% annual coupon and a face value of $1,000. Complete the following table (show all your calculations). Years to maturity Yield to maturity Current Price 2 5 2 8 3 5 3 8 What relationships do you observe between maturity and discount rate and current price (12 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started