Answered step by step

Verified Expert Solution

Question

1 Approved Answer

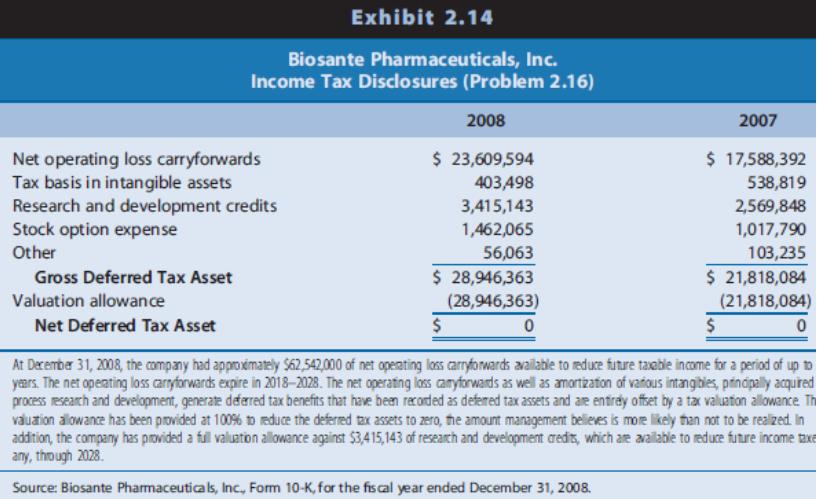

Deferred Tax Assets. Components of the deferred tax asset of Biosante Pharmaceuticals, Inc., are shown in Exhibit 2.14. The company had no deferred tax

Deferred Tax Assets. Components of the deferred tax asset of Biosante Pharmaceuticals, Inc., are shown in Exhibit 2.14. The company had no deferred tax liabilities. REQUIRED a. At the end of 2008, the largest deferred tax asset is for net operating loss carryforwards. (Net operating loss carryforwards [also referred to as tax loss carryforwards] are amounts reported as taxable losses on tax filings. Because the tax authorities generally do not "pay" corporations for incurring losses, companies are allowed to "carry forward" taxable losses to future years to offset taxable income. These future tax benefits give rise to deferred tax assets.) As of the end of 2008, what is the dollar amount of the company's net operating loss carryforwards? What is the dollar amount of the deferred tax asset for the net operating loss carryforwards? Describe how these two amounts are related. b. Biosante has gross deferred tax assets of $28,946,363. However, the net deferred tax assets balance is zero. Explain. c. The valuation allowance for the deferred tax asset increased from $21,818,084 to $28,946,363 between 2007 and 2008. How did this change affect the company's net income? Exhibit 2.14 Biosante Pharmaceuticals, Inc. Income Tax Disclosures (Problem 2.16) 2008 2007 $ 23,609,594 $ 17,588,392 Net operating loss carryforwards Tax basis in intangible assets Research and development credits Stock option expense 403498 538,819 3,415,143 2,569,848 1,462,065 1,017,790 Other 56,063 $ 28,946,363 (28,946,363) 103,235 $ 21,818,084 (21,818,084) Gross Deferred Tax Asset Valuation allowance Net Deferred Tax Asset 24 At Derember 31, 2008, the company had approvimately $62,542,000 of net opeating los carryforwards avallable to educe future taxoble income for a period of up to yars. The net opeating loss caryforwards expire in 2018-2028. The net operatting lass camyforwards as well as amortization of vartous intangibles, pindipally acquired process research and development, generate dafarred tax benefits that have been racorded as defered tax assets and are entirdy offet by a tax valuation allowance. Th vauzion alowance has been provided at 100% to reduce the defered tax assets to zero, the amount management believes is more likely han not to be realized In addition, the company has provided a full valuation allowance against $3,415,143 of research and development redis, which are avalable to reduce future income taxe any, though 2028. Source: Biosante Pharmaceuticals, Inc, Form 10-K, for the fis cal year ended December 31, 2008.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started