Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Peter owned a 5-year bond A with a coupon rate of 6.6% p.a., paying coupon semi-annually and with a face value of $1,000.

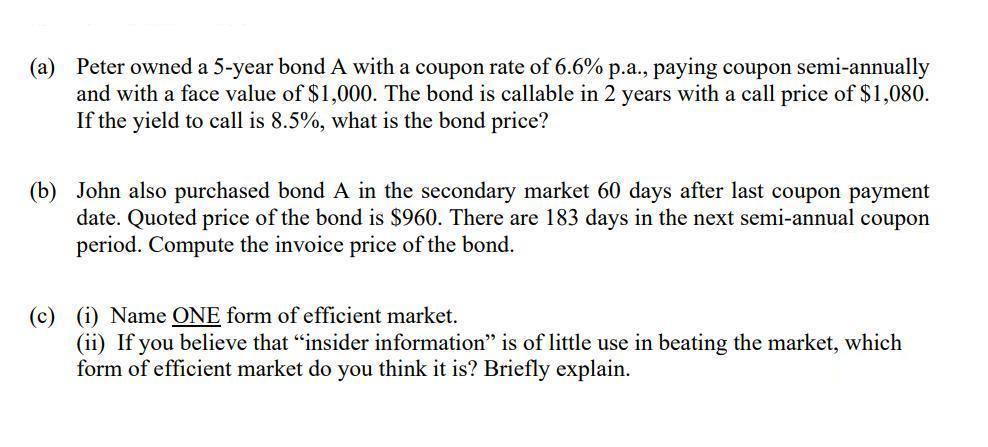

(a) Peter owned a 5-year bond A with a coupon rate of 6.6% p.a., paying coupon semi-annually and with a face value of $1,000. The bond is callable in 2 years with a call price of $1,080. If the yield to call is 8.5%, what is the bond price? (b) John also purchased bond A in the secondary market 60 days after last coupon payment date. Quoted price of the bond is $960. There are 183 days in the next semi-annual coupon period. Compute the invoice price of the bond. (c) (i) Name ONE form of efficient market. (ii) If you believe that "insider information" is of little use in beating the market, which form of efficient market do you think it is? Briefly explain.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Bond Price with Callable Feature Given data Coupon rate 66 per annum Coupons paid semiannually Face value 1000 Callable in 2 years at 1080 Yield to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started