Answered step by step

Verified Expert Solution

Question

1 Approved Answer

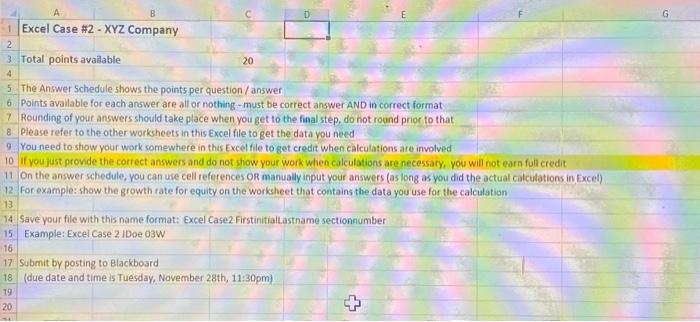

A B 1 Excel Case #2 - XYZ Company 2 3 Total points available 4 5 The Answer Schedule shows the points per question/answer 6

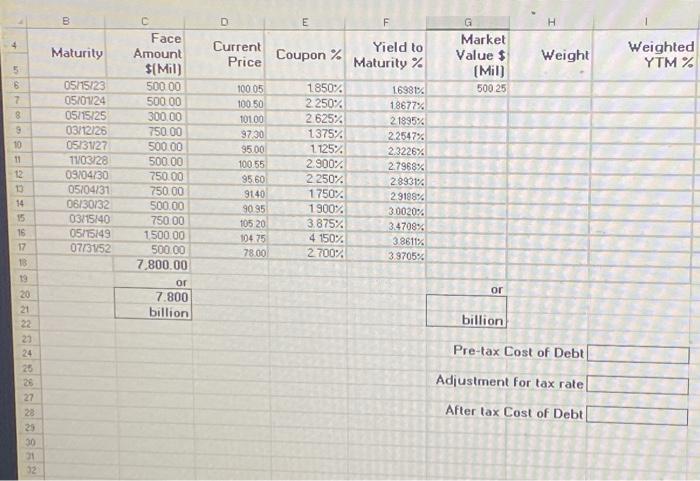

A B 1 Excel Case #2 - XYZ Company 2 3 Total points available 4 5 The Answer Schedule shows the points per question/answer 6 Points available for each answer are all or nothing - must be correct answer AND in correct format 7 Rounding of your answers should take place when you get to the final step, do not round prior to that 8 Please refer to the other worksheets in this Excel file to get the data you need 20 D 9 You need to show your work somewhere in this Excel file to get credit when calculations are involved 10 If you just provide the correct answers and do not show your work when calculations are necessary, you will not earn full credit 11 On the answer schedule, you can use cell references OR manually input your answers (as long as you did the actual calculations in Excel) 12 For example: show the growth rate for equity on the worksheet that contains the data you use for the calculation 13 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started