Answered step by step

Verified Expert Solution

Question

1 Approved Answer

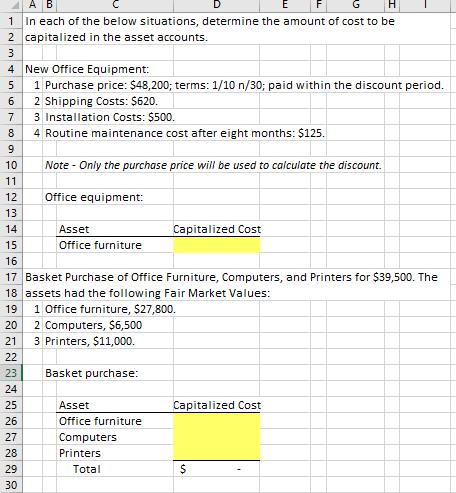

A B 1 In each of the below situations, determine the amount of cost to be 2 capitalized in the asset accounts. 3 4

A B 1 In each of the below situations, determine the amount of cost to be 2 capitalized in the asset accounts. 3 4 New Office Equipment: 5 1 Purchase price: $48,200; terms: 1/10 n/30; paid within the discount period. 2 Shipping Costs: $620. 3 Installation Costs: $500. 6. 7 8 4 Routine maintenance cost after eight months: $125. 9. 10 Note - Only the purchase price will be used to calculate the discount. 11 12 Office equipment: 13 14 Asset Capitalized Cost 15 Office furniture 16 17 Basket Purchase of Office Furniture, Computers, and Printers for $39,500. The 18 assets had the following Fair Market Values: 1 Office furniture, $27,800. 19 2 Computers, $6,500 3 Printers, $11,000. 20 21 22 23 Basket purchase: 24 25 Asset Capitalized Cost 26 Office furniture 27 Computers 28 Printers 29 Total 30 30 31 Land purchased for business expansion: 1 Purchase price, $65,200. 2 Cost to remove trees and clear the land, $4,320. 3 Lumber sold for $1,710. 3 Preparation of land for new building, $9,500. 4 Construction of new building, $304,000. 32 33 34 35 36 37 38 Land and building: 39 40 Asset Allocated Costs 41 Land 42 New Building 43 Total 44 45

Step by Step Solution

★★★★★

3.56 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 CALCULATION OF THE COST FOR CAPITALIZATION OF EQUIPMENT Purchase price of Equipment 4820...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started