Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. b. Abel and Baker decided to come together on 1 Immary and form a business sharing profits and losses equally. Abel contributed 35,000

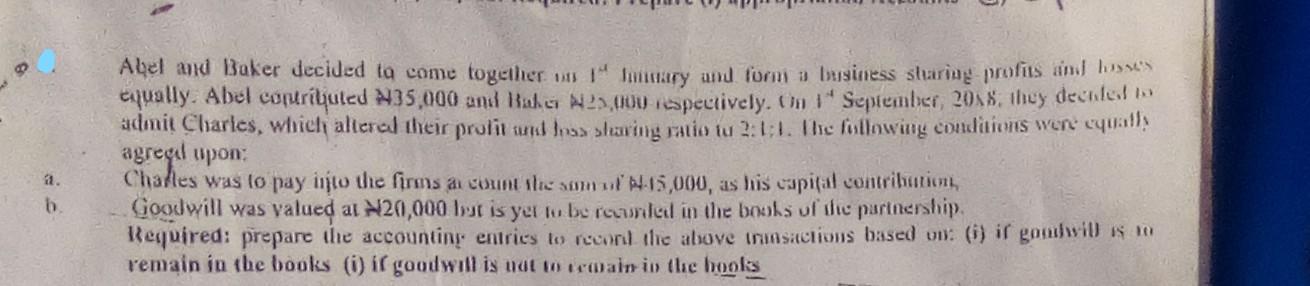

a. b. Abel and Baker decided to come together on 1 Immary and form a business sharing profits and losses equally. Abel contributed 35,000 and Baker 25,000 respectively. On 1 September, 2018, they decided to admit Charles, which altered their profit and loss sharing ratio to 2:1:1. The following conditions were equally agreed upon: Charles was to pay into the firms at count the sum of $415,000, as his capital contribution, Goodwill was valued at N20,000 lut is yet to be recorded in the books of the partnership. Required: prepare the accounting entries to record the above transactions based on: (i) if goodwill is to remain in the books (i) if goodwill is not to remain in the books

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

I If goodwill is to remain in the books Dr Abels Capital Account 43500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started