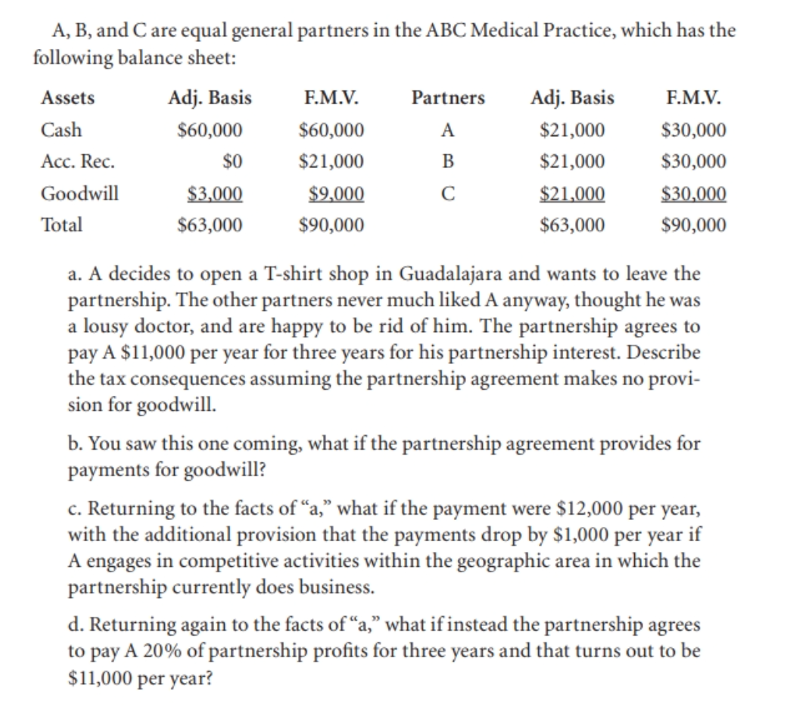

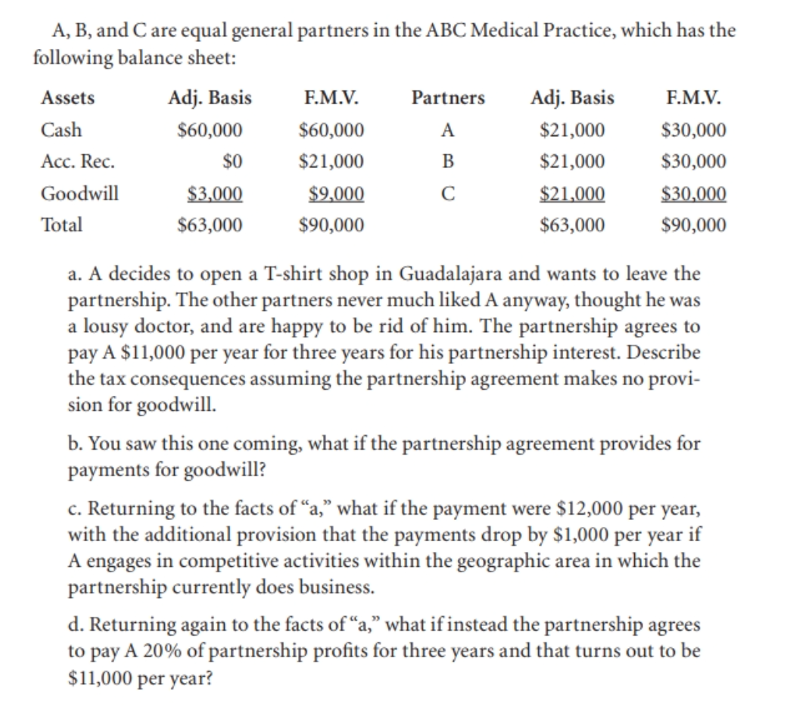

A, B, and C are equal general partners in the ABC Medical Practice, which has the following balance sheet: Assets Cash Acc. Rec. Goodwill Total Adj. Basis $60,000 $0 $3,000 $63,000 F.M.V. $60,000 $21,000 $9,000 $90,000 Partners A B Adj. Basis $21,000 $21,000 $21,000 $63,000 F.M.V. $30,000 $30,000 $30,000 $90,000 a. A decides to open a T-shirt shop in Guadalajara and wants to leave the partnership. The other partners never much liked A anyway, thought he was a lousy doctor, and are happy to be rid of him. The partnership agrees to pay A $11,000 per year for three years for his partnership interest. Describe the tax consequences assuming the partnership agreement makes no provi- sion for goodwill. b. You saw this one coming, what if the partnership agreement provides for payments for goodwill? c. Returning to the facts of a," what if the payment were $12,000 per year, with the additional provision that the payments drop by $1,000 per year if A engages in competitive activities within the geographic area in which the partnership currently does business. d. Returning again to the facts of a," what if instead the partnership agrees to pay A 20% of partnership profits for three years and that turns out to be $11,000 per year? A, B, and C are equal general partners in the ABC Medical Practice, which has the following balance sheet: Assets Cash Acc. Rec. Goodwill Total Adj. Basis $60,000 $0 $3,000 $63,000 F.M.V. $60,000 $21,000 $9,000 $90,000 Partners A B Adj. Basis $21,000 $21,000 $21,000 $63,000 F.M.V. $30,000 $30,000 $30,000 $90,000 a. A decides to open a T-shirt shop in Guadalajara and wants to leave the partnership. The other partners never much liked A anyway, thought he was a lousy doctor, and are happy to be rid of him. The partnership agrees to pay A $11,000 per year for three years for his partnership interest. Describe the tax consequences assuming the partnership agreement makes no provi- sion for goodwill. b. You saw this one coming, what if the partnership agreement provides for payments for goodwill? c. Returning to the facts of a," what if the payment were $12,000 per year, with the additional provision that the payments drop by $1,000 per year if A engages in competitive activities within the geographic area in which the partnership currently does business. d. Returning again to the facts of a," what if instead the partnership agrees to pay A 20% of partnership profits for three years and that turns out to be $11,000 per year