Answered step by step

Verified Expert Solution

Question

1 Approved Answer

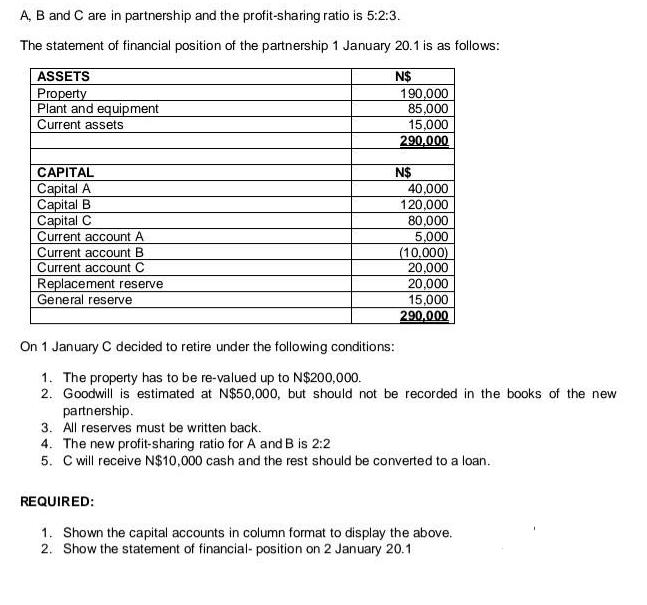

A B and C are in partnership and the profit-sharing ratio is 5:2:3. The statement of financial position of the partnership 1 January 20.1

A B and C are in partnership and the profit-sharing ratio is 5:2:3. The statement of financial position of the partnership 1 January 20.1 is as follows: ASSETS N$ 190,000 85,000 15,000 290,000 Property Plant and equipment Current assets CAPITAL Capital A Capital B Capital C Current account A Current account B N$ 40,000 120,000 80,000 5,000 (10,000) 20,000 20,000 15,000 290,000 Current account C Replacement reserve General reserve On 1 January C decided to retire under the following conditions: 1. The property has to be re-valued up to N$200,000. 2. Goodwill is estimated at N$50,000, but should not be recorded in the books of the new partnership. 3. All reserves must be written back. 4. The new profit-sharing ratio for A and B is 2:2 5. Cwill receive N$10,000 cash and the rest should be converted to a loan. REQUIRED: 1. Shown the capital accounts in column format to display the above. 2. Show the statement of financial- position on 2 January 20.1

Step by Step Solution

★★★★★

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Journal cntries Camount in Particulars Debir credit Bs caurrent gecainl TO cs ur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started