Question

A. B and C are in partnership sharing profits and losses in the ratio of 5:3:2. On 1 Jan 2020, their capital balances are:

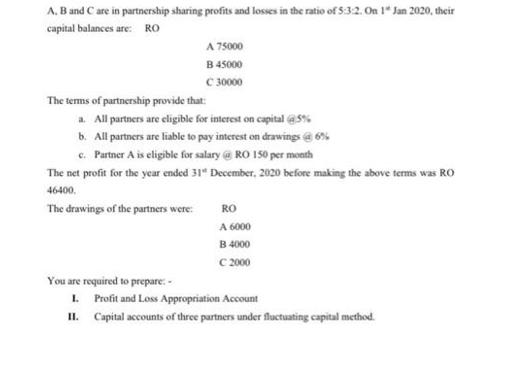

A. B and C are in partnership sharing profits and losses in the ratio of 5:3:2. On 1 Jan 2020, their capital balances are: RO A 75000 B 45000 C 30000 The terms of partnership provide that: a. All partners are eligible for interest on capital (@5% b. All partners are liable to pay interest on drawings @ 6% c. Partner A is eligible for salary@RO 150 per month The net profit for the year ended 31 December, 2020 before making the above terms was RO 46400, The drawings of the partners were: You are required to prepare: - RO A 6000 B 4000 2000 C L. Profit and Loss Appropriation Account II. Capital accounts of three partners under fluctuating capital method.

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Financial Accounting

Authors: Anne Marie Ward, Andrew Thomas

9th Edition

1526803003, 978-1526803009

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App