Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following situations relate to professional accountants in public practise: 1. Jack Tuna recently completed the audit of Home-Made (Pty) Ltd (a boutique retailer

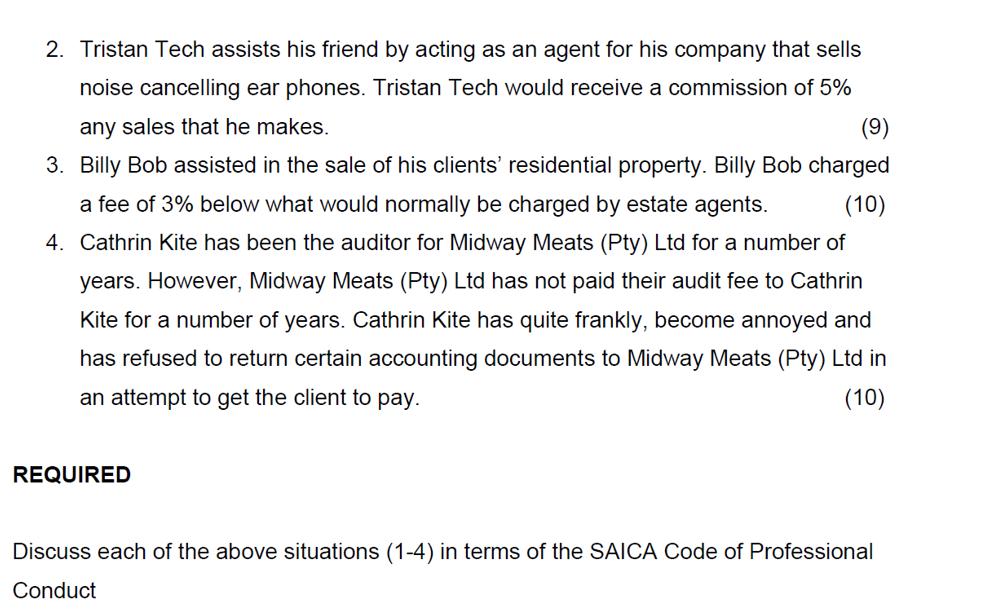

The following situations relate to professional accountants in public practise: 1. Jack Tuna recently completed the audit of Home-Made (Pty) Ltd (a boutique retailer of luxury office furniture). The audit fee amounted to R360 000. Jack Tuna recently did a rebranding and renovation of his consulting offices. He proposed the following to Home-Made (Pty) Ltd, a) Home-Made (Pty) Ltd would supply Jack Tuna (free of charge) with office furniture with a cost value of R200 000. b) Home-Made (Pty) Ltd would not raise a sale in their records but would write the amount of R200 000 off as an allowance for obsolete inventory. c) Home-Made (Pty) Ltd would then invoice Jack Tuna an amount of R160 000 for the audit. (10) 2. Tristan Tech assists his friend by acting as an agent for his company that sells noise cancelling ear phones. Tristan Tech would receive a commission of 5% any sales that he makes. (9) (10) 3. Billy Bob assisted in the sale of his clients' residential property. Billy Bob charged a fee of 3% below what would normally be charged by estate agents. 4. Cathrin Kite has been the auditor for Midway Meats (Pty) Ltd for a number of years. However, Midway Meats (Pty) Ltd has not paid their audit fee to Cathrin Kite for a number of years. Cathrin Kite has quite frankly, become annoyed and has refused to return certain accounting documents to Midway Meats (Pty) Ltd in an attempt to get the client to pay. (10) REQUIRED Discuss each of the above situations (1-4) in terms of the SAICA Code of Professional Conduct

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Situation 1 Jack Tuna and HomeMade Pty Ltd a According to the SAICA Code of Professional Conduct independence should be maintained by professional accountants in public practice Accepting free offic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started