Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vintage RT Bhd operates in the manufacture of guitars and prepares its financial statements to 31 December each year. A profit before tax for

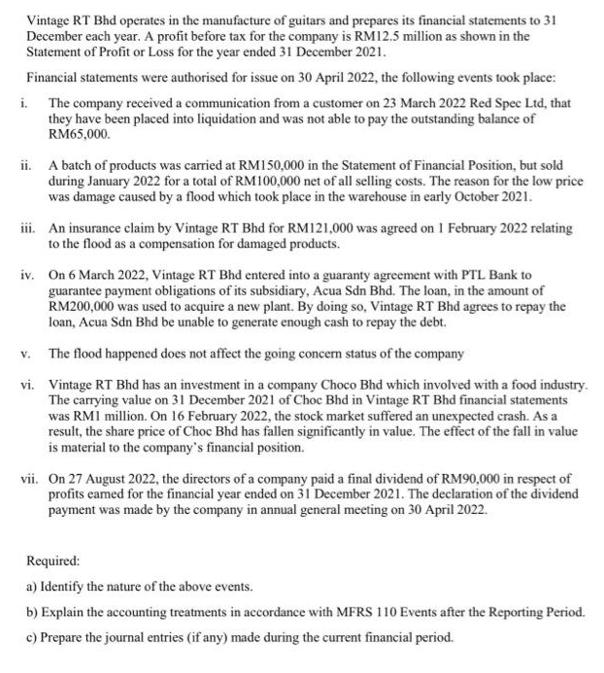

Vintage RT Bhd operates in the manufacture of guitars and prepares its financial statements to 31 December each year. A profit before tax for the company is RM12.5 million as shown in the Statement of Profit or Loss for the year ended 31 December 2021. Financial statements were authorised for issue on 30 April 2022, the following events took place: i. The company received a communication from a customer on 23 March 2022 Red Spec Ltd, that they have been placed into liquidation and was not able to pay the outstanding balance of RM65,000. ii. A batch of products was carried at RM150,000 in the Statement of Financial Position, but sold during January 2022 for a total of RM100,000 net of all selling costs. The reason for the low price was damage caused by a flood which took place in the warehouse in early October 2021. iii. An insurance claim by Vintage RT Bhd for RM121,000 was agreed on 1 February 2022 relating to the flood as a compensation for damaged products. iv. On 6 March 2022, Vintage RT Bhd entered into a guaranty agreement with PTL Bank to guarantee payment obligations of its subsidiary, Acua Sdn Bhd. The loan, in the amount of RM200,000 was used to acquire a new plant. By doing so, Vintage RT Bhd agrees to repay the loan, Acua Sdn Bhd be unable to generate enough cash to repay the debt. The flood happened does not affect the going concern status of the company Vintage RT Bhd has an investment in a company Choco Bhd which involved with a food industry. The carrying value on 31 December 2021 of Choc Bhd in Vintage RT Bhd financial statements was RM1 million. On 16 February 2022, the stock market suffered an unexpected crash. As a result, the share price of Choc Bhd has fallen significantly in value. The effect of the fall in value is material to the company's financial position. v. vi. vii. On 27 August 2022, the directors of a company paid a final dividend of RM90,000 in respect of profits eamed for the financial year ended on 31 December 2021. The declaration of the dividend payment was made by the company in annual general meeting on 30 April 2022. Required: a) Identify the nature of the above events. b) Explain the accounting treatments in accordance with MFRS 110 Events after the Reporting Period. c) Prepare the journal entries (if any) made during the current financial period.

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started