Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A, B, and C have 10% profit and loss sharing ratios and D has a 70% profit and loss sharing ratio. A is a nonresident

A, B, and C have 10% profit and loss sharing ratios and D has a 70% profit and loss sharing ratio. A is a nonresident alien and all of the other partners are U.S. citizens.

a. How will Partnership ABCD report its operations to its partners? Explain.

b. Does it matter that D personally has $450,000 of I.R.C. 179 expenditures? Explain.

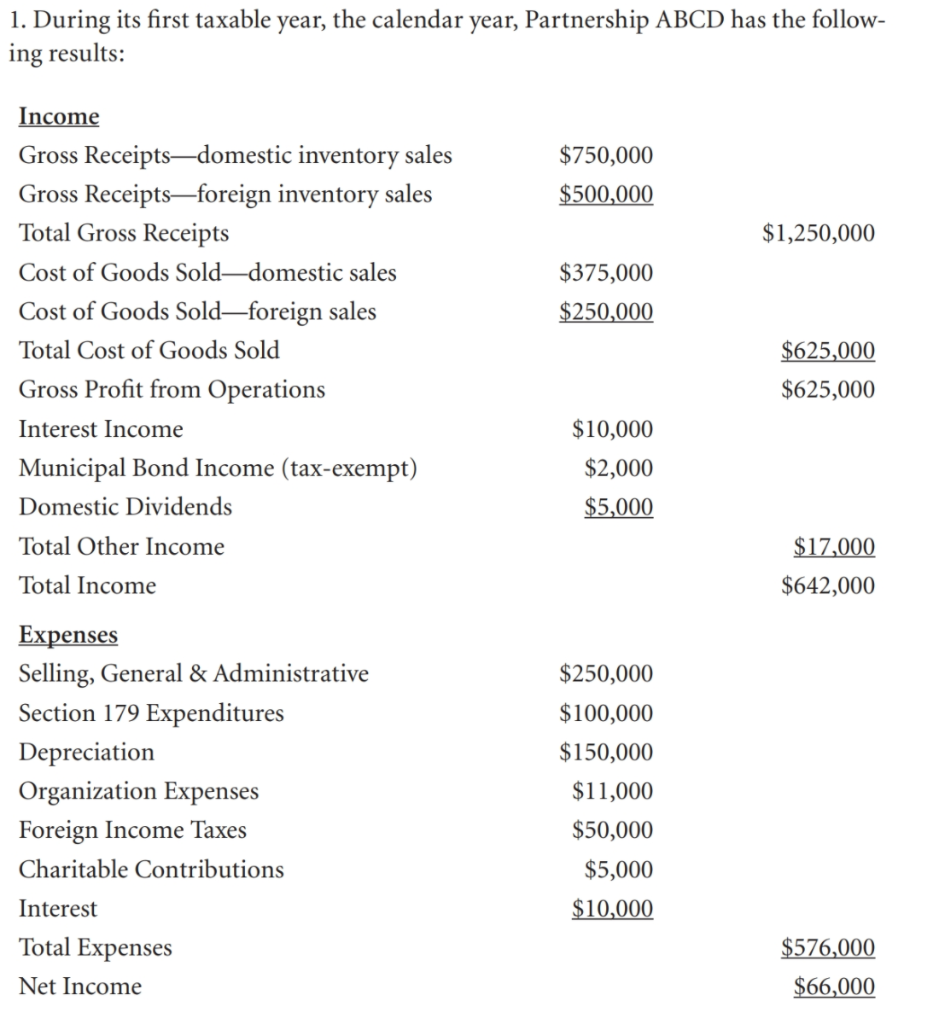

1. During its first taxable year, the calendar year, Partnership ABCD has the follow- ing results: $750,000 $500,000 $1,250,000 $375,000 $250,000 Income Gross Receiptsdomestic inventory sales Gross Receiptsforeign inventory sales Total Gross Receipts Cost of Goods Solddomestic sales Cost of Goods Soldforeign sales Total Cost of Goods Sold Gross Profit from Operations Interest Income Municipal Bond Income (tax-exempt) Domestic Dividends Total Other Income Total Income $625,000 $625,000 $10,000 $2,000 $5,000 $17,000 $642,000 Expenses Selling, General & Administrative Section 179 Expenditures Depreciation Organization Expenses Foreign Income Taxes Charitable Contributions Interest Total Expenses Net Income $250,000 $100,000 $150,000 $11,000 $50,000 $5,000 $10,000 $576,000 $66,000 1. During its first taxable year, the calendar year, Partnership ABCD has the follow- ing results: $750,000 $500,000 $1,250,000 $375,000 $250,000 Income Gross Receiptsdomestic inventory sales Gross Receiptsforeign inventory sales Total Gross Receipts Cost of Goods Solddomestic sales Cost of Goods Soldforeign sales Total Cost of Goods Sold Gross Profit from Operations Interest Income Municipal Bond Income (tax-exempt) Domestic Dividends Total Other Income Total Income $625,000 $625,000 $10,000 $2,000 $5,000 $17,000 $642,000 Expenses Selling, General & Administrative Section 179 Expenditures Depreciation Organization Expenses Foreign Income Taxes Charitable Contributions Interest Total Expenses Net Income $250,000 $100,000 $150,000 $11,000 $50,000 $5,000 $10,000 $576,000 $66,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started